While the NASDAQ index has continued to march higher in recent days and closed at another new all-time high yesterday, the rest of the major indices appear to remain stuck in a sideways trading range. And with the earnings parade about to begin and another troubled Italian bank trying to raise capital, the back-and-forth action could easily stick around awhile. As such, let's continue our exploration of the alternative investing space.

So far we've established that investors began to seek other "alternatives" to the traditional alt classes such as gold, commodities and REITs, after devastating bear markets occurred in commodities and gold in recent years. In response, a new category of alts has sprung to life including strategies such as Managed Futures, M&A Arbitrage, Long/Short Equity and Credit, Global Macro, etc.

To review, these new-age alternatives are supposed to provide (a) non-correlated positions in a portfolio, (b) a hedge against big, bad bear markets, and (c) a way to "print money" - i.e. an alternative to bonds. Again, sounds good, right?

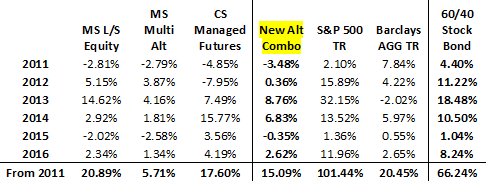

However, as we discussed yesterday, the returns of these new-age alts have been more than a little underwhelming. Since the inception of the CS Managed Futures index in 2006, a combination of Morningstar's Long/Short Equity, Morningstar's Multialternative, and CS Managed Futures indices would have produced a cumulative return of +15.09% from 2011 through 2016 - a far cry from the +101% gain seen in the stock market.

New-Age Alternatives

View Larger Image

Therefore, I believe it is fair to conclude that, so far at least, the new-age alts should not be viewed as an alternative to the stock market - the numbers just aren't there.

However, a combination of REITs and Gold actually has done a decent job of competing with the stock market. Since 2006, the combo would ...