Good Monday morning and welcome back to the land of blinking screens. My guess is that after the big game - and what a game it was - the last thing anyone is thinking about is a bunch of market models and indicators. But this is what discipline is all about. So, let's buckle down and run through a review of my favorite models and indicators.

The State of the Trend

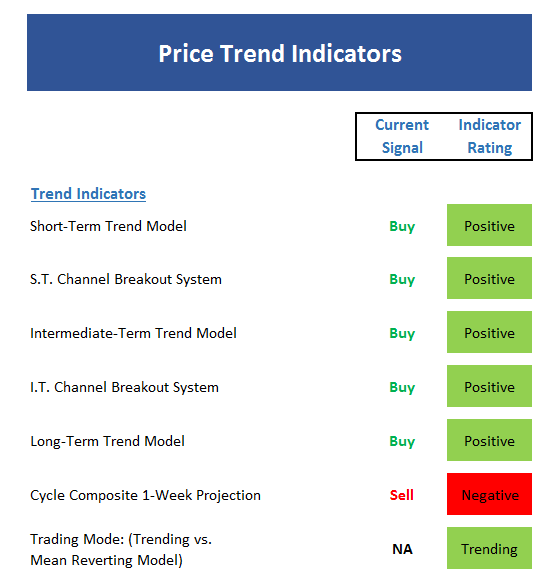

We start each week with a look at the "state of the trend" from our objective indicator panel. These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

Executive Summary:

- With the major indices flirting at all-time highs, it is not surprising to see a lot of green on the trend board.

- However, the question of the day is if the bulls can break on through to the other side

- The negative on the board is the Cycle Composite, which projects slightly lower prices by the end of the week

- It is worth noting that the "trading mode" models are not unanimous at this point and as such, the strength of the current trend is a question mark

The State of Internal Momentum

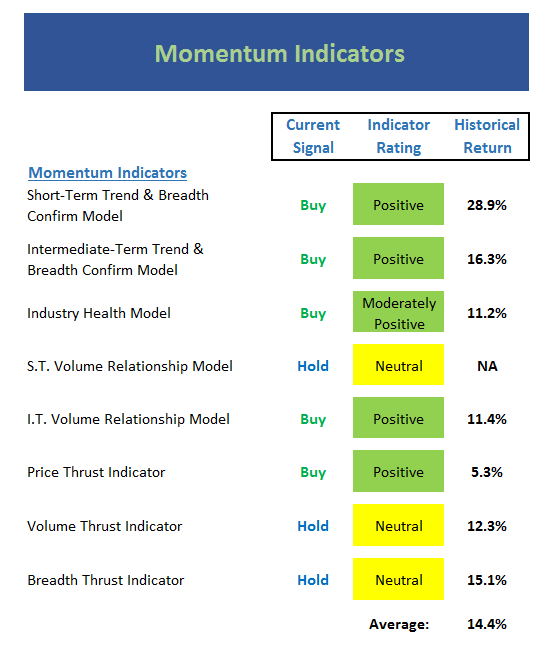

Now we turn to the momentum indicators...

Executive Summary:

- Overall, the momentum board is clearly positive

- However, the ST Volume, Volume Thrust, and Breadth Thrust indicators are all neutral, which suggests there isn't a lot of "oomph" behind the current move (well, so far, at least)

- The Price Thrust indicator is also barely in the green zone

- In sum, the board's historical return is pretty strong and suggests siding with the bulls for the time being

The State of the "Trade"

Next up is the "early warning" board, which is designed to indicate when traders ...