When you talk about stocks that we’ve wanted to stay away from for a long time, it’s hard not to think about shares of McDonalds. Since our big picture target was hit in late 2011, this has been a name we’ve wanted to stay away from, particularly from a structural perspective. Shorter-term it’s been pretty choppy as well struggling to get above the overhead supply that we’ve see over the past 4 years. Although this might be frustrating for those who have been involved, I think this consolidation is actually healthy long-term and all signs are pointing to an eventual breakout. But I don’t think it’s happening tomorrow. I believe we can still be patient.

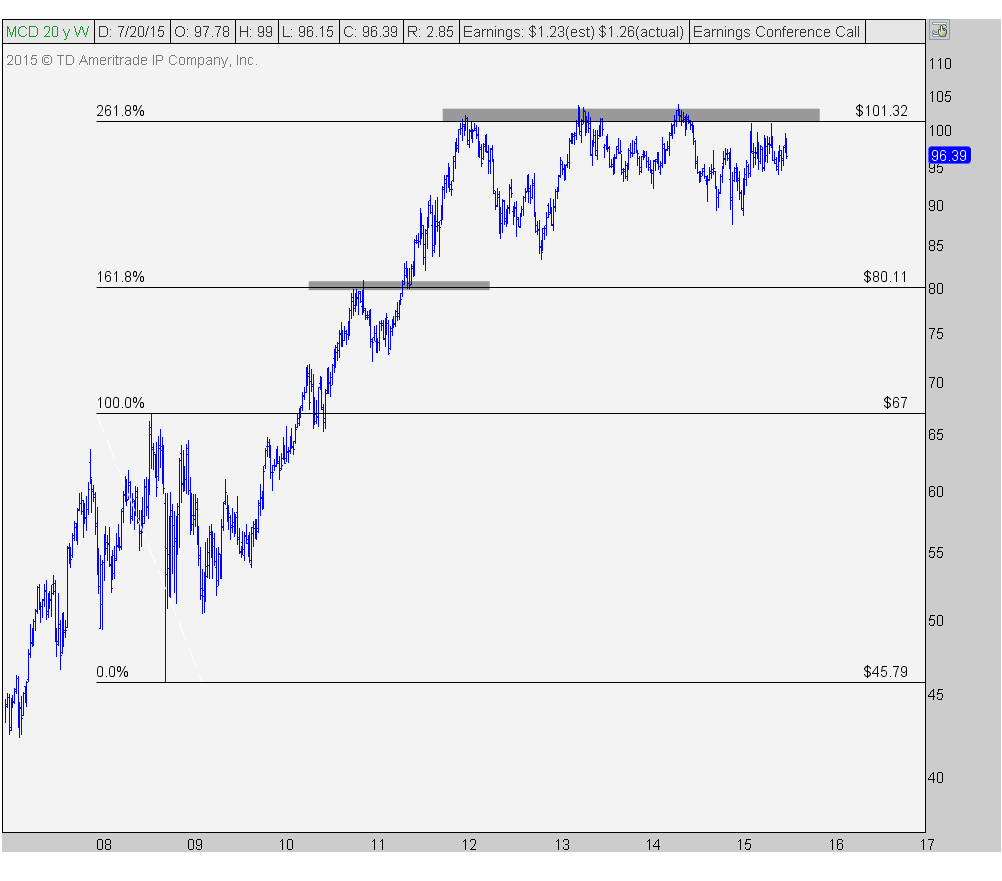

Here is a weekly bar chart of $MCD showing prices hitting our 261.8% Fibonacci extension target just above $100 that we get based of the size of the consolidation during the 2008-2009 market correction. I do not believe in triple tops so I think this ultimately gets through and we see another leg higher:

This next chart shows the uptrend line from the 2011 lows, just before it’s final leg higher, which broke last year. This is a problem that has kept us away short-term as well. I think that as long as prices remain below this broken uptrend, it’s still a no touch:

Finally here is the daily timeframe where I included a 200 day simple moving average. Back in February when prices shot up I was very vocal about it being a fade and staying away because the smoothing mechanism was still downward sloping. After a lot more choppy action since then, the 200 day is now starting to slope up. I think this is great but based on the weight of the evidence, we still want to stay away for now. This probably has a few more months left before we breakout, at least.

This is one we want to keep on our radar because big picture it’s setting up beautifully. Short-term however, we want to remain patient.

***

Click Here to receive weekly updates on each of these charts including the rest of the Dow 30 components on multiple timeframes including MSFT, AAPL, CVX, IBM, WMT etc

Recent free content from J.C. Parets

-

Overhead Supply in the Dow Components

— 9/23/15

Overhead Supply in the Dow Components

— 9/23/15

-

How Low Is Apple Going To Go?

— 8/20/15

How Low Is Apple Going To Go?

— 8/20/15

-

Is It Time To Buy Apple? Or Is It A Sell?

— 7/22/15

Is It Time To Buy Apple? Or Is It A Sell?

— 7/22/15

-

Webinar Tuesday November 18th

— 11/17/14

Webinar Tuesday November 18th

— 11/17/14

-

Cisco Gets Ready for a Breakout!

— 10/06/14

Cisco Gets Ready for a Breakout!

— 10/06/14

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member