Stocks have been slumping since the beginning of 2016. Sellers just keep selling. Tech stocks have been dropping fast the past couple of weeks, from biotechs to internets to semiconductors to software; across the board, they have all been weak.

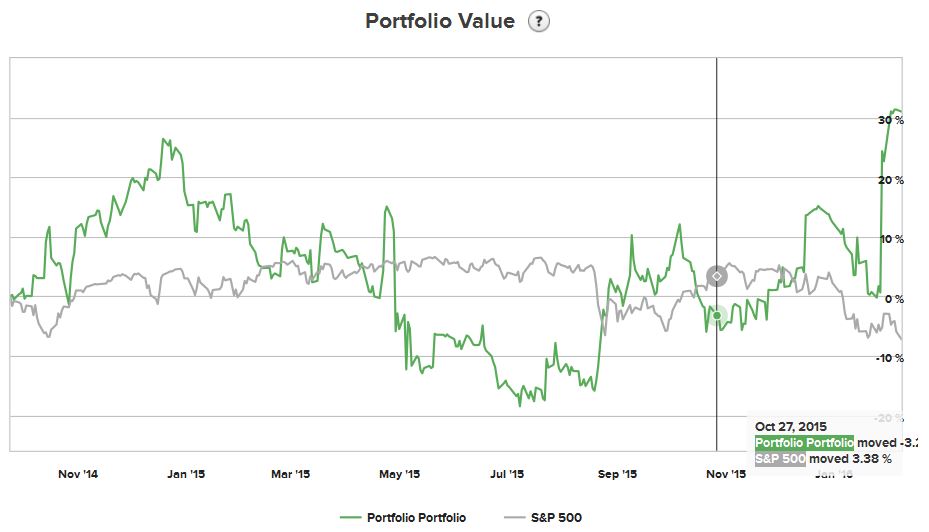

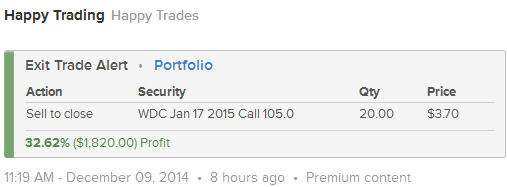

We have been staying mostly in cash and playing the downside here and there. While the markets have been pulling back, we have been making nice gains. My Happy Trades portfolio has popped more than +30% in the past 30 days!

In October last year, I wrote an article, titled "Time to Buy Some Gold!". While gold traded mostly flat in the following months, GLD has now just broken out to the up side. During these past couple of weeks, investors have really started to put money into gold, while getting out of the stock market.

Near-term resistance for GLD lies between $116 to $118. But, I think we can add some gradually. Things are still very volatile. Positions in GLD will be mid- to long-term positions.

Good morning and HappyTrading! ™