It was another volatile week. Stocks tumbled during the first 3 days of trading, hitting an intraday low of 1820.66 on Wednesday before bouncing back. But, by Friday's close, SPX was back up to test 1890!

Things once again went according to my weekly Market Forecast. Last weekend, I wrote,

" Financials will be very important, especially their earnings. Biotechs could see more selling to catch up to the broader market. Below 1900, SPX has support at 1880. Nasdaq has support at 4240."

On Monday, the market fought to keep above 1880, but, failed. On Tuesday, buyers tried again to keep that support. But, earnings from WFC and JPM were not good enough. On Wednesday, stocks experienced a bit of "free falling", dropping nearly 50 points to 1820 before bouncing! On Friday, MS's report was better and stocks rebounded, with both SPX and Nasdaq closing above their respective support levels.

We did very well in my Happy Stocks Portfolio, still with 100% of our trades being profitable. Last week, our GILD puts fetched us profits as high as +47.83%:

| MNST Options Sell to close 10.00 (4.73%) of MNST Nov 22 2014 Put 92.5 at 5.50000 | 5.77% ($300.00) Profit |

| GILD Options Sell to close 10.00 (7.14%) of GILD Nov 22 2014 Put 100.0 at 8.50000 | 47.83% ($2,750.00) Profit |

| GILD Options Sell to close 5.00 (3.49%) of GILD Nov 22 2014 Put 100.0 at 7.90000 | 37.39% ($1,075.00) Profit |

| GILD Options Sell to close 15.00 (10.90%) of GILD Nov 22 2014 Put 100.0 at 8.50000 | 47.83% ($4,125.00) Profit |

This portfolio is now up +11.31%!

For the week, the Dow was down 163.69 points; SPX fell 19.73 points; Nasdaq lost 17.8 points. Gold bounced again to around $1237/ounce, while oil fell again to just above $83/barrel. At the time of this writing, Asian markets were mostly higher. Let's see where the US markets stood after Friday's close:

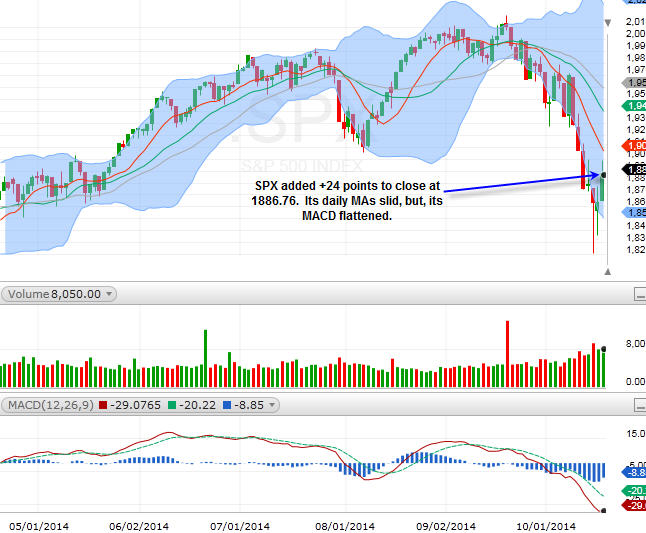

SPX

On Friday, SPX added +24 points to close at 1886.76. Its daily MAs slid, but, its MACD flattened.

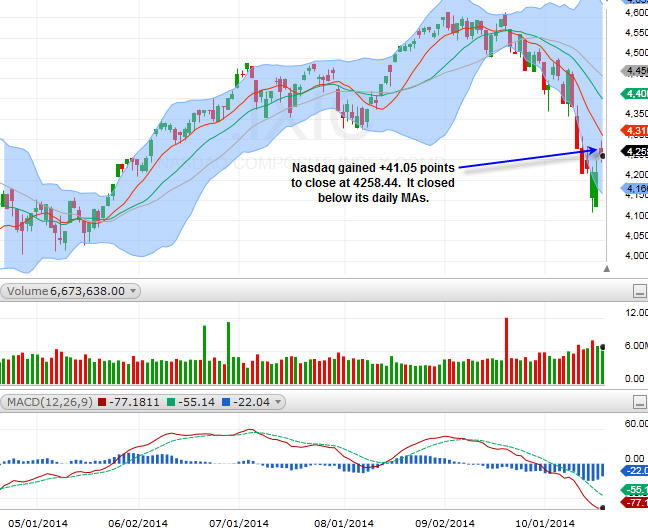

Nasdaq

Nasdaq gained +41.05 points to close at 4258.44. It closed below its daily MAs.

Although both SPX and Nasdaq were able to bounce back above their respective support levels, all three major indices (including the Dow) closed below their respective daily MAs. For the new week, earnings season is going into full gear, with AAPL and IBM coming after the market on Monday!

Monday: (AM) HAL, HAS, BTU, PETS, SAP; (PM) AAPL, CMG, ILMN, IBM, STLD

Tuesday: (AM) ATI, KO, COCO, UTX; (PM) BRCM, CREE, VMW, YHOO

Wednesday: (AM) ABT, BIIB, BA, EMC, PII, SPG, SMED, USB; (PM) CAKE, CTXS, MLNX, PLCM, TSCO, WFT

Thursday: (AM) AMG, CAT, CELG, CX, DO, LO, NUE, OXY, PCP, RS, LUV, UAL, UA, YNDX; (PM) ALTR, BMRN, CERN, DECK, JNPR, MSFT, QLIK, TPX

Friday: (AM) CL, F, EDU, PG, SHPG, STT

I think we can see stocks continue to bounce a bit. SPX has resistance around 1910, while Nasdaq can see resistance around 4370-4380. AAPL and IBM's earnings on Monday will be very important. YHOO's earnings comes in on Tuesday. Then, we have MSFT on Thursday, which could already be traded on SAP's earnings on Monday morning.

Again, financials will be crucial. It will be interesting to see if energies can start establishing a base.

Sector Watch

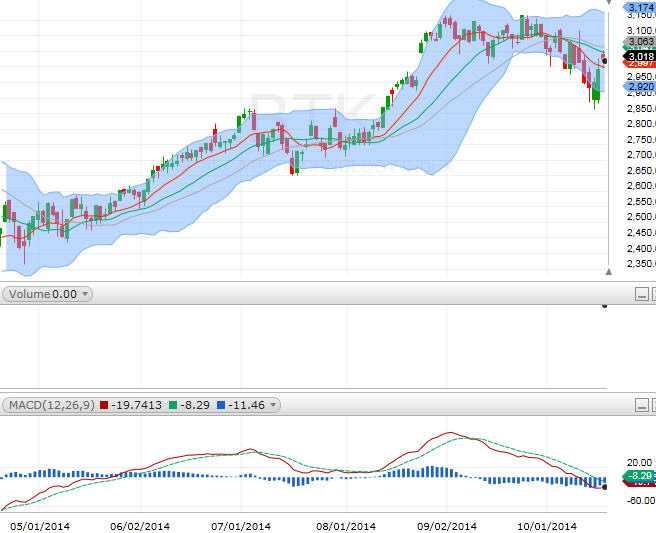

BTK (biotech)

BTK actually closed higher for the week. There are still a lot of buyers in this sector. It is a better "safe haven" than gold! CELG, BIIB, and ILMN are all reporting in the coming week. Both CELG and BIIB still appear weak.

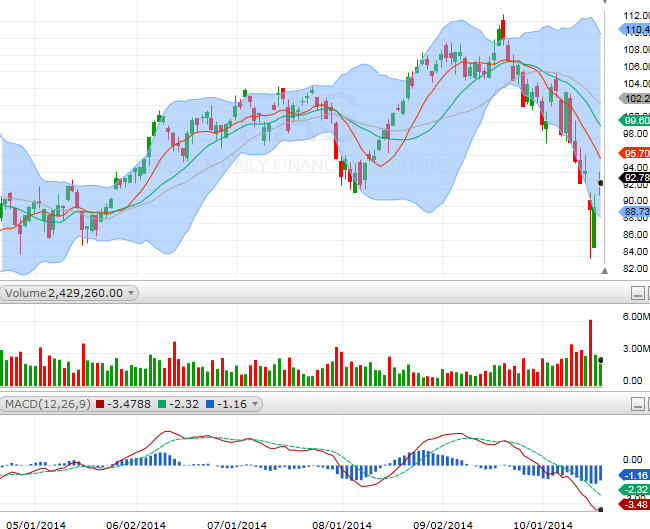

FAS (financial)

FAS has dropped sharply in the past couple of weeks. GS, JPM, WFC, and BAC are all weak. Credit cards are not looking strong either: V, MA, COF, AXP.

AGQ (silver)

AGQ is trying to establish a base. GLD (gold) is doing much better. I think within a couple of weeks, we should see some buying in silver. Above $48, AGQ should make a run to test $51-$52.

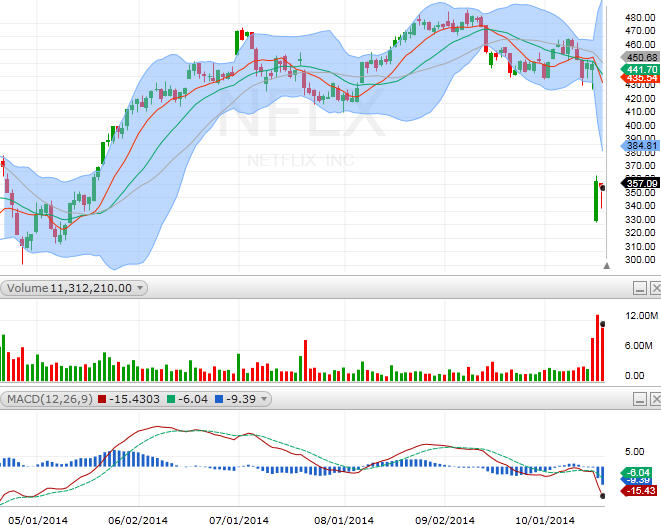

NFLX

I entered this trade too early here. NFLX has resistance at $380. I might want to pick up some calls if the market is really strong. Otherwise, I think we will stick with the puts, NFLX should at least test $320.

Although we may be due for a little bounce, I am not overly positive about the markets at this point. The complacency is certainly gone, which is now replaced by fear. Let's watch the resistance levels carefully. I will try to make updates after Monday's close.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

(Much) More Downside to Come?

— 5/11/22

(Much) More Downside to Come?

— 5/11/22

-

Is Gold A Safe Haven Again? GLD

— 2/09/16

Is Gold A Safe Haven Again? GLD

— 2/09/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member