"Herd behavior, or the tendency of individuals in a group to 'follow the trend,' has frequently been observed in equity markets. Herd behavior in investors leads to a convergence of action." [Yan, Zhao, Sun (2012)]

"Theoretical models on herd behavior predict that under different assumptions, herding can bring prices away (or towards) fundamentals and reduce (or enhance) market efficiency." [Yan, Zhao, Sun (2019)]

For anyone still shaking their head over the recent eye-popping, one-way trends in the stock market, the academic assessments of "herd behavior" above may provide one of the best summations I've seen.

Or, if you prefer something a little more pop culture oriented, there is Eddie Vedder's view on the subject from the 1996 Pearl Jam hit Do The Evolution... "I'm the man buying stocks on the day of the crash... It's herd behavior, uh huh, it's evolution, baby." (P.S. If you are looking for a little kick-start to your day, this video will definitely do the trick.)

Blame It On The Computers?

To be clear, I have never been involved with a high-speed or high-frequency trading shop. As such, I have to admit that I do not know all the ins and outs of how today's algorithmic trading programs function - or even what triggers them. However, I have done a fair amount of research on the subject and as such, I am pretty confident that algo-induced herd behavior had a hand in both the slow-motion crash that occurred between 12/4 and 12/24 and the ensuing joyride to the upside that began on 12/26.

I know, I know. We can't blame everything on the computers. And yes, there were definitely "issues" that traders and investors had to sort through/deal with in December. Not the least of which was the fear that a policy misstep from Powell & Co. was unfolding before their very eyes. But the bottom line is that the computer algorithms were the herd this time around.

You're Fired!

Lest we forget, the President had a hand in the problem as he appeared to channel his best "Apprentice" act relating to his desire/ability to "fire" the Fed Chair. In short, this put the FOMC in a bit of a spot. While the data - especially the "soft data" and almost anything related to inflation pressures - was clearly weakening, the new Chairman most definitely could not appear to kowtow to politics.

I think it is safe to say that it was the Fed's need to publicly display its independence from the White House that caused Powell to appear more hawkish than anticipated in December. And from my seat, it was the hawkish stance and the use of words such as "autopilot" that seemed to indicate that a Fed-induced recession might suddenly be a reality. A reality that needed to be priced into stock prices.

The New Herd

In any event, the S&P 500 proceeded to plunge -11.3% in the 6.5 sessions between 12/13 and 12/24. Call it a "bad news panic," a "waterfall decline, or an "emotional flush," but the end result was one of the finest displays of computerized "herd behavior" ever witnessed.

Then Mr. Powell had a change of heart, and words like "patient" began to be used publicly by Fed officials. Maybe it was the daily 2% declines in the major stock market indices, the plunge in bond yields, or the sudden realization that inflation pressures had dried up almost completely. But suddenly, the Fed was on pause. The balance sheet runoff was up for discussion. Data dependence was back to the fore. And a gaggle of Fed officials tried to convey a "prudent" way forward whenever/wherever possible.

To say that the new stance/tone from FOMC members was well received by the markets is an understatement. An upside "whoosh" began in response, once again displaying the power of the herd.

Maybe I'm wrong. Maybe John Q. Public was busy moving money around in their 401K accounts every day in late December due to the new market narrative. Maybe the "Soccer Mom's" got collectively short. And maybe, just maybe, the entire world is now the "fast money," all of whom, by the way, traded both the viscous decline and explosion to the upside correctly - just ask 'em.

My point on this fine Monday morning is that computerized "herd behavior" isn't likely to go away anytime soon - especially when things get dicey in the markets. As such, one needs to have a plan to deal with these one-way moves.

Will The Historic Run Continue?

On that note, the next logical question is, will the current one-way upside trend continue? After all, the S&P 500 is up +15.1% in 26 days, which certainly qualifies as a positive "thrust" for the index. And as we've detailed a time or two over the years, this type of "thrust" event tends to bode well for the bulls going forward.

For example, since 1980, six months after what is called a Double 10:1 Up Day signal (two sessions in which advancing volume exceeds declining volume by 10 to 1 or more without an intervening 10:1 "Down Day"), the S&P 500 has been higher 85.7% of the time, by an average of 11.8%. (Source: Ned Davis Research). For the record, the latest Double 10:1 signal occurred on 1/4/19.

Yet at the same time, there is certainly a limit to how much a market can move in a short period of time, right? To be sure, +15% in 5 weeks is a big pop and stocks are now overbought. So, can we really expect stocks to simply dance merrily to new highs from here?

Short answer; probably not right here, right now.

Let's remember that stocks were down about 10% before the mid-December freak-out really got rolling. My thinking is that at least some of that decline was in recognition of the fact that both economic and earnings growth is slowing. An issue that has most definitely not gone away.

There is also the pesky little fact that the big bounces that typically follow waterfall declines tend to succumb to at least one retest phase. Generally speaking, the retest phase occurs as the initial reason for the decline resurfaces after the big bounce off the emotional low has run its course.

For example, despite the impressive track record of gains six months after a Double 10:1 Up Day signal has been given, NDR computers tell us that the S&P 500 has closed BELOW the price where the signal was given a whopping 80% of the time. In this case, this would mean a close below the 1/4/19 close on the S&P 500 of 2531.94.

P.S. The average decline for the "retest pullback" after a Double 10:1 Up Day signal has been -4.3%, which from Friday's close would be 2590, while the worst "retest pullback" was 8.1%, which would put the S&P at 2468.

Near-Term Game Plan

Unless both economic and earnings growth is going to consistently surprise to the upside going forward, some backing and filling would appear to be in order at some point in the near future. And unless/until something big happens to change the herd's narrative yet again, the history of waterfall/emotional lows and "thrust" buy signals reminds us that buying the next dip is a strong way to play going forward. Well, as soon as the herd gets done celebrating the jobs report and the expected China deal, that is.

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

View My Favorite Market Models Online

The Bottom Line:

- The narrative and the market environment continue to change quickly. This is illustrated by the rapid changes seen on the Primary Cycle board. For the fifth week in a row, there are important changes - this time it's one to the upside and one to the downside. On the positive front, the Risk/Reward Model flashed a buy signal and moved up into the positive zone, reversing a sell signal that had given us fair warning that all was not right with the indicator world back in February 2018. On the negative side, my "Desert Island" model slipped to a sell and into the red. However, the reading is not convincing and is response to overbought conditions. But the bottom line here is clear: The board leaves a lot to be desired.

This week's mean percentage score of my 6 favorite models improved to 48.9% from 47.8% (2 weeks ago: 41.9%, 3 weeks ago: 46.1%, 4 weeks ago: 40.3%) while the median rose to 46.7% from 45% (2 weeks ago: 40%, 3 weeks ago: 55%, 4 weeks ago: 50%).

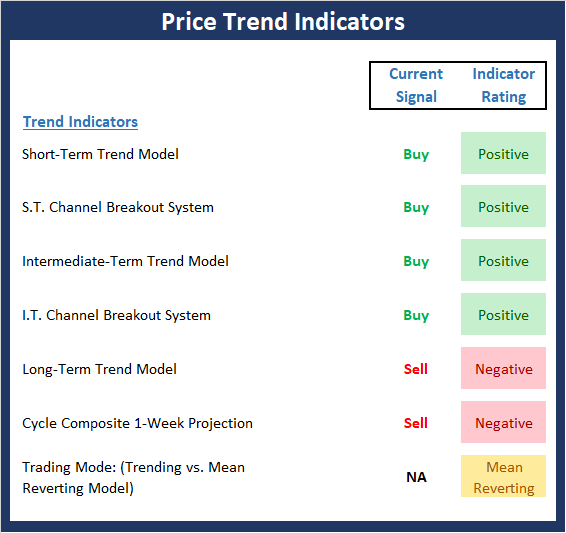

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

The Bottom Line:

- The bulls continue to assert themselves last week, flipping both the short- and intermediate-term channel breakout systems positive. However, the cycle composite calls for a pause in the action and given the overbought nature of the market and the overhead resistance represented by the seemingly important 200-day moving average, logic dictates that the bulls could take a break soon.

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

The Bottom Line:

- The fact that the Momentum board is awash in green this week is an excellent indication that the recent rally, which has gained more than 15% in just 5 weeks, has some intensity behind it. This may be due to the abrupt change in the Fed's policy or the increasing hopes for a trade deal with China. But in any event, the momentum favors the bulls and suggests a buy-the-dip environment has returned.

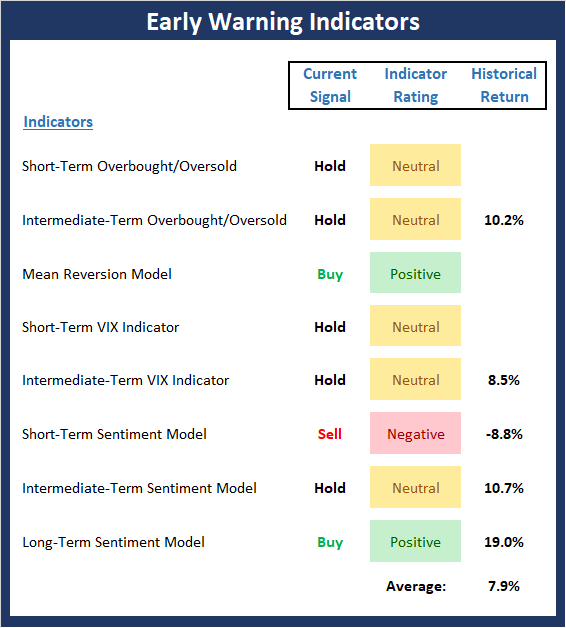

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

The Bottom Line:

- Stocks remain overbought from both a short- and intermediate-term perspective. And while the board isn't flashing a lot of red, it is important to note that it is VERY close to doing just that. As I have written for the past two weeks, almost any decline will trigger a sell signal from our s.t. overbought/sold model as well as both VIX models. The bottom line remains the same; stocks are ripe for a pullback.

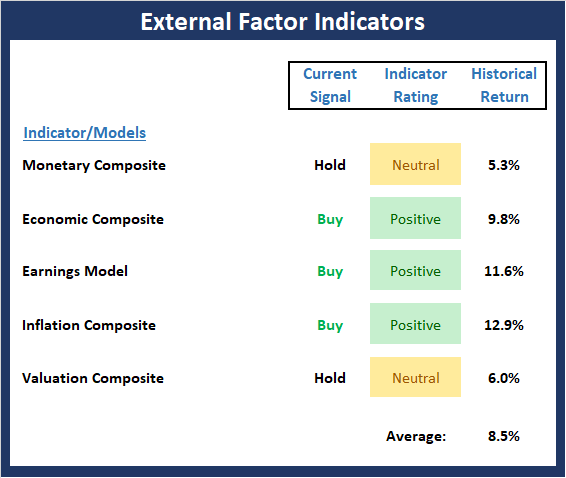

The State of the Macro Picture

Now let's move on to the market's fundamental factors - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View Environment Indicator Board Online

The Bottom Line:

- Despite all the talk about #GrowthSlowing, the fact that the economic growth rate is still above the recent trend, that rates have pulled back, that earnings continue to advance, that inflation pressures have fallen, and that valuations have improved combine to suggest that the external backdrop for the stock market looks fairly solid.

Thought For The Day:

Always forgive your enemies; nothing annoys them so much. - Oscar Wilde

Wishing you green screens and all the best for a great day,

David D. Moenning

Founder, Chief Investment Officer

Heritage Capital Research

HCR Focuses on a Risk-Managed Approach to Investing

What Risk Management Can and Cannot Do

HCR Awarded Top Honors in 2018 NAAIM Shark Tank Portfolio Strategy Competition

Each year, NAAIM (National Association of Active Investment Managers) hosts a competition to identify the best actively managed investment strategies. In April, HCR's Dave Moenning took home first place for his flagship risk management strategy.

<hr>Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -12.29% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and when below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicator looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from an intermediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliché, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

<hr>Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

Mr. Moenning may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19