Good morning. Sadly, the first week of October starts with the news of the deadliest gunman attack in U.S. history. So, let me first say that our thoughts and prayers go out to the victims, the injured, and all those traumatized by the sickening attack that occurred in Las Vegas last night.

My second thought this morning may not win me many friends as I normally try to avoid any political commentary in my morning market missives. However, in light of this event, I simply have to say it; why on earth these types of weapons available for purchase by the public?

To be sure, this type of event makes it tough to focus on mundane things like investing. However, the stock market will open in less than an hour, so let's go ahead and review my key market models/indicators and see where we stand. To review, the primary goal of this exercise is to try and remove any subjective notions about what "should" be happening in the market in an attempt to stay in line with what "is" happening in the markets. So, let's get started.

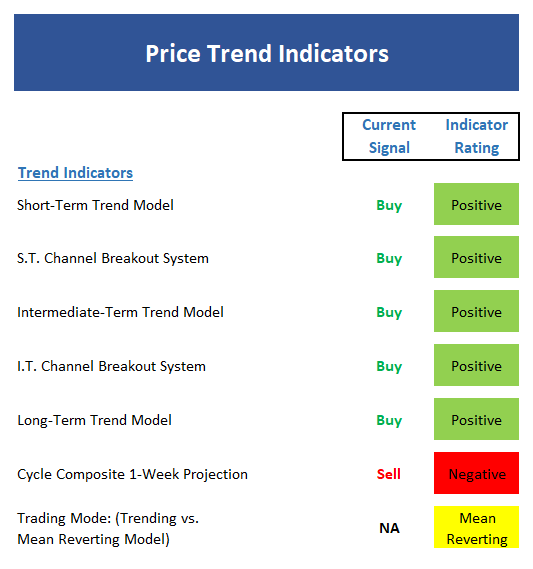

The State of the Trend

We start our review each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term Trend Model is back to positive with the S&P closing a fresh all-time highs.

- The short-term Channel Breakout System remains on a buy signal. This system's stop point stands at 2488 to start the week.

- The intermediate-term Trend Model is also positive.

- The intermediate-term Channel Breakout System did a great job issuing a buy signal on 8/22. The system would require a drop below 2443 to leave the positive zone.

- The long-term Trend Model remains solidly green.

- The Cycle Composite remains negative and is clearly out of sync from a short- and intermediate-term perspective at this time.

- The Trading Mode models are not yet convinced that the trend is "in gear" but one of the models is positive and the other two are moving in the right direction.

- In sum, as the saying goes, the most positive thing a market can do is make new highs. Now if the Dow and NASDAQ 100 would just confirm.

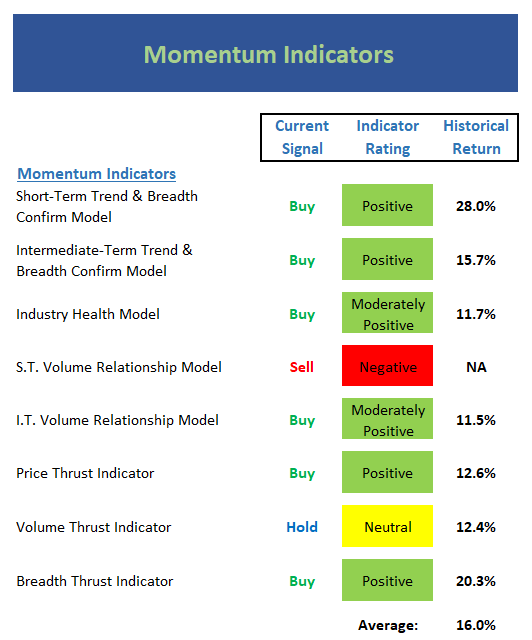

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- Both the short- and intermediate-term Trend and Breadth Confirm Models are positive.

- The Industry Health Model continues to waffle in the moderately positive zone. As I've said many times, I would prefer to see this model in an outright positive mode.

- The short-term Volume Relationship remains negative and is not improving here. While the indicator could certainly turn in the near-term, this is a nagging concern

- The intermediate-term Volume Relationship has upticked and is improving.

- The Price Thrust Indicator remains positive.

- The Volume Thrust Indicator continues with a neutral reading. But we should note that the historical return in neutral is fairly strong.

- The Breadth Thrust Indicator remains positive this week.

- From a momentum perspective, the bottom line is things are pretty good. However, I would like to see the volume relationship model confirm the overall message in the near-term.

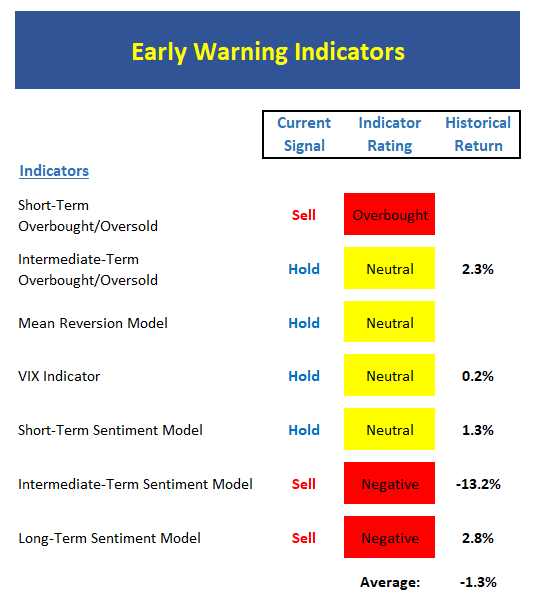

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are once again overbought. However, it has been a more than a month since the S&P was oversold and as such, the bulls will argue that this is becoming a "good overbought" condition.

- From an intermediate-term view, stocks are have reached an overbought condition as well. However, we prefer for these indicators to reverse from an extreme position before turning negative.

- The Mean Reversion Model

- The shorter-term VIX Indicator has issued a sell signal while the intermediate-term model's last signal was a buy.

- From a short-term perspective, market sentiment is become more optimistic but has not yet reached a level that is considered negative.

- The intermediate-term Sentiment Model remains negative and the indicator hasn't budged.

- Longer-term Sentiment readings are worsening and approaching the lowest levels of the year.

- Yes, stocks are now overbought from short-, intermediate-, and long-term time frames. But it is important to remember, that overbought conditions can remain in effect for long periods of time when the bulls are running.

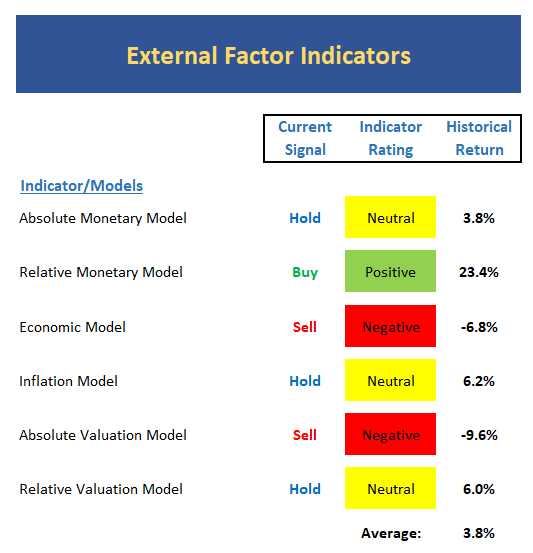

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Absolute Monetary conditions continue to weaken with the recent spike in rates.

- But… the Relative Monetary Model remains upbeat. The divergence between the two models has to do with the overall level of rates.

- Our Economic Model (designed to call the stock market) issued a sell signal last week. However, I note that the model designed to "call" the economy remains positive.

- The Inflation Models continue to show weakening inflation pressures.

- The Absolute Valuation Model remains negative. However, we should recognize that the trend of the model reading is slightly down. As such, one can argue that valuations are improving - albeit from extreme levels.

- On the other hand, our Relative Valuation Model continues to improve and is very close to turning positive.

The State of the Big-Picture Market Models

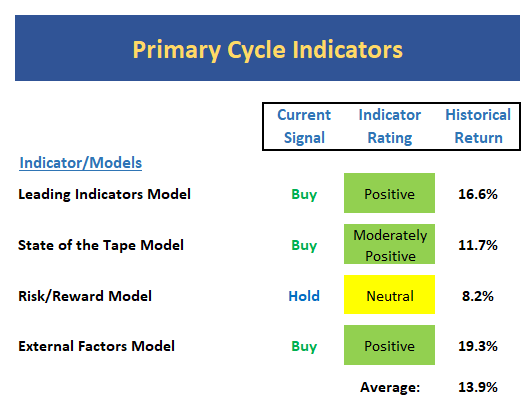

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, which was our best performing timing model during the last cycle, remains positive after giving a whipsaw signal earlier in the year.

- The overall message from "the tape" remains constructive, but it could be better with stocks at all-time highs.

- The Risk/Reward model continues to suggest this is not a low-risk environment

- The External Factors model sums things up nicely here from a big-picture perspective. While there are concerns, this composite of external indicators remains green.

My Takeaway...

I think the takeaway from this week's indicator review is that despite the confluence of "issues" the bears continue to talk about, the market remains at all-time highs. Some will argue that this represents a classic case of stocks climbing a wall of worry. And with the majority of our indicators in decent shape, I can concur with this analysis. However, there are indeed some chinks in the indicator armor here. Of course, these problem areas could also be resolved with some time. So, with very positive seasonality just around the corner, it is probably a good idea to give the bulls the benefit of the doubt here and to continue to buy any/all dips.

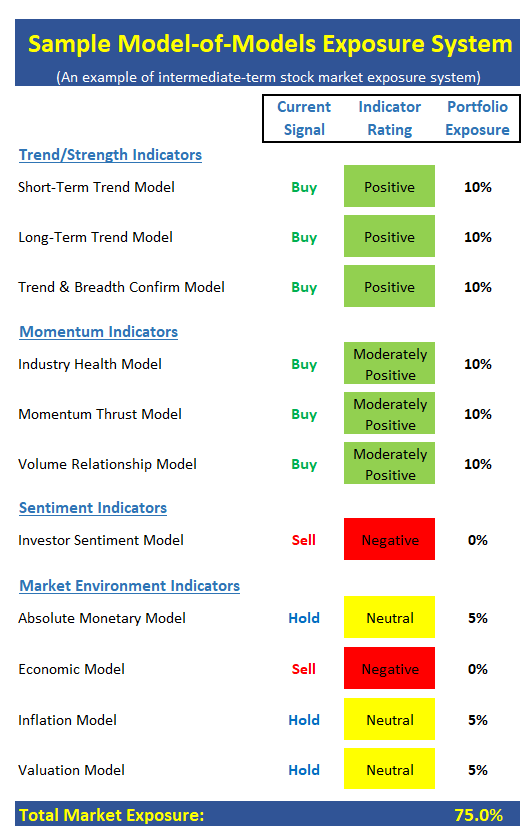

Sample Risk Exposure System

Below is an EXAMPLE of how some of above indicators might be used in order to determine exposure to market risk. The approach used here is a "Model of Models" comprised of 10 independent Models. Each model included gives separate buy and sell signals, which affects a percentage of the model's overall exposure to the market.

Trend models control a total 40% of our exposure. The 3 Momentum Models and 3 Environment Models each control 10% of the portfolio's exposure to market risk. The model's "Exposure to Market Risk" reading (at the bottom of the Model) acts as an EXAMPLE of a longer-term guide to exposure to market risk.

In looking at the "bottom line" of this model, my take is that readings over 75% are "positive," readings between 50% and 75% are "moderately positive," and readings below 50% should be viewed as a warning that all is not right with the indicator world.

View Sample Exposure Model Online

The model above is for illustrative and informational purposes only and does not in any way represent any investment recommendation. The model is merely a sample of how indicators can be grouped to create a guide to market exposure based on the inputs from multiple indicators/models.

Thought For The Day:

It requires less character to discover the faults of others, than to tolerate them. -J. Petit Senn

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Geopolitics

2. The State of the Economic/Earnings Growth (Fast enough to justify valuations?)

3. The State of the Trump Administration

4. The State of Fed Policy

Indicators Explained

Short-Term Trend-and-Breadth Signal Explained: History shows the most reliable market moves tend to occur when the breadth indices are in gear with the major market averages. When the breadth measures diverge, investors should take note that a trend reversal may be at hand. This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 5-day smoothing and the All-Cap Equal Weighted Equity Series is above its 25-day smoothing, the equity index has gained at a rate of +32.5% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +13.3% per year. And when both are below, the equity index has lost +23.6% per year.

Channel Breakout System Explained: The short-term and intermediate-term Channel Breakout Systems are modified versions of the Donchian Channel indicator. According to Wikipedia, "The Donchian channel is an indicator used in market trading developed by Richard Donchian. It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen."

Intermediate-Term Trend-and-Breadth Signal Explained: This indicator incorporates NDR's All-Cap Dollar Weighted Equity Series and A/D Line. From 1998, when the A/D line is above its 45-day smoothing and the All-Cap Equal Weighted Equity Series is above its 45-day smoothing, the equity index has gained at a rate of +17.6% per year. When one of the indicators is above its smoothing, the equity index has gained at a rate of +6.5% per year. And when both are below, the equity index has lost -1.3% per year.

Industry Health Model Explained: Designed to provide a reading on the technical health of the overall market, Big Mo Tape takes the technical temperature of more than 100 industry sectors each week. Looking back to early 1980, when the model is rated as "positive," the S&P has averaged returns in excess of 23% per year. When the model carries a "neutral" reading, the S&P has returned over 11% per year. But when the model is rated "negative," stocks fall by more than -13% a year on average.

Cycle Composite Projections: The cycle composite combines the 1-year Seasonal, 4-year Presidential, and 10-year Decennial cycles. The indicator reading shown uses the cycle projection for the upcoming week.

Trading Mode Indicator: This indicator attempts to identify whether the current trading environment is "trending" or "mean reverting." The indicator takes the composite reading of the Efficiency Ratio, the Average Correlation Coefficient, and Trend Strength models.

Volume Relationship Models: These models review the relationship between "supply" and "demand" volume over the short- and intermediate-term time frames.

Price Thrust Model Explained: This indicator measures the 3-day rate of change of the Value Line Composite relative to the standard deviation of the 30-day average. When the Value Line's 3-day rate of change have moved above 0.5 standard deviation of the 30-day average ROC, a "thrust" occurs and since 2000, the Value Line Composite has gained ground at a rate of +20.6% per year. When the indicator is below 0.5 standard deviation of the 30-day, the Value Line has lost ground at a rate of -10.0% per year. And when neutral, the Value Line has gained at a rate of +5.9% per year.

Volume Thrust Model Explained: This indicator uses NASDAQ volume data to indicate bullish and bearish conditions for the NASDAQ Composite Index. The indicator plots the ratio of the 10-day total of NASDAQ daily advancing volume (i.e., the total volume traded in stocks which rose in price each day) to the 10-day total of daily declining volume (volume traded in stocks which fell each day). This ratio indicates when advancing stocks are attracting the majority of the volume (readings above 1.0) and when declining stocks are seeing the heaviest trading (readings below 1.0). This indicator thus supports the case that a rising market supported by heavier volume in the advancing issues tends to be the most bullish condition, while a declining market with downside volume dominating confirms bearish conditions. When in a positive mode, the NASDAQ Composite has gained at a rate of +38.3% per year, When neutral, the NASDAQ has gained at a rate of +13.3% per year. And when negative, the NASDAQ has lost at a rate of -8.5% per year.

Breadth Thrust Model Explained: This indicator uses the number of NASDAQ-listed stocks advancing and declining to indicate bullish or bearish breadth conditions for the NASDAQ Composite. The indicator plots the ratio of the 10-day total of the number of stocks rising on the NASDAQ each day to the 10-day total of the number of stocks declining each day. Using 10-day totals smooths the random daily fluctuations and gives indications on an intermediate-term basis. As expected, the NASDAQ Composite performs much better when the 10-day A/D ratio is high (strong breadth) and worse when the indicator is in its lower mode (weak breadth). The most bullish conditions for the NASDAQ when the 10-day A/D indicator is not only high, but has recently posted an extreme high reading and thus indicated a thrust of upside momentum. Bearish conditions are confirmed when the indicator is low and has recently signaled a downside breadth thrust. In positive mode, the NASDAQ has gained at a rate of +22.1% per year since 1981. In a neutral mode, the NASDAQ has gained at a rate of +14.5% per year. And when in a negative mode, the NASDAQ has lost at a rate of -6.4% per year.

Short-Term Overbought/sold Indicator: This indicator is the current reading of the 14,1,3 stochastic oscillator. When the oscillator is above 80 and the %K is above the %D, the indicator gives an overbought reading. Conversely, when the oscillator is below 20 and %K is below its %D, the indicator is oversold.

Intermediate-Term Overbought/sold Indicator: This indicator is a 40-day RSI reading. When above 57.5, the indicator is considered overbought and wnen below 45 it is oversold.

Mean Reversion Model: This is a diffusion model consisting of five indicators that can produce buy and sell signals based on overbought/sold conditions.

VIX Indicator: This indicators looks at the current reading of the VIX relative to standard deviation bands. When the indicator reaches an extreme reading in either direction, it is an indication that a market trend could reverse in the near-term.

Short-Term Sentiment Indicator: This is a model-of-models composed of 18 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a short-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Intermediate-Term Sentiment Indicator: This is a model-of-models composed of 7 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a intrmediate-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Long-Term Sentiment Indicator: This is a model-of-models composed of 6 independent sentiment indicators designed to indicate when market sentiment has reached an extreme from a long-term perspective. Historical analysis indicates that the stock market's best gains come after an environment has become extremely negative from a sentiment standpoint. Conversely, when sentiment becomes extremely positive, market returns have been subpar.

Absolute Monetary Model Explained: The popular cliche, "Don't fight the Fed" is really a testament to the profound impact that interest rates and Fed policy have on the market. It is a proven fact that monetary conditions are one of the most powerful influences on the direction of stock prices. The Absolute Monetary Model looks at the current level of interest rates relative to historical levels and Fed policy.

Relative Monetary Model Explained: The "relative" monetary model looks at monetary indicators relative to recent levels as well as rates of change and Fed Policy.

Economic Model Explained: During the middle of bull and bear markets, understanding the overall health of the economy and how it impacts the stock market is one of the few truly logical aspects of the stock market. When our Economic model sports a "positive" reading, history (beginning in 1965) shows that stocks enjoy returns in excess of 21% per year. Yet, when the model's reading falls into the "negative" zone, the S&P has lost nearly -25% per year. However, it is vital to understand that there are times when good economic news is actually bad for stocks and vice versa. Thus, the Economic model can help investors stay in tune with where we are in the overall economic cycle.

Inflation Model Explained: They say that "the tape tells all." However, one of the best "big picture" indicators of what the market is expected to do next is inflation. Simply put, since 1962, when the model indicates that inflationary pressures are strong, stocks have lost ground. Yet, when inflationary pressures are low, the S&P 500 has gained ground at a rate in excess of 13%. The bottom line is inflation is one of the primary drivers of stock market returns.

Valuation Model Explained: If you want to get analysts really riled up, you need only to begin a discussion of market valuation. While the question of whether stocks are overvalued or undervalued appears to be a simple one, the subject is actually extremely complex. To simplify the subject dramatically, investors must first determine if they should focus on relative valuation (which include the current level of interest rates) or absolute valuation measures (the more traditional readings of Price/Earnings, Price/Dividend, and Price/Book Value). We believe that it is important to recognize that environments change. And as such, the market's focus and corresponding view of valuations are likely to change as well. Thus, we depend on our Valuation Models to help us keep our eye on the ball.

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member