It is a well-known fact that Janet Yellen is an uber-dove when it comes to interest rates. For those not schooled in the world of Fedspeak, the term "dove" means that the central banker in question errs on the side of lower rates and higher economic growth. This is diametrically opposed to the "hawks" (aka inflation hawks), who tend to focus on keeping inflation under control.

I bring this up because according to the WSJ, Janet Yellen's testimony on Capitol Hill yesterday "seemed a bit more hawkish than some had been expecting." In her prepared testimony, the Fed Chair said, "waiting too long to remove accommodation would be unwise, potentially requiring the FOMC to eventually raise rates rapidly, which could risk disrupting financial markets and pushing the economy into recession."

In addition to Ms. Yellen's hawkish tone, Dallas Fed President Robert Kaplan said on Tuesday that it would be "prudent" for the U.S. central bank to raise rates sooner rather than later.

Yesterday's Fedspeak caused the futures market to increase the odds of a rate hike at both the March and May meetings, with the probability of a May hike now above 50%.

We should also note that Tuesday's PPI report came in above expectations as both the headline and core PPI numbers exceeded the consensus forecasts. On a monthly basis, the PPI rose by the largest amount since 2012.

As one might have expected, the U.S. dollar and bond yields rose on the news. And it is worth noting that the 10-year is trading this morning back above 2.5%.

What might seem odd to some is that after opening lower, the stock market rebounded and moved steadily higher from just before lunch into the closing bell - and the VIX sank toward the lows of the year.

For those who see this as odd or even worrisome behavior due to the possibility that Yellen's merry band of central bankers raising rates sooner than expected, you are likely missing the point.

Yes, the FOMC "could" raise rates in March. But given Yellen's propensity to "warn" the markets well in advance of taking action, the markets are only pricing in one-in-three odds of a "surprise" rate hike next month.

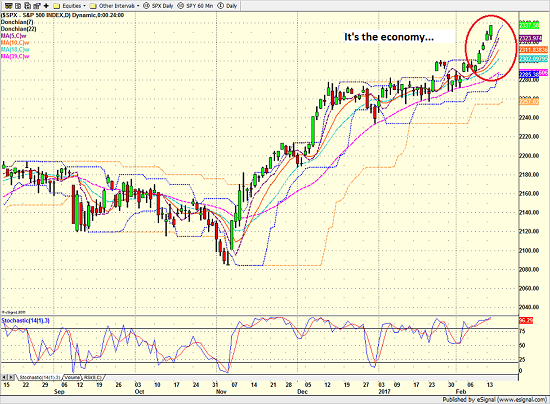

From my perch, the key to the "odd" behavior in the stock market yesterday is simple. As James Carville famously said in 1992, "It's the economy, stupid."

S&P 500 - Daily

View Larger Image

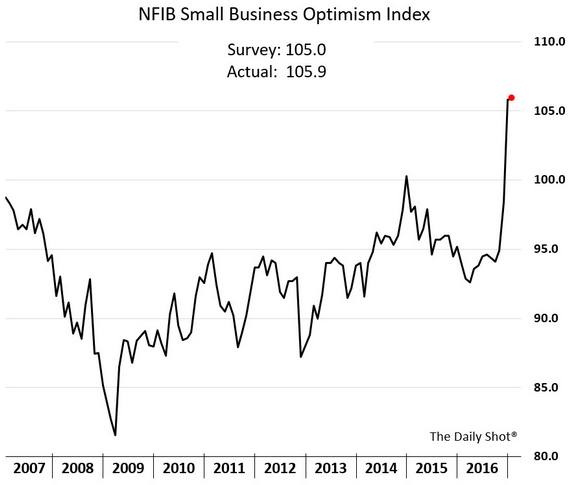

Although the NFIB Small Business Optimism Index is not followed as closely as something like the monthly update on Nonfarm Payrolls, the report was chock full of good stuff Tuesday. And again, in my humble opinion, it is this type of data that is likely behind the bullish shift in stocks.

For example, the NFIB's headline Optimism Index came in well above expectations and has spiked since the election to levels not seen since well before the crisis.

Source: NFIB

In addition, the NFIB report showed that earnings, hiring and planned wage payments all moved higher last month, with the index on earnings hitting the highest level in more than 5 years.

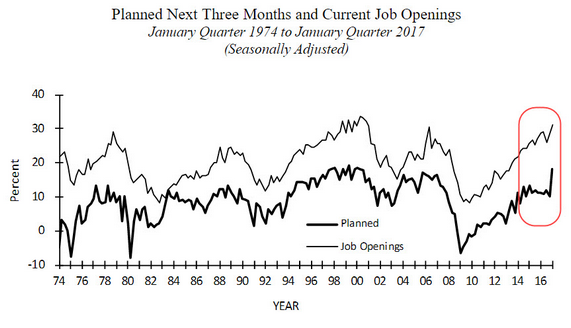

Finally, the readings for Current and Planned Job Openings (seasonally adjusted) spiked in the January quarter to the highest level seen since the financial crisis ended.

Source: NFIB

While economic reports should never be viewed in a vacuum, it is important to recognize that - again, in my humble opinion - the current rally in stocks has been based on the idea of better days ahead for the economy. I've also opined that this theory will need to be supported by actual economic data and earnings if the move is to hold up or continue from a big-picture perspective.

And the bottom line appears to be that reports like the one we saw yesterday from the NFIB just might be a step in that direction.

Thought For The Day:

If you follow the crowd, you run the risk of getting lost in it...

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Trump Administration Policies

2. The State of the U.S. Economy

3. The State of Global Central Bank Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member