Good morning and welcome back to the land of blinking screens. From my seat, the state of the Trump administration appears to have taken the place of tensions with North Korea this week in terms of what markets are most concerned about. This may be a temporary thing during what is traditionally prime vacation season on Wall Street. So, with volume light and trading desks thinly staffed, we should probably expect volatility to continue for a while.

Since it's the start of a new week, let's now focus on our objective review the key market models and indicators and see where things stand. To review, the primary goal of this weekly exercise is to remove any subjective notions one might have in an effort to stay in line with what "is" happening in the markets. So, let's get started.

The State of the Trend

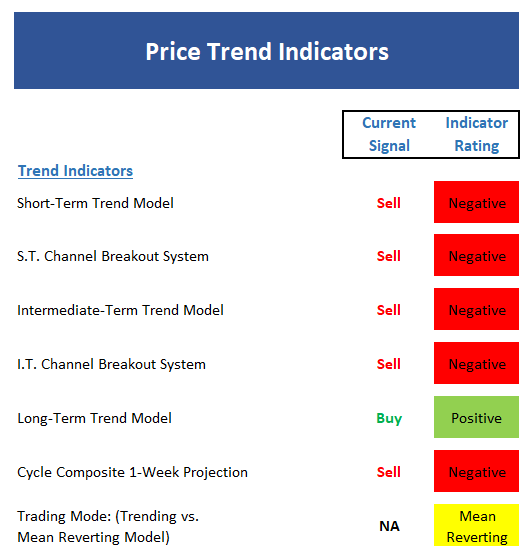

We start each week with a look at the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

Executive Summary:

- The short-term Trend Model remains negative.

- Both the short- and intermediate-term Channel Breakout Systems are on sell signals. A short-term buy would occur at 2480 and an intermediate-term buy would require a move over 2491.

- The intermediate-term Trend Model has also slipped to moderately negative. We're on the lookout for a "lower low" below 2409.

- The long-term Trend Model remains positive.

- The Cycle Composite continues to point lower.

- The Trading Mode models continue to suggest stocks are in a mean-reverting environment.

The State of Internal Momentum

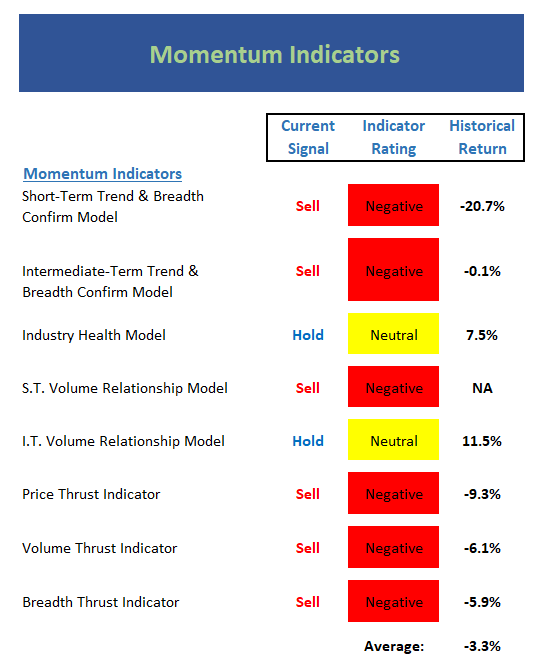

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend...

View Momentum Indicator Board Online

Executive Summary:

- The short-term Trend and Breadth Confirm Model remains negative.

- Our intermediate-term Trend and Breadth Confirm Model is also negative. The combination suggests weak internal breadth.

- The Industry Health Model hasn't experienced any dramatic change at this point but continues to trend lower within the neutral zone.

- The short-term Volume Relationship is negative and up-volume is near the lows of the year.

- The intermediate-term Volume Relationship continues to weaken.

- All three "thrust" indicators are solidly negative.

- In short, momentum remains weak.

The State of the "Trade"

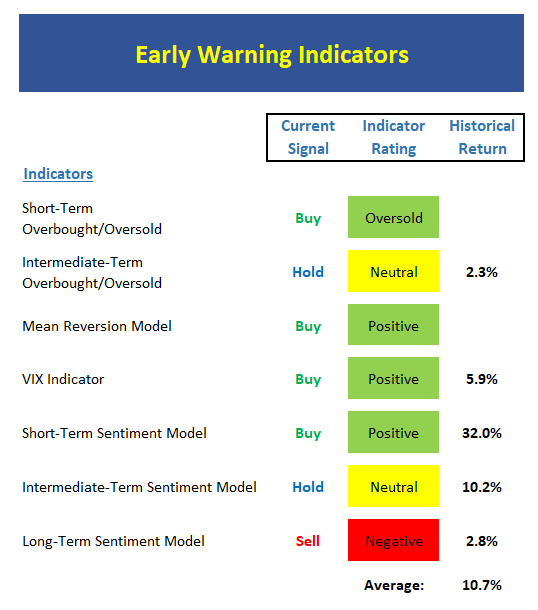

We also focus each week on the "early warning" board, which is designed to indicate when traders may start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

Executive Summary:

- From a near-term perspective, stocks are now oversold.

- But from an intermediate-term view, the market is only neutral. So, the stars are not aligned (yet?)

- The Mean Reversion Model flashed a buy signal late last week.

- The VIX Indicators have issued two buy signals.

- From a short-term perspective, market sentiment is now moderately negative, which is a positive.

- The intermediate-term Sentiment Model remains neutral.

- Longer-term Sentiment readings are improving a bit, but there is still too much optimism in the market.

The State of the Macro Picture

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View External Factors Indicator Board Online

Executive Summary:

- Absolute Monetary conditions are unchanged and remain moderately positive.

- The Relative Monetary Model moved smartly into the green last week. Note that this is the first time monetary conditions have been positive this year.

- Our Economic Model (designed to call the stock market) remains moderately positive, but is heading the wrong direction at the present time.

- The Inflation Model continues to fall within the neutral zone. Thus, inflation is now trending lower.

- Our Relative Valuation Model continues to improve a bit but is still within the neutral bounds.

- The Absolute Valuation Model continues to improve - albeit ever so slightly within the very overvalued zone.

The State of the Big-Picture Market Models

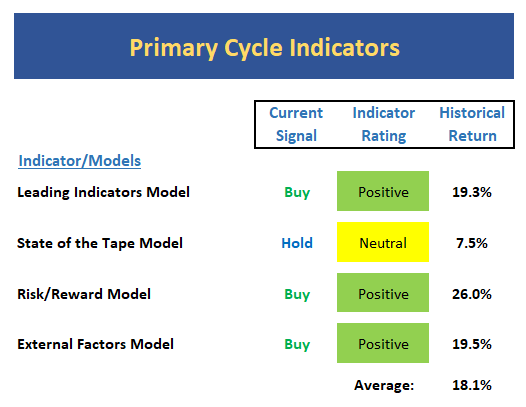

Finally, let's review our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

View My Favorite Market Models Online

Executive Summary:

- The Leading Indicators model, which was our best performing timing model during the last cycle, remains green. However, the model reading slipped back to 60% last week from 90%.

- The Tape remains stuck in neutral as momentum and breadth was weak before the current decline began.

- With monetary conditions improving and stocks becoming oversold, the Risk/Reward model has upticked to moderately positive.

- The External Factors model is holding just over the line between positive and neutral. This continues to be a positive from a big-picture standpoint.

The Takeaway...

Stocks are in a downtrend from a short-term perspective as the S&P 500 put in a lower-low on Thursday and Friday last week. However, the intermediate- and long-term uptrends are still intact. From a technical perspective, a sustained close below 2410 would change this picture for the worse. Next, it is worth noting that our big-picture models have been improving a bit and that stocks are oversold. Thus, I conclude that while we may continue to see some "price discovery" to the downside, the fundamental backdrop is still in pretty good shape. This tells me that a buy-the-dip strategy continues to make sense from a longer-term perspective. With that said however, the cycle composite suggests that there may be more downside ahead. So, a bit of patience would seem to be in order for a while longer yet.

Thought For The Day:

Truth is stranger than fiction. -Mark Twain

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Trump Administration

2. The State of the Economic/Earnings Growth (Fast enough to justify valuations?)

3. The State of Geopolitics

4. The State of Fed Policy

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member