As we entered calendar year 2017, hope reigned supreme. There was hope for tax reform, reduced legislation, and a plan to rebuild America's infrastructure. And with Republicans controlling the White House and both houses of Congress, getting the new administration's agenda implemented was expected to be a snap.

After eight years of sup-par economic growth (if memory serves, the current expansion has been the weakest of the modern era), all of the above was going to jump-start the economy. Economic growth was going to shift from a "plow horse" pace to the "race horse" (hat tip to First Trust's Brian Wesbury) rate that investors needed/wanted.

Everybody on Wall Street agreed. Inflation would rise. Stock market valuations would improve. And bond yields had nowhere to go but up. It was obvious - and investors large and small planned accordingly.

"If It's Obvious, It's Obviously..."

However, as Joe "I'm the Greatest" Granville became famous for saying, "If it's obvious, it's obviously wrong!" And so far at least, Mr. Granville's view has been spot-on in terms of the bond market.

The battle cry for bonds coming into 2017 was to move away from long-dated treasuries. The thinking was that bonds had entered a mega bear phase that was going to destroy value like nothing anyone had ever seen. The plan was to shorten duration, shy away from governments, increase exposure to corporates and junk, and to employ alternatives in your portfolio.

So what has happened to the bond market since the beginning of the year? Oh that's right, the consensus has once again been dead wrong.

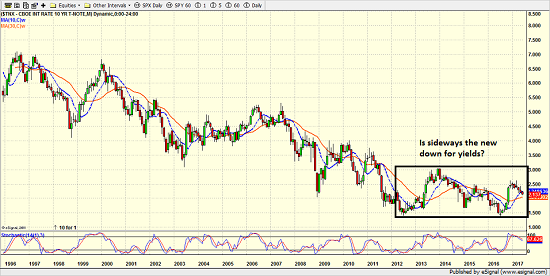

The yield on the 10-Year US Gov't T-Note closed yesterday at the low for the year at 2.137% - down from 2.446% at the end of last year. And as the chart below clearly illustrates, the current trend of bond yields is now moving from the upper left to the lower right.

10-Year US Treasury Yield - Daily

View Image Online

In the investing game, it is important to remember that reality eventually trumps expectations. Instead of the "race horse economy" that Trump & Co. were supposed to generate, GDP growth has remained tepid and as our models have been saying, inflation has faltered in recent months. In short, President Donald Trump's presidency hasn't yet triggered the surge in economic growth that everyone expected.

Instead, according to the latest Commerce Department data, GDP grew at an annual pace of just 1.2% in the first three months of the year. And while the numbers for Q2 appear to be better, they are a far cry from expectations.

The bottom line for the bond market is investors have spent the last three and one-half months paring their expectations for the economy, inflation, and fiscal policy. And what happens to yields when expectations for the economy and inflation fall? Yep, that's right; prices rise and yields decline.

In a note to clients regarding the state of the 10-year yield, Torsten Slok, who is the chief international economist at Deutsche Bank, wrote, "The problem is that Wall Street economists have been consistently too optimistic for the past 15 years."

Slok points out that the Fed has had similar difficulty in predicting economic growth. According to Deutsche, growth projections for the ensuing 12 months by the Federal Reserve Bank of Philadelphia's quarterly survey of professional forecasters have been 0.6 percentage points too high on average since 2003.

The Deutsche report goes to point out that the latest survey, which was released last month, projects a 2.9% yield in the April-to-June period of next year. Adjusting for the average over-shoot, this suggests the yield on the 10-year will likely be in the 2.3% range, just a smidgen higher than current levels. So much for the great advance in rates everyone is looking for.

The same story holds true when looking for the great bond bear, which has been an obsession of many analysts for years now. But a funny thing has happened on the way to the bond debacle - it just hasn't happened.

From my seat, the action on the long-term chart of bond yields suggests that a classic bottoming phase has been in place for more than five years now and that sideways may be the new down for bond yields - well, until the economy actually perks up, that is.

10-Year US Treasury Yield - Monthly

View Image Online

To be sure, rates can surprise to the upside at any time, for any reason. The analysts are correct, if the economic growth begins to strengthen and inflation heats up, yields will rise. However, trying to call when the 30+ year trend lower in bond yields will morph into a bear has so far been a fool's errand.

Thought For The Day:

Don't jump to conclusions, there may be a perfectly good explanation for what you just saw. -Proverbs 25:8

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the U.S. Economy

2. The State of Earning Growth

3. The State of Trump Administration Policies

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member