Call it the "Trump Trade," the "Trump Bump," the "reflation allocation," or whatever you'd like, but since November 9th, it is safe to say that traders have been looking ahead to better days. And by now, everyone knows the bullet points of the bull argument which include lower taxes, less regulation, and better economic growth. According to our heroes in horns, all of the above are expected to result in higher profits for corporate America. Which, of course is expected to be a good thing for stock prices.

But if I've learned anything in my 30+ years as a money manager, it is that when a theme becomes too widely accepted - particularly when it comes to predicting the future of the stock market - things don't always go according to plan.

So, my thinking is that at some point, what I've been referring to as "economic reality" needs to actually materialize and morph into upside surprises during an earnings parade in the not-too distant future. As such, our furry friends in the bear camp are quick to remind us that the bulls could be at risk if there are any hiccups or false starts along the way.

I will opine that this concern is at least partially responsible for the current sideways action taking place in the major indices. Well, outside the NASDAQ, which seems to be marching to the beat of a different drummer lately, that is.

So, is it over? Has the "Trump Bump" run its course? Will traders now wait for policies to be announced? Or will the animal spirits take over soon and allow the bulls to continue their recent run for roses?

While pondering these and other questions, I decided to take a look at what the historical cycles might have to say about the future direction of stock prices.

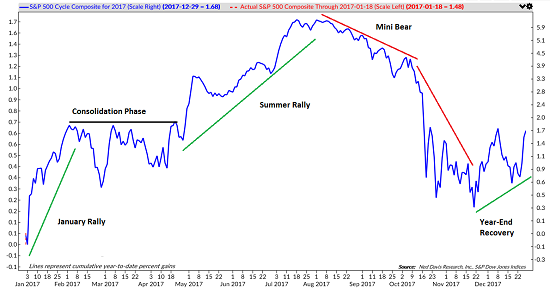

To review, the folks at Ned Davis Research create a composite that combines all the 1-year seasonal cycles, the 4-year Presidential cycles, and the 10-year decennial cycles since 1900. The idea is to come up with a single composite of historical cycles in order to try and project what to expect for the coming year.

To be sure, the stock market doesn't always follow the historical cycles and sometimes Ms. Market can deviate wildly from the historical scripts (the decline seen in Jan/Feb of 2016 is Exhibit A here). However, when the cycle composite is "on," I've found it to be "scary good" as a predictor of stock prices. And the bottom line is that from a bigger-picture point of view, the composite has done a very good job over the past 6 years or so in projecting what the future might look like.

But before we go any further, I need to insert an important caveat as I do NOT manage money based on cycles, market calls, or gut instinct! However, understanding that the stock market often travels in a cyclical fashion can be helpful when trying to determine when to put new money to work, rebalance portfolios, or initiate a new approach. It is for this reason that I check in with the cycle composite of the S&P 500 on a regular basis.

So what do the historical cycles project for 2017, you ask? Let's take a look.

Historical Cycle Projection for 2017

View Larger Image

The first thing to note is that while a great many analysts are looking for a year similar to last year in the stock market, the cycle projection says, "not so fast."

Since I was on record early in 2016 as leaning bullish and encouraging folks to buy the dips whenever things got dicey, I'd like to now go on record and remind readers that all good things in the stock market eventually come to an end. And while I do NOT believe that the secular bull trend is likely to end this year, the historical cycles suggest that the mini-bull that began in February 2016 could come under pressure in the second half of 2017.

But first, the projection says that we should enjoy higher prices in the market. The cycles suggest a rally into early February to be followed by a consolidation phase. Next up is the traditional summer rally, which if the projection holds, would push prices to new highs.

However, after that, things could get interesting. Instead of the typical "fall swoon," this year's projection suggests a fairly stiff correction could take hold. And as we've learned, once a trend develops it can last longer than expected. As such, it isn't a stretch to think that the type of "mini bear" that was seen from August 2015 through February 2016 could ensue as the leaves begin to turn.

And lest we forget, this is a year that ends in "7," which have tended to experience some difficulty in the early fall at times.

To be clear, this is simply a projection of what "could" happen. And while I can argue with this projection all day long, this particular forecast should serve as a reminder that trees don't grow to the sky.

But for now, I believe the battle cry remains unchanged and investors should be ready to buy the dips for a while longer.

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the "Trump Trade"

2. The State of Global Central Bank Policies

3. The State of U.S. Economy

4. The State of Bond Yields

Thought For The Day:

Everything that irritates us about others can lead us to an understanding of ourselves. - Carl Jung

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member