Modern times demand modern thinking in portfolio design. Learn more...

Good morning and welcome to the fourth week of May. By the way, does anybody know where the first half of 2016 has gone?

Since it is Monday, it's time to take a step back and review the state of the market and our major market indicators/models as objectively as we can. As usual, the first stop is a review of the price/trend of the market. Here's my take...

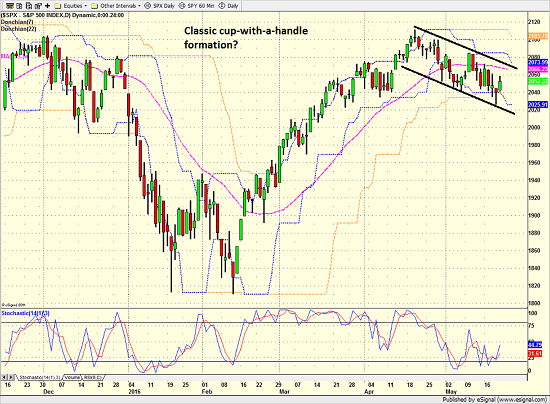

- From a short-term perspective, the trend remains down.

- So far at least, the downside has been very "orderly".

- Key near-term support level at 2040 was tested last week.

- My guess is the market's real support will be at 2020 which is where the 150-day ma currently resides.

- One can argue that the S&P 500 is currently tracing out a classic "cup with a handle" formation, made famous by William O'Neill. Thus, a break above the current downtrend line would produce a buy signal for technicians.

- The cycle composite is now positive for the next 2 weeks and largely positive for the next month and a half.

- My indicators continue to suggest stocks are trading in a mean-reverting mode.

S&P 500 - Daily

View Larger Image

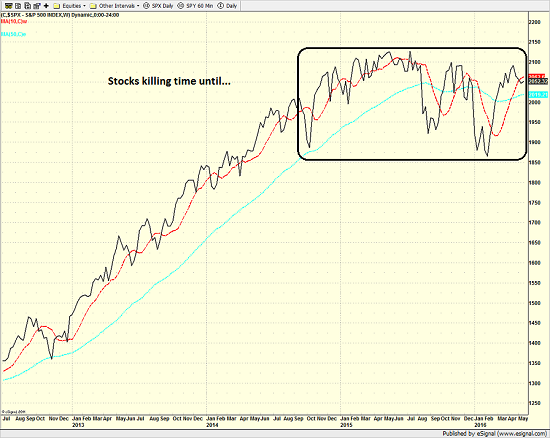

From a longer-term perspective (e.g. looking at a weekly chart of the S&P 500)...

- The intermediate-term trend (price relative to 10-week ma) is now negative - but only slightly so.

- Not much has changed here as the trading range remains intact.

- From my seat, stocks appear to be killing time until a long list of uncertainties can be resolved including the state of the economy, the consumer, retail, and earnings, as well as the election and what the Fed plans to do next.

- I contend that the current action continues to be a consolidation pattern, which, according to the textbooks, should be resolved to the upside.

S&P 500 - Weekly

View Larger Image

Here's the view of the "state of the trend" from our indicator panel.

- Although there are several red boxes on the board, the readings are not severely negative.

- Overall, I'm going to rate the current board as neutral.

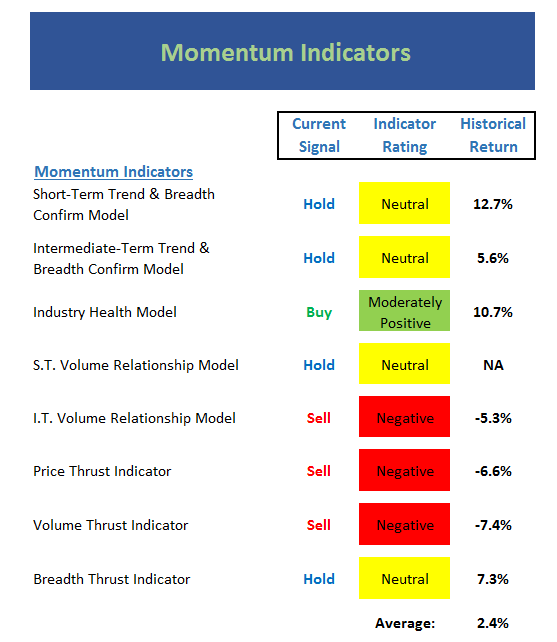

Next up is the momentum indicator board...

- The short-term Trend & Breadth Confirm Model is now neutral. Since 1980, stocks have performed moderately well with the model in a neutral mode. However, over the past 10 years, the neutral mode has actually been the most profitable due to the propensity for stocks to put in a V-Bottom. The model indicates that stocks gain more than 31% on an annualized basis when the model moves to neutral.

- The Industry Health Model remains neutral. However, the model is now moving higher and stocks have tended to perform about 2% per year (annualized) better than average when the model is in this mode.

- Surprisingly, the short-term Volume Relationship Model is not negative. To me this is a plus

- The Volume Thrust Indicator is actually only moderately negative.

- The Breadth Thrust Indicator has moved up to neutral - again, kind of odd for a downtrend.

- Despite the recent weakness in stocks, the historical return average for the momentum board remains slightly positive. This tells us that the selling pressure has not been intense.

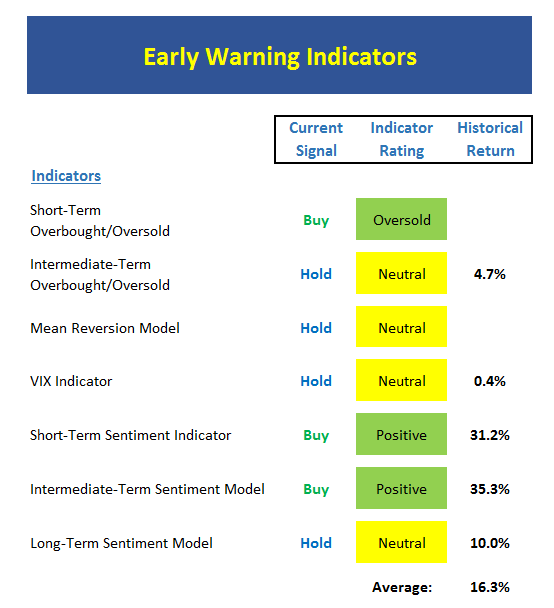

Next up is the "early warning" board, which is designed to indicate when traders may start to "go the other way" for a trade.

- My group of short-term Overbought/Sold indicators suggest that an oversold signal has been given.

- However, since the best moves come when all the time-frame stars are aligned, we should note that the intermediate-term indicators show a neutral condition.

- The Mean Reversion Model is very close to giving a buy signal.

- The VIX remains in never-land.

- The Short-term Sentiment Model is now positive and stocks have gained ground at an annualized rate of more than 31% when the model is positive.

- The Intermediate-term Sentiment Model is also positive and sports an historical gain of more than 35% in this mode.

- The Long-term Sentiment Model is neutral (i.e. no longer negative).

- Thus, the sentiment situation suggests that the time to buy stocks for a trade may be close at hand.

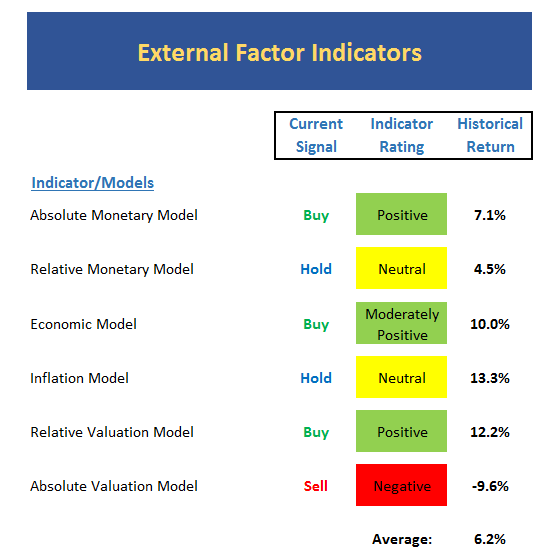

Now let's move on to the market's "external factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

As a reminder, this board doesn't change very often.

- There is no change in the overall Monetary picture.

- But when reviewing the Absolute Monetary Model results since 2007, I note that the impact of positive monetary conditions has lost much of its punch. I.E. The average annual returns are MUCH lower since 2007 than for the period from 1980.

- A component of the Economic Model has upticked and suggests the economy is now approaching "strong growth"

- The Inflation Model has downticked to neutral. This means that there is some inflation percolating in the economy.

- All in, the takeaway is this board is less positive than it has been with the current historical return reading below the historical norm.

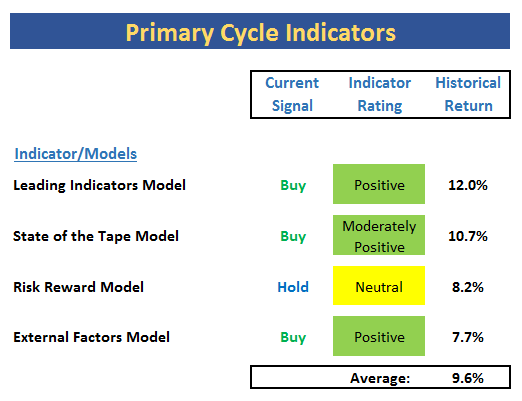

Finally, let's turn to our favorite big-picture market models, which are designed to tell us which team is in control of the prevailing major trend.

- The Leading Indicator Model remains positive. However, when viewed in more recent times (since 2000), the market's return is much lower (+12%/year) than the average of 19% seen since 1980. This tells me that some of the stuff that once was a key leading "tell" for the market has become less valuable since the turn of the century.

- After a brief (one week) trip into positive territory a few weeks back, the Risk/Reward Model remains neutral.

- The External Factor Model has also proved less valuable since 2000, with annual returns now averaging 7.7%, which is well below the rate seen since 1980.

- The average historical annualized return for the board currently stands at 9.6%. This is in line with historical average returns for the stock market.

The Takeaway...

From a short-term perspective, key support is between 2020 and 2040. Should 2020 give way, rest assured that the bear algos will take over the game for a while. Next, it is interesting (well, to me, anyway) that the volume relationship indicators aren't more negative (a plus) and that the momentum models in general aren't worse. In addition, it is positive that sentiment conditions now favor the bulls. However, with inflation starting to percolate, investors will need to watch the level of interest rates.

To sum up, I believe the "weight of the evidence" continues to favor the bulls. However, we are not talking about a robust environment here at all. Yet, while everyone on the street is looking for middling/disappointing returns, our models suggest this view might be a bit too dour. Thus, barring a fresh crisis, the models tell me to look for average to better-than average returns for stocks when viewed over the next 12-18 months.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Growth

2. The State of Interest Rates

3. The State of Global Central Bank Policy

4. The State of the Stock Market Valuations

Today's Pre-Game Indicators

Here are the Pre-Market indicators we review each morning before the opening bell...

Major Foreign Markets:

Japan: -0.49%

Hong Kong: -0.22%

Shanghai: +0.64%

London: -0.32%

Germany: -0.76%

France: -0.87%

Italy: -2.04%

Spain: -0.74%

Crude Oil Futures: -$0.52 to $47.89

Gold: -3.50 at $1249.40

Dollar: higher against the yen, euro, and pound

US 10-Year Bond Yield: Currently trading at 1.829%

German 10-Year Bund Yield: Currently trading at 0.162%

Stock Indices in U.S. (relative to fair value):

S&P 500: +0.88

Dow Jones Industrial Average: +5

NASDAQ Composite: +6.90

Thought For The Day:

"I have never met a man so ignorant that I could not learn something from him." -Galileo Galilei

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member