Hey Everyone! Happy Monday!

Regardless of whether your preferred team won the Superbowl yesterday, you may be interested in learning about the famed "Superbowl Indicator (SBI)." Apparently, if we go back over the 48 previous SuperBowl games, all the way back to the Green Bay Packers in SB #1 against the Kansas City Chiefs (1967), and note which team won each year, it turns out that the winning team's conference -- AFC or NFC -- predicts whether the stock market will be higher or lower by December 31st...with a 77.8% accuracy!

Yesterday, the New England Patriots won by 4 points over the Seattle Seahawks. New England plays in the American Football Conference, while Seattle plays in the National Football Conference. According to the SBI, this is bad news for stocks. As it turns out, AFC winners tend to predict bear markets, while NFC winners predict bull markets. Why? I haven't a clue.

Regardless, I've been deep in market analysis the past several days, and have been drawing out my own road map for the markets for the rest of the quarter and year. More on that in a moment.

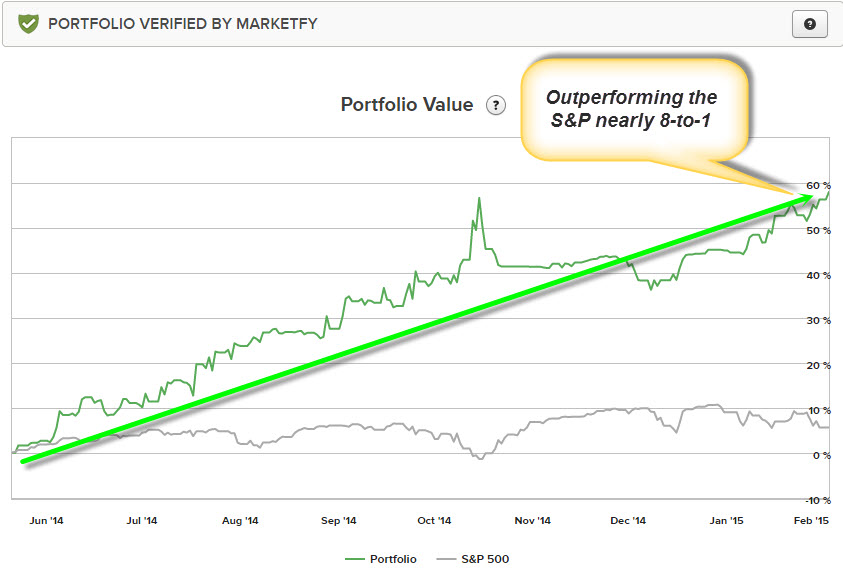

First, have you noticed that the Dr. Stoxx Options Letter is now 9 for 9 so far in 2015, including the 2 spreads which closed Friday for full profit? In fact, we have a string of 16 winners in a row. You have to go back to early December to find our last loss. You'll see our overall returns below. And more good news: our current set of open trades are doing fine too. The kind of heightened volatility we've seen in recent weeks is absolutely ideal for the kind of low-risk options trades we send out to subscribers each day. So bring it on, Superbowl Indicator!

As for my own market map: I happen to agree with the SBI. I'm bearish overall for stocks for the rest of the quarter. I think we'll get a couple of weak bounce attempts along the way, but that the major indexes will close the quarter lower, with a possible test of the October lows by late Spring. We'll probably get a weak summer rally, but the Fall could get very ugly. As for oil: it will likely chop its way higher into the end of the year. My target is $63 for crude by January, 2016. Gold: I'm not sure this is the big breakout here. The dollar is just too strong. We may see another test of the 1150-1200 lows before finally getting a late-year rally into 2016. But in the short-term there is a bullish breakout building for the gold miner's index which should play out in the next week or two.

That's ll for now. And if you aren't already a subscriber, come join us in the Dr. Stoxx Options Letter. Daily market guidance, low-risk option trades, and a free "Options 101" webinar. Can't beat it!

Blessings, all, TC

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member