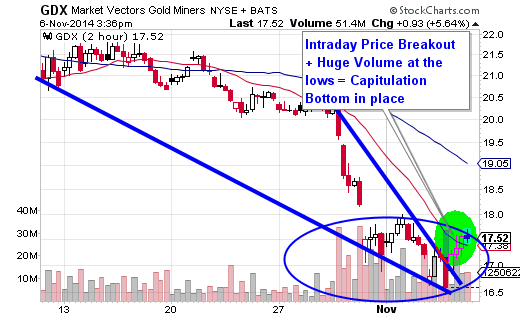

The Gold mining index of stocks, represented by the exchange traded fund, GDX, have been in a steady downtrend for months. But the recent pick up in downside momentum, coupled with a massive increase in share volume suggest a capitulation bottom may be in place. Today's bullish action on above average volume, the index's second recent attempt to shove off from the support level of 16.50, bears the clear marks of institutional buying.

I'm attaching here a picture of the chart of GDX using a 2-hour intraday chart. You'll see clear signs of capitulation: panic selling following by big volume buys off the lows. What seems to be happening is that lots of retail traders are selling their shares to deep-pocketed institutional buyers.

I prefer to play this kind of chart by selling naked puts. With a clear low marked on the chart, we have an ideal strike price defined (in this case, 16.50). If we go about 2 weeks out, we can bank premium in the range of 0.30 to 0.40 per put. This puts our break-even price at 16.15 or so. As long as shares close above that level 2 weeks from now, we make money. Even if we are assigned shares, we have an excellent entry price and can always sell calls against those shares to further reduce our cost basis.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member