The following article is sponsored by the Dr. Stoxx Options Letter.

Disclaimer: subscribers are in BIDU put-writes

I have long been a fan of Baidu, the megalithic Chinese internet search engine, ever since they IPO'd back in 2005. They traded then at a split-adjusted price in the single digits. Oh, how I wish I had had the foresight to back up the truck. Just as I wish I had bought shares of Google, Baidu's American counterpart, at it's 2004 IPO when shares exchanged hands at around $50 each.

No matter. While Google's best days are probably behind it, Baidu is just getting started. Why? Because more than 100 million Chinese each year are taking advantage of their growing economy and infrastructure and are getting online. And once they are online, there is only really one choice for searches: Baidu. Baidu does have competition for ad revenue from the likes of Sina and Sohu, but with projected CAGR revenue growth pegged at 73% into 2017, there is plenty to go around. And again, Baidu is the only choice for search functions.

It is no wonder JPMorgan in a report last month selected Baidu as their top stock pick in Asia. Yes, the share price of Baidu has been a bit sluggish in recent months. And yes, they did miss their eps numbers in Wednesday's earnings announcement. But this is only because the company has been upgrading its platform and spending billions (literally) on R&D as it tools up to capture more of the mobile search market. The company has also been beefing up its iQiyi site, which is something like the Chinese version of Youtube. But all that investment should be accretive in 2015.

Here is what you get when you buy BIDU:

- +36% projected eps growth next year

- +59% historical year on year eps growth over 5 years

- 52% growth in sales this year

- +58% growth in sales last 5 years

- low debt, huge margins, strong analyst support

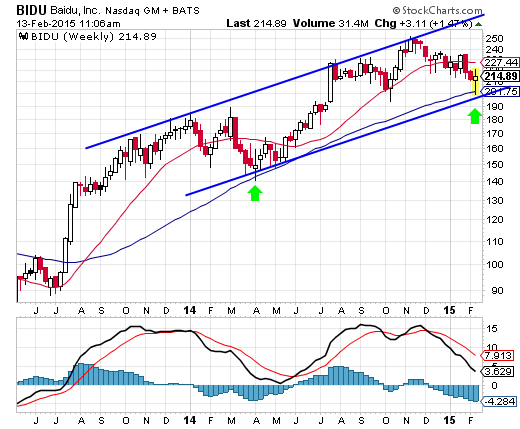

And a chart that looks ready to resume its long term uptrend:

Thus I see Thursday's dip post-earnings as a great place to start a new position in BIDU, or to add to an established one. If you are long-term bullish on China, then you need to be in China's biggest and best online company. It may well be one of the alltime great investment stories over the next decade.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member