Last week the markets reacted to a rather dovish statement from Chair Yellen in very bullish fashion, pushing both the S&P 500 and the Dow Jones Industrial Index to new all-time highs. We've seen that move solidify this week, albeit on holiday-lightened volume. But what about next week, when the New Year presents itself to the full arsenal of holiday-rested traders back at their desks?

December is known to be the most bullish month of the year, and this week the best of December. But what happens when those end of year forces run out of time?

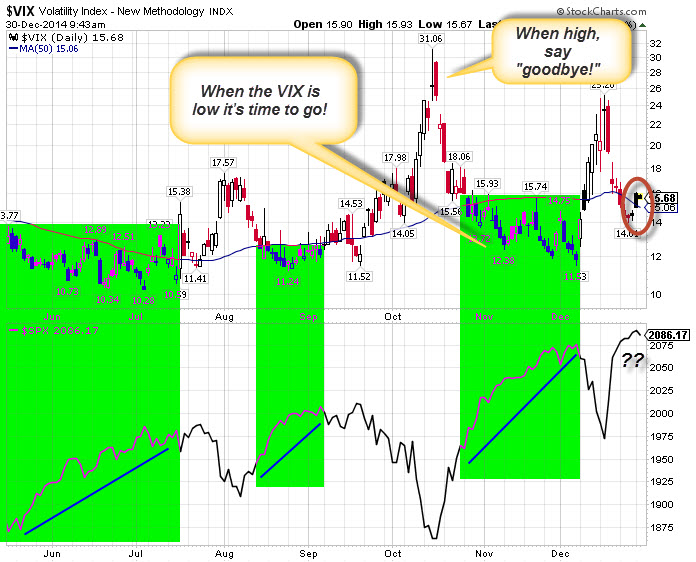

We might get a clue how 2015 will start by looking to the CBOE Volatility Index, better known as the VIX, and sometimes called the "fear index." In general, the markets love to see a VIX in low numbers. This signals that the big traders are not buying near-term "put insurance" (which is what the VIX measures), likely because they see the markets heading higher over the near term. And more often than not, they are right.

See my chart below. The green boxes highlight the fact that whenever the VIX spends a sustained period below its 50-day moving average, the S&P rallied significantly. Whenever the VIX remains above its 50-day moving average, however, the S&P has a rougher go of it.

Note where the VIX is now, off to the right edge of the chart. It is currently trading at 15.55, or about 3% above its 50-day moving average. And the S&P looks a bit top-heavy at the same time.

Now, this doesn't require that we will see a selloff anytime soon. The VIX is notorious for playing hide and seek with its moving average; a game it can play for weeks before committing itself one way or the other. But it does give one pause. If the big boys are concerned enough going forward to be increasing their market protection as we head into January, maybe the rest of us should be too?

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member