The Russell 2000 smallcap index is often used as a predictive indicator by market analysts. When it is running strong, the assumption is that traders and investors are willing to take on risk. But when the index falls, it can set a bearish tone for the market.

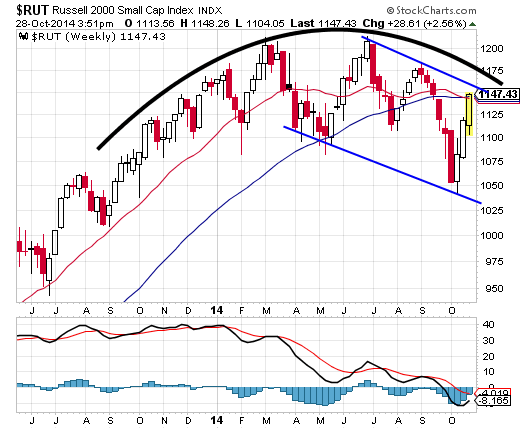

After underperforming for several weeks, the Russell has made a tremendous comeback. It is currently trading more than 10% above its recent deep-cut low, printed at 1040 on October 15th. Now the index has reached 2 technical levels of resistance. It has run up into the 50 week moving average, and also the underside of a downsloping trendline set by the two previous pivot highs. See our chart below:

Technical indicators on the Russell are all running higher, confirming the strength of the rally. But given that the ramp up is nearly vertical and that the index has moved outside its upper Bollinger Band (signifying a move beyond 2 standard deviations), odds favor a pullback from here.

Looking for a safe way to profit from the next big move in the Russell 2000? If you are bullish, you can put on a put Credit Spread below the current price. You can, for example, sell some November 1040 puts and buy the 1030 puts as protection. You'll get to keep the difference between them if both expire worthless. If you are bearish, you would do the same with a call Credit Spread placed above the current price level. You'll need to look for strikes that are at least above the September high -- 1200 would do it -- and with enough time value to give you a decent premium spread.

Our "Dr. Stoxx Index Spread Trader" guides into trades like these every week. It's a low-risk way to bank several hundred dollars to several thousand dollars a week, every week, depending on your account size and risk tolerance.

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member