Scott

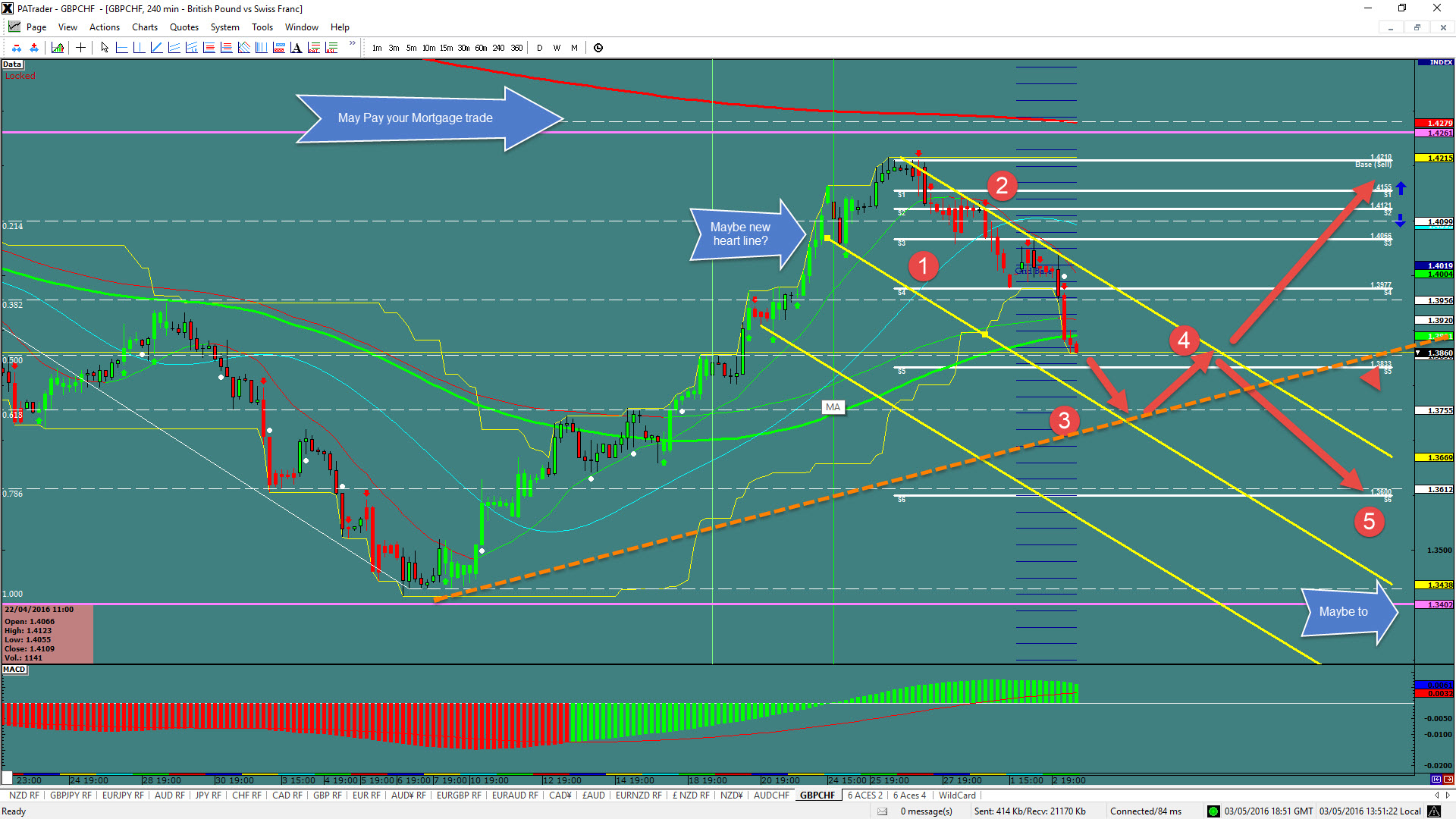

When looking at this pair on a 240 min chart you'll notice that we are in a nice trending move to the downside. The nice thing about this setup is that it has two great trading scenarios depending on your view and both Elkana and I represent those two views. If the currency continues to move in the trend direction it has 120 Pips to the 0.618 Fibo and then after the correction it has 240 Pips down to the S6 for a total of 510 pips with the potential for an even further move of 210 pips down to the day chart bottom @ 1.2403 for a total of 840 Pips if it trend down all the way. A break up instead of a just the correction would yield a potential 390 pips up for a total both ways of 510 pips.

Elkana

He is looking for a move down to the 0.618/0.786 Fibo but a solid bounce there to finish the 2nd wave and a marching 3rd wave move back above wave 1 to the 1.4500 area. That move could produce 120 Pips down and then 750 Pips to the upside.

The pair’s ATR (Average True Range) is currently 142 pips a day (14-day average) so a 510-750 pip trade could take a while. Both Elkana and I agree that this is a great opportunity. Which is it? The market will confirm that as we go along.

Our trading methodology is based on proprietary technical indicators. We pay attention to what the big banks are doing in the markets (the Big Boys) and specifically look for opportunities that have a high opportunity and low risk. We always identify our target before entering a trade, and we focus on the risk of the trade instead of the reward. We have (and follow) rules, and we press our winning trades without exception.

Remember that we recommend that you always trade with stops. And if you don't trust yourself or think you'll get cold feet in a long trade like this, then place the trade and walk away. Better to get taken out by a stop or target than to second guess an active trade and take yourself out. Do your research before you place your own trade. Trust your research.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recent free content from Pro Act Traders

-

EUR/AUD-Breakout in the range

— 4/25/24

EUR/AUD-Breakout in the range

— 4/25/24

-

GBP/USD-continuing the channel

— 4/24/24

GBP/USD-continuing the channel

— 4/24/24

-

CHF/JPY-continuing a 3rd wave

— 4/23/24

CHF/JPY-continuing a 3rd wave

— 4/23/24

-

AUD/USD-starting the up move

— 4/22/24

AUD/USD-starting the up move

— 4/22/24

-

GBP/AUD-Sweet opportunity down

— 4/18/24

GBP/AUD-Sweet opportunity down

— 4/18/24

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member