The stock market is beginning to look eerily like it did in early February this year...just before the market rolled-over. Investors are ignoring a big pick-up in the coronavirus cases...and the rally is a very narrow one once again. Thankfully, the Fed is providing a massive amount of liquidity, so the odds that that market will decline more than 30% over the next few months (like it did in Feb/March) are very low. However, the resurgence of Covid-19 and the narrowing of the market could/should be signaling that at least a near-term pull-back in the stock market is in the offing.

Yesterday’s advance was very much like Monday’s...as it came on very low volume (3.6bn shares) and incredibly mediocre breadth. In fact, the advancers vs. decliners numbers were BARELY positive on the S&P 500, the Nasdaq Composite and the NYSE Composite indexes. None of these major indices has breadth that was better than 1.1 to 1 positive...which is terrible for a day when they all rallied by a half of a percentage point or more. We’d also note that even the NDX Nasdaq 100 Index...which rallied 0.78% on the day had breadth that was less than 2 to 1 positive.

This is not a phenomenon that is only a very days old. After playing catch-up during the early part of June, the S&P equal weight index has underperformed pretty significantly recently. It was basically unchanged yesterday and now stands almost 9% below its early June highs. That compares to the regular S&P 500 Index, which is just 3% below its June highs. So as you can see, fewer and fewer stocks are fueling the stock market right now.

Of course, one of the big reasons for this is the rally in mega tech stocks....as AAPL, MSFT, AMZN, FB, NFLX & NVDA are trading at new all-time highs. (GOOGL is not quite there, but it still stands 39% above its March lows.) These stocks are becoming ones that are considered “win-win” stocks. If the market can continue to rally, they’ll be led by these names...just like the rally has since the March lows. However, if the resurgence of the coronavirus causes the market to see another significant pull-back, these stocks should hold-up well...because they’re great “stay at home” stocks.

In other words, believe it or not, the mega-cap tech stocks have become defensive plays in many investor’s minds. So we’re seeing a situation where people are concerned about the ability of the stock market to rally a lot further after the powerful rally off of the March lows, so they’re playing heavily in the “win-win” stocks...while hedging themselves in other defensive assets like gold. This is a smart strategy, but it is also one that signals that the strength in the economy is not broad. It’s great that people say (correctly) that these mega-cap stocks deserve to be outperforming, but when their outperformance becomes as wide as it has been once again recently, it’s a signal that the broad economy is beginning to flatten-out after its sharp initial bounce.

However, the mega cap tech group is not the only area that has been outperforming. The biotech stocks have broken-out very, very nicely. The IBB biotech ETF has broken above its 2015 all-time highs by over 4%...and now stands almost 47% above its March lows. That compares with a 49% rally in the XLK technology ETF and 51% surge in the SMH semiconductor ETF. So as you can see, this sub-group of the healthcare sector is keeping up with the tech stocks very nicely.

The IBB is starting to get overbought. It’s not an extremely overbought reading, so we wouldn’t be surprised if rallied a bit more over the next week or two, but it’s “next decline” is going to be very, very important. If the “next decline” is a shallow one...especially if it can hold above its 2015 highs (“old resistance” becomes “new support”), it will confirm an important breakout above the old record highs. If the IBB can follow any “shallow decline” going forward with a new “higher-high”, it’s going to give the sector the kind of upside momentum is saw in the 2014, 2015 time frame........There is no question that the coronavirus has focused investor attention on the importance of this industry on a fundamental basis, so if it also gets a confirmed breakout of its old record highs, it should give the group a double-barreled shot of bullish momentum. (First chart below.)

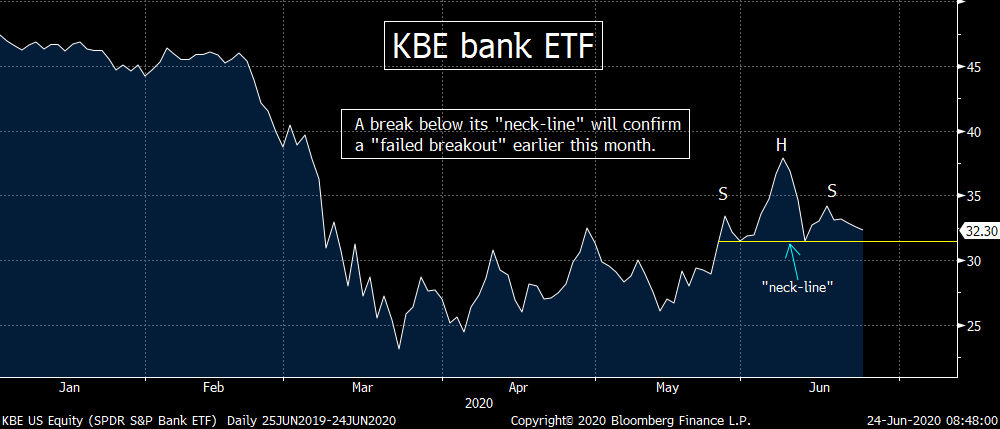

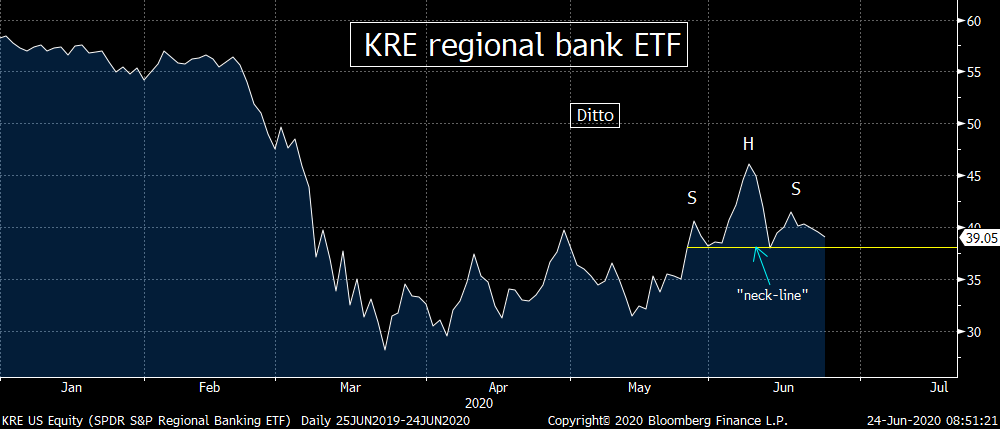

On the flip side, the bank stocks have been quite disappointing recently. Despite a mild rise in long-term interest rates above the 0.7% level and a mild steepening of the yield curve, the bank stocks have been falling this week. This action means that both the KBE and KRE bank ETFs are forming “head & shoulder” patterns...and they are both now flirting the “neck-lines” of those patterns. Therefore, if they break below their neck-lines in any meaningful way, it’s going to be signal the rally in the group in early June was just another head-fake...and cause the stocks to see yet another bout of underperformance. (2nd & 3rd charts below.)

Back to the broad market, we’re still at a critical juncture...with the 3,232 level on the S&P 500 providing key resistance and the 200 DMA (near 3,000) providing key support. We’ll need a meaningful break of ONE of those levels to see which way the market will breakout of the “critical juncture” we’ve been talking about recently. The renewed “narrowness” of the rally raises the odds that we’ll get a bearish resolution to this critical juncture, but until one of those support/resistance lines are broken in a significant way, we won’t know for sure.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member