THE WEEKLY TOP 10

Table of Contents:

1) We expect a much more gradual rebound after this recession than the consensus believes.

2) That said, the initial bounce in stocks will be strong…even if it becomes more gradual later.

3) Looking forward, we’ll have to compare 2021 earnings forecasts with 2019 earnings, not 2020.

4) Bear markets take overvalued stock markets down to undervalued levels. They don’t stop at fairly valued.

5) The technical support/resistance levels on the chip group (a key leadership group) are well defined.

6) Many leveraged investors have “de-levered”, but few highly leveraged companies have done the same.

6a) There’s a different between “forced selling” and “I give up” selling, but they’re both powerful forces.

7) Nice bounce in crude on relief in terms of supply, but the demand side still sssssssssssssssucks.

8) We’re watching some VERY important support/resistance levels on the DXY dollar index.

9) Let’s give the authorities some time to implement their relief programs.

10) Could the European banks cause another financial crisis?

11) Keeping an eye on the credit markets (and CDS prices for investment grade crop bonds).

12) Shanghai & KOSPI indexes could/should be leading indicators for global improvement.

13) I love NY!

14) Summary of our current stance.

Short Version:

1) The bull market of 2009-2020 was fueled much more by central bank stimulus…AND the leveraging up by investors and corporations that went with it…than it was fueled by fundamental growth. Although the Fed will do want ever it takes to give the markets a safety net, they might not (and maybe cannot) push asset prices higher…in the same strong and/or as sustainable fashion that they did when we came out of the last recession. Therefore, we expect a retest/undercut of the March lows…and a more gradual rebound in the stock market…than we experienced after the last two bear markets/recessions.

2) That said, when the bear market ends, the initial bounce should still be quite strong. Therefore, since bear markets end long before a recession ends, investors should still be engaging in a strict and gradual “scale down” buying strategy in the stocks of strong companies starting now…..During a bear market, A LOT of companies go “on sale.” However, since the market bottoms-out before the economy does, the BEST time to buy at least some of the shares (of a lot) of great companies at discount prices is DURING a bear market…NOT after the coast is clear!!!

3) To a degree, the stock market is already looking past the healthcare crisis…otherwise the stock market would be a lot lower given the current outlook for Q2 & Q3. Therefore, we cannot get too excited about 2021’s inevitable big bounce-back in growth yet.……The S&P 500 now stands exactly where it did at the beginning of 2019. We saw zero earnings growth in 2019. So if the S&P is going to rally above its current level once we get a good idea of the 2021 earnings situation, we’re going to have see 2021 earnings come-in a lot better than 2019’s earnings growth…no matter how much stronger it is than 2020’s growth.

4) Another reason to think that the stock market will see at least a retest (and probably an undercut) of the March lows is that the stock market is not cheap…even after its recent sharp decline. As Doug Kass points out, it’s market cap-to-GDP ratio is still higher than its 20 year average……..History tells us that when an overvalued market rolls over, the ensuing bear market does not end when the stock market becoomes “fairly valued.” It always seems to move to an “undervalued” level before it reaches its ultimate bottom.

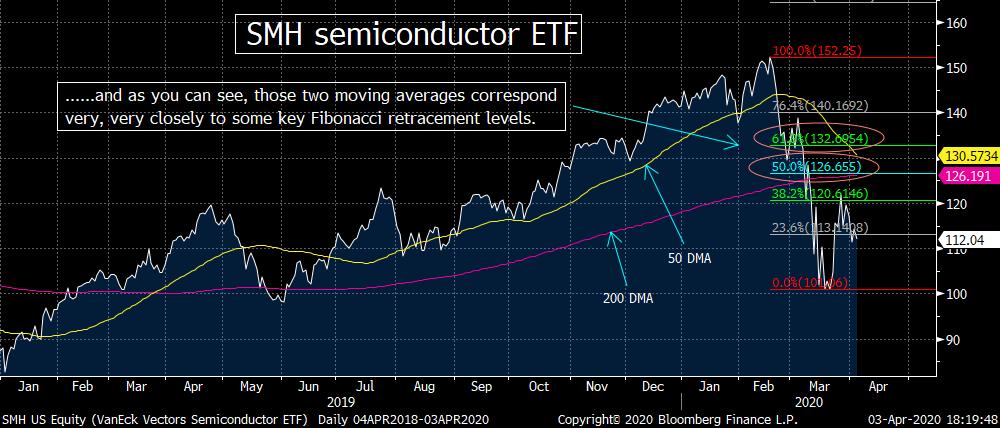

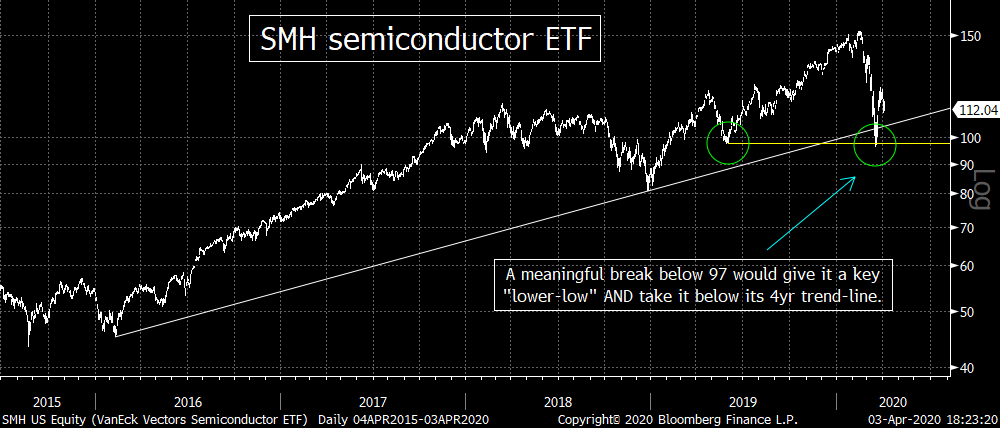

5) Shifting gears a bit, the semiconductor stocks continue to be a very important leadership group. Thus the SMH should continue to be a good indicator for the rest of the market going forward. The battle lines are well defined for the SMH…with its 200 and then 50 DMA’s providing resistance…and its 2019 (& March) lows providing support. Whichever way it breaks one of those levels should be key.

6) We are in a “de-leveraging” cycle. The first part of this has involved the de-leveraging of many (but not all) leveraged investors. The next part will involve the “de-leveraging” of many companies (and some more investors as well). This is why history is filled with bear markets that see strong/sharp rallies that are followed by “lower-lows.” It’s a process…and these “liquidation phases” tend to come in waves. This is another reason why we believe the March lows will be retested…at the very least.

6a) We’d also note bear markets don’t always end with “forced selling.” Sometimes there is also a wave of “I give up” selling…which usually doesn’t happen until the stock market has been down…and has STAYED down…for a while.

7) Crude oil had a very strong rally this past week. The “new-news” (about Russia & OPEC) fueled the bounce, but it was also helped along by the fact that the commodity had become extremely oversold and over-hated. If an agreement can be hammered out by OPEC+ (on the supply side of things), it will help the commodity a bit further, but until the impact of the coronavirus subsides considerably, the demand side of things will keep the rally in crude from becoming a major one. (Judge Smails said it best, demand sssssssssssssucks!)

8) The volatility in the currency markets was off the charts during parts of March. It has calmed down quite a bit more recently, but we still need to be watching the DXY dollar index closely. If it breaks above its key resistance level of 103.50 in any meaningful way, it should signal a strong (further) rally in the greenback. If, however, it breaks meaningfully below 95, it should signal a change in trend. If/when either of those developments takes place, it’s going to have a big impact on other asset classes (like commodities, emerging markets, etc.)

9) This is the bullet point is where we usually touch-on the political side of things, but it’s hard to spend too much time thinking about the 2020 Presidential Election right now. So we’ll make a few quick comments. First, a contested Democratic convention is still not out of the question. Second, de Blasio is toast. Third, we’re going to step back and give the gov’t some time to implement this monumental relief package. The expectations are too high (some of which is their own fault). It’s a war…and sometimes the U.S. gets off to a poor start in wars.

10) The situation with the European banks still worries us a great deal. This group is made yet another “lower-low” late last week…in a series of “lower-highs/lower-lows” that goes back more than a decade. This raises some major red flags in our minds. We’ve all heard the chatter about the derivative exposure some of these banks have over the years. If any of this chatter is accurate, this healthcare/economic crisis could quickly become another financial crisis.

11) There is no question that the credit markets have calmed down since the Fed fired its double-barreled bazooka, but doesn’t mean they won’t see more volatility. There is no question that many areas in the credit markets saw a pick-up in stress last week. That stress is still A LOT lower than it was 2-3 weeks ago, so we don’t want to make a big deal over this issue. However, we’ll be watching to see how the high yield market trades next week…as well as how credit spreads trade….and also how the CDS prices move in the investment grade area.

12) The situation with the coronavirus in China & South Korea seems to be improving…but since they’re such large exporters, it’s not helping their stock markets much. Therefore, we’ll be watching the Shanghai & KOSPI indexes over the coming weeks for signs that the global economy is finally moving past the worst of this crisis (or not).

13) I am an avid sports fan and I have lived in Boston all of my adult life, so I should hate NY, right? Well that’s not the case at all. In fact, my thoughts and prayers go out to all of the people of NYC (& NY state)…and the other hot spots in our country and around the world. We’re all in this together. So stay safe and healthy out there!

14) Summary of our current stance……We believe that a retest (and likely an undercut) of the March lows is probable. Bear markets usually see a series of “liquidation phases” before they bottom. In between, they always see strong bounces, but those bounces tend to fail before long……Very simply, we believe we are going through a new “de-leveraging” process. This will involve several different groups that need to “de-leverage” themselves…which means that the process will most likely playout in waves (like it usually does)…….On top of all this, it is very difficult to know how long the coronavirus will keep the economy shut-down…or what kind of long-term impact it will have on the economy. Therefore, we do not know how much “de-leveraging/liquidation/forced selling” will need to take place…or when it will end……..With this in mind, we believe that a retest and/or an undercut of the March lows is likely. It’s also a key reason why we believe that a strategy that involves buying the stocks of high quality companies…on a very gradual “scale-down” basis…is the best strategy to follow right now.

Long Version:

1) We’re going to begin this weekend’s piece by using our first two bullet points to discuss one bearish issue and one bullish one. Of course, there will be other bullish and bearish issues that we’ll discuss, but these two stand out to us.

Bad news first…..On top of thinking about whether the stock market will retest or undercut the March lows (which we will discuss in later points), we also need to consider whether the stock market will bounce-back sharply once this healthcare crisis subsides in a considerable manner. The stock market bounced very, very strongly after all of the corrections over the past 12 years, but this time it involves a bear market and a recession. Therefore, it’s a good guess that it will take a bit longer for us to see a rebound. However, there is also no guarantee that the market will bounce-back with the same sustainability as it did after the last two recessions/bear markets.

Of course, we WILL see the unleashing of a big rolling surge of pent-up demand once the healthcare crisis starts to calm down. No, the restrictions will not be lifted all at once (hence our belief that it will be a “rolling” surge of demand…and not one big one all at once), but it will still lead to a very nice pick-up in economic growth.

However, what will that mean for the stock market? People keep saying that at some point, the market will look past the coronavirus crisis and price-in a recovery. Well, to a certain degree, the stock market is ALREADY looking past this crisis. The economy has ground to a halt…and as we learned last week, the employment picture is absolutely abysmal…and it will get a lot worse in coming weeks. If the stock market was pricing-in a situation where the economy would remain in its present state for an extended period of time, it would be down A LOT more than 25.6%!!!

Therefore in order to figure out where the stock market (and individual stocks) will bottom out, it will involve trying to figure out how quickly the economy will bounce-back.

HOWEVER, WE BELIEVE IT IS CRITICALLY IMPORTANT TO LOOK AT THIS ISSUE FROM AN ANGLE THA MOST PEOPLE ARE NOT THINKING ABOUT RGHT NOW. We have to realize that the situation could be much different than it was back in the immediate aftermath of the financial crisis. Back then, the Fed’s number one tool to help the economy recover was the stock market and other asset prices. As Ben Bernanke said at the time…and other former Fed officials have repeated since then…the goal of the Fed’s policies back then was to force people into risk assets. The theory was that since the banking system was flat on its back, it was going to be very, very difficult for the economy to regain a level of self-sustainability to give us the recovery we needed. Therefore, they used the stock market (and other risk assets) as a tool to help the economy (and the banking system) recover! This was MUCH DIFFERENT in the past…when they tried to help the economy bounce-back…usually along with some help from fiscal policy.

In other words, historically policies and programs had been initiated to help the economy grow. That, in turn, would help the stock market rally. Yes, the stock market would rally first…because it would sniff out the improvement in the economy in advance…but it still rallied BECAUSE the economy was beginning to (or about to) improve. Thus traditionally, it was the pick-up in growth (and the expected further pick-up in growth that had become evident) that CAUSED the stock market to rally. The last time around, however, it was MUCH different. It was the stock market’s rally that CAUSED the economy to improve!!!

In other words, back in 2009, 2010, 2011, 2012 and other years when they continually introduced new QE programs…the Fed’s answer to the devastating de-leveraging process that took place from 2007 to 2009…was to get investors (and companies) to leverage themselves back-up as quickly as possible! This allowed the markets (and economy) to recover a lot more quickly than they did during the Great Depression (the last time the financial system completely broke down). The one problem with this strategy is that although it allowed the markets/economy to recover much more quickly, it did not allow them to recover in a more sustainable fashion (like they were after the Great Depression).

Of course, WWII played a HUGE role in that rebound, but many/most businesses that had over-extended themselves during the roaring 20’s failed. This did not happen during the last crisis. Many, many businesses that should have failed survived…as did the executives who did such a poor job during the years leading up to the crisis. Therefore, the lessons of the crisis were not learned in the way they were learned after the Great Depression. Instead of having a generation of executives who used leverage very cautiously (like the “Greatest Generation” did)…they went right back to doing what they were doing in the years leading up to 2007-09. In fact, since our elected officials did not show any leadership by providing fiscal stimulus, the business leadership was actually ENCOURAGED to leverage themselves back-up once again!

As we have said many times over the years, the single-digit growth we have seen for the vast majority of the past 12 years…in terms of both economic growth and earnings growth…was not enough to justify the almost 400% gain we experienced in the stock market over that time frame. In other words, it was the immediate RE-LEVERAGING up of the U.S. stock market…and later, the U.S. economy…that allowed for such large gains in prices of stocks and other risk assets. It was NOT the kind of self-staining growth that led to these big rallies…like it had in most of the other strong rallies in our history.

THEREFORE, ON TOP OF TRYING TO FIGURE OUT HOW QUIKCLY THE ECONOMY CAN REGAIN ITS FOOTING, WE ALSO HAVE TO SPEND A LOT OF TIME TRYING TO FIGURE OUT IF BOTH INVESTORS AND COMPANIES ARE GOING TO RE-LEVERAGE THEMSELVES BACK-UP IN THE COMING YEARS. If they do not…it will mean that once the stock market makes-up the “downside overshoot” that always takes place in a bear market, the upside follow-through might not be as pronounced as it was after credit crisis. (0r after the tech bubble burst. Remember, it was the inflating of the housing bubble that allowed the credit bubble to create such a strong rally after 2003.)

Maybe the Fed will indeed create another bubble in the years ahead. However, that solution will not work forever. At some point, trying to re-inflate another bubble just won’t work (for a variety of reasons). What if the Fed decides this is not the time to re-engage in that kind of policy??? What if they let the economy regain its footing on its own? Don’t get us wrong, there is no question in our minds that the Fed will continue to do “whatever it takes” to keep things from completely imploding during this healthcare crisis. However we wonder if they will (or can) produce the same kind of endless liquidity that was essential to helping the stock market rally so strongly for many years following the last recession.

It is not a lock that they will once again use risk assets to the same extreme degree to help the economy bounce-back. If that is the case, we’re going to have to look at the recovery periods after the 1929 crash and the deep recession of the 1970s for clues…and not the rebounds of the last two bear markets. In the last two bear markets…when Fed induced bubbles helped the markets recover…the stock market was able to regain it old highs within 6-7 years. In the previous two examples…it took 25 years and 10 years respectively.

Of course, using the Great Depression as a comparison might be a bit too extreme. However, there is no question in our minds that that the stock market rallied a lot more than the underlying fundamentals would have justified over the past 12 years…due to the way the Fed enticed investors and businesses to lever-up. Therefore, if the Fed does not encourage the same kind of practices going forward, it’s going to be hard for the stock market to recover as strongly as some of the more bullish pundits think it will. The “initial” bounce should still be a very strong one…but a more sustainable one might be much harder to come-by.

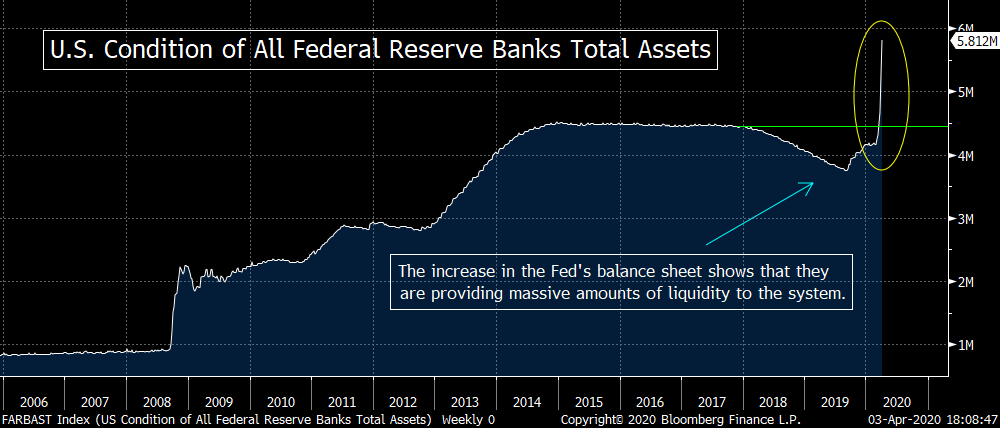

2) Okay, let’s move to the bullish side of the ledger. First of all, the Federal Reserve IS providing massive amounts of liquidity during this crisis. We were merely saying that they might not provide it to the same degree in the aftermath of the healthcare crisis. (Again, they’ll do whatever it takes to stabilize things DURING the crisis, but will they…or can they…provide much liquidity once the crisis has subsided?) Either way, the Fed is supporting things right now…and THAT is positive.

This goes to another issue we’ve highlighted several times in recent weeks…and we’d like to reiterate it here once again. Very simply, the stock market always bottoms in a bear market LONG BEFORE the economy does. Therefore, those investors who wait until every thing “feels” much better in the economy, A LOT of the bounce-back will already have taken place. Right now, the stock market is already down almost 30%. Yes, it could fall quite a bit more from current levels, but it’s all but impossible to buy at the exact bottom in any stock. Therefore, dipping one’s toe back into the stocks of great companies with great balance sheets (and great managements) is a good idea at these levels in our opinion. This does NOT mean jumping back in with both feet, but picking away at the best names should be a good move.

In other words, if you wait that long, you will miss the massive “discounts” that always become available during a bear market. As we’ve said a zillion times before, Warren Buffett became a billionaire by buying stocks and companies when they were very cheap for one reason or another. Some companies go “on sale” at “discounts” when the rest of the market is acting just fine. However, during a bear market, A LOT of companies go “on sale.” In other words, the BEST time to buy at least some the shares of a lot great companies at discount prices is DURING a bear market…NOTafter the coast is clear!!!

Therefore, we believe the best way to play the market right now is the same as we suggested last week. Buy those stocks on a strict and gradual “scale-down” basis. Buy 10%-15% of what you want to own (or want add to an existing position) here. Then buy another 10%-15% down 5%-7% from current levels…and then repeat. No you won’t buy everything you want to accumulate down at these levels, but you’ll be able to build a VERY NICE “base” from which to work from…once the worst is behind us.

One last point. You might be asking yourself, “Well, if the market isn’t going to rally in a strong way over the next few years (based on what we said in point #1), why wouldn’t we just wait? We should still have plenty of time to buy my favorite stocks at low prices!”

Well, that sounds good, but when good stocks get “thrown out with the bathwater” during one or more of the “liquidation phases” of a bear market, they DO bounce back VERY strongly once those phases are over. Therefore, even if the broad market is not going to rally in a significant way over the next 2-3 years, the INITIAL bounce should still be a very strong one…and the best stocks in the market place will not trade anywhere near their “liquidation/capitulation/wash-out” levels again…any time in the coming years! So even if the next bull market is not as strong as the previous one was (like we think it might not be), the “initial” surge should still be a powerful one…even if the follow-through isn’t. Therefore, “waiting” will still make you miss the best “discount/sale” prices.

3) If you believe earnings are the number one long-term driver of the stock market, it’s very, very difficult to come up with a scenario where the S&P 500 rallies back to 3,200 or 3,400 the way that some perma-bulls are calling for over the next 9-12 months. When we talk about earnings, we cannot focus only on the impact the coronavirus will have on 2020 earnings…or even 2021 earnings. We have to think about the earnings we saw in 2019 as well!!! Remember, the stock market rallied more than 30% in 2019…despite the fact that earnings growth was ZERO in that year!!! Therefore, last year’s rally was totally fueled by “multiple expansion”…and saying that the stock market rallied due to multiple expansion is really just another way of saying the stock market got more expensive.

At the beginning of THIS year, many/most of the bulls were saying that any further gains were dependent on decent earnings growth in 2020. We’ll we’re not going to get that…not even close! Instead, we’re going to get just the opposite. Therefore, not only will it be difficult for the stock market to see any rise from where it started the year, the events of the past 2-3 months now make it tough to anyone to justify last year’s gains…because last year’s gains were not fueled by fundamental growth!!!

Again, 2019 earnings growth was zero….and the stock market is now sitting exactly where it stood at the beginning of 2019. Therefore, we’re going to have to compare 2021 earnings forecasts to the 2019 earnings, not the 2020 earnings. Those 2021 numbers are going to have to be better than 2019, NOT JUST better than 2020…in order to justify a meaningful rally from current levels!

In other words, no matter how well the economy (and thus earnings) improve later this year, it’s going to be very hard for the stock market to bounce-back in a substantial way based on the earnings growth of 2019 and 2020. This does not mean that the market has to fall another 30%, but it does suggest that some sort of undercut of the March lows is definitely possible…and even probable. It also suggests that it’s going to be very difficult for the stock market to rally-back in anywhere near the same fashion it did after the deep correction of late 2018. Finally, we believe it makes 3,400 on the S&P 500 a pipe dream over the next 12 months.

4) We worry that too many people agree with us when we say that we expect a retest or even an undercut of the March lows. When we’re with the majority, it always makes us nervous. So maybe THE lows have indeed been made for this decline. However, we read a great list that was recently compiled by Doug Kass…which stated several of the key issues on both sides of the bull/bear ledger. The one that stood out to us was the one that said the stock market is not particularly cheap like it was in early 2009….and like it usually is towards the end of ALL bear markets.

Mr. Kass highlighted that the market cap to GDP is still higher than the 20 year average…even at its lowest level after the recent sell-off. We’d add that even though the S&P 500 trades at 16x their stated earnings…which is in-line with the long-term average…basically all bear markets take the stock market from an overvalued level to an UNDER-valued level before it bottoms-out. Needless to say, the 20+ multiple that existed in January and February were on the expensive side of history…and 16x is far from reaching a level that would be considered cheap. On top of all this, we have no idea what kind of forward multiple to put on the stock market right now…because we have NO IDEA what the earnings picture looks like for the next 3-5 quarters at this time.

Strong bull markets always overshoot historical levels of “fair valuation” to the upside…and the stock market is like a pendulum. It always over-shoots to the downside as well when those strong bull markets come to an end. When overvalued markets reverse, they do not stop falling when they reach “fairly valued”…they keep falling until they reach an undervalued level. This is another reason to think we’ll see at least a retest of the March lows before the stock market bottoms.

5) Switching gears a bit, we want to talk about another leadership sector in the market we’ll be watching closely in the stock market going forward. In our weekend piece last weekend, we highlighted that one key leadership index…the Russell 2000…should continue to be a key leading indicator for the market going forward. Another one is a group we have concentrated on quite a bit over the last few years, but we have not touched-on it over the past week or two…the semiconductors. As we have harped on many times in the past, this group rolled-over well before the rest of the market in 2018…and it led the market throughout much of the rally of 2019. The SMH semiconductor did not roll-over before the rest of the market this time around, but the index remains a very important indicator for the broad market (and the industry remains an important one for the global economy).

The battle lines are clearly drawn for the SMH, so we should have some good measurements in the days and weeks ahead. On the resistance side of things, we have the 200 DMA (of $126). That line provided great support when the SMH saw a pull-back in the spring of last year, so that “old support” level, now becomes “new resistance.” We’d also note that the 126 level is also a 50% retracement of the entire February/March decline…so it’s important on two different levels…..Above that, we have the 50 DMA of 132.60…which is also a Fibonacci 61.8% retracement of the recent big decline. Therefore, we have the odd situation where both the 200 DMA and the 50 DMA both coincide with important Fibonacci retracement levels.

As for the key support level, that comes in just below the 100 level (near 97). That’s the lows from both this March and last May, so any significant move below that level would give the SMH a very important “lower-low.” That would not be good. On top of that, it would also take it below its trend-line going all the way back to the early 2046 lows……Therefore if (repeat, IF), the SMH rolls back over at any time in the 2nd quarter and falls below that 97 level in a material way, it’s going to be quite bearish for the chip stocks.

We’d also highlight that the SMH is getting relatively close to a “death cross”…and a death cross tends to be quite bearish for this group (which we will discuss in more detail if/when it gets closer to such a “cross”). However, right now we’ll be watching the above mentioned support/resistance levels. Whichever ones are broken first should be important for the group…and the rest of the stock market.

6) As we’ve been saying in several of our bullet points, we believe that the stock market will see a retest of the March lows…and probably an undercut of those lows…before we see the ultimate bottom for the stock market for this decline. This does not mean it will come within the next week or two, but we do think it is coming. That said, the one thing that concerns us the most about this opinion is that so many other people share that opinion as well. Back in early/mid-February…when the stock market was making new highs (but the Treasury market and the price of gold were telling us that the coronavirus was eventually going to cause some significant problems for the stock market…which was priced for perfection)…we were in a very small minority. Although a lot of people think the lows have been made, there are also a very sizeable group of people who expect a retest (or worse)…just like we are right now.

The reason we’re sticking with our belief that the markets will see more weakness before too long is that we strongly believe that we’re in the midst of a “de-leveraging” cycle. The first part of this new cycle involved the de-leveraging (liquidation) for many leveraged investors. The second part of it will involve the de-leveraging of many companies. Yes, some companies will actually have to ADD a lot of leverage (debt) to survive, but others will go through defaults and/or bankruptcies. Therefore, as that “liquidation process” plays out, we think we’ll see another leg lower before the ultimate bottom has been put-in.

History shows us that there are frequently several “liquidation phases” (several bouts of “forced selling) within a bear market. Each one of them was followed by a strong bounce (sometimes a very strong bounce)…but each time, the next liquidation phase took the stock market to new lows. We certainly saw that during the financial crisis.There were several bouts of “forced selling” before the Lehman collapse…one when Lehman actually did collapse…and another one several months later. We’d also note that there

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member