There is no question that the bounce in the stock market yesterday was a good one…as the “internals” were quite strong. Breadth was a whopping 44 to 1 positive on the S&P 500 index and 13 to 1 positive for the NYSE composite index. It was also a “90% up-day”…with the “up-volume” more than 90% of the total volume. This is going to sound weird, but the fact that volume was lower than it has been on the recent “big down days” yesterday was actually positive. When you get the kind of volume we’ve seen recently…the kind that signals that at least a short-term “wash-out” has taken place…we would EXPECT the volume to fall on the rally days…and thus the lower volume is not a concerning development at all.

Of course, we’ve seen quite a few big one-day bounces since this bear market began, but as we all know, we haven’t been able to see any upside follow-through and string two rally-days together. The futures have been bouncing around once again in overnight trading, but they’re actually bouncing around within a smaller range than we have seen on many other occasions in recent weeks. Of course, we’re a long way from declaring that volatility is going to decline in a significant way, but it’s still nice to see that we’re not seeing the futures trade in the kind of crazy 8%-10% ranges we have seen many times over the past month.

Today is going to be a very important. Of course, they’re all important right now, but investors have become use to seeing the market rolling over in an immediate and powerful way after one-day rallies. This probably led a lot of short-term traders to add to short positions at/near the close last night. Therefore, if the stock market can fight off this early morning weakness…and bounce-back once the cash market opens…it’s going to catch some short-sellers off guard……No, we did not see any evidence that the very-short-term players now have huge short positions and therefore they could create a huge upside follow-through rally today. However, if (repeat, IF) they do get squeezed a little bit, it could be the kind of catalyst to creates a further rally over the coming days.

This is particularly true given that the double-barreled bazooka (or howitzer…or whatever you want to call it) that the Federal Reserve has fired this week…has calmed the credit markets in a material way. As we said over the weekend, the most important hole in the dike that needed to be plugged right now was the “forced selling” that was taking place in the credit markets. The Fed has gone a LONG WAY to plugging that hole very effectively, so the odds that the markets can stabilize…and rally for more than just one day…are finally starting to rise. In other words, it’s great that the White House and Congress have struck a deal on the stimulus package, the most important thing we have to watch over the very-near-term is whether or not the forced selling that was taking place in the markets last week (especially in the credit markets) subsides in a substantial way.

What we’re trying to say is that even if this health crisis gets a lot worse over time, the stock market is not going to decline in a straight line. Yes, things have become much more condensed in today’s markets. Everybody realizes that the speed of this decline/crash has been much faster than almost all previous ones. However, history still tells us that when the first round of “forced selling” subsides, a sharp and (at least some-what) prolonged rally takes place. These bounces are frequently followed by retests of the initial lows…and even undercuts of those lows (sometimes deep undercuts of the initial lows)…but when “forced selling” abates in a significant way, it always becomes a very tough time for the shorts…rather quickly.

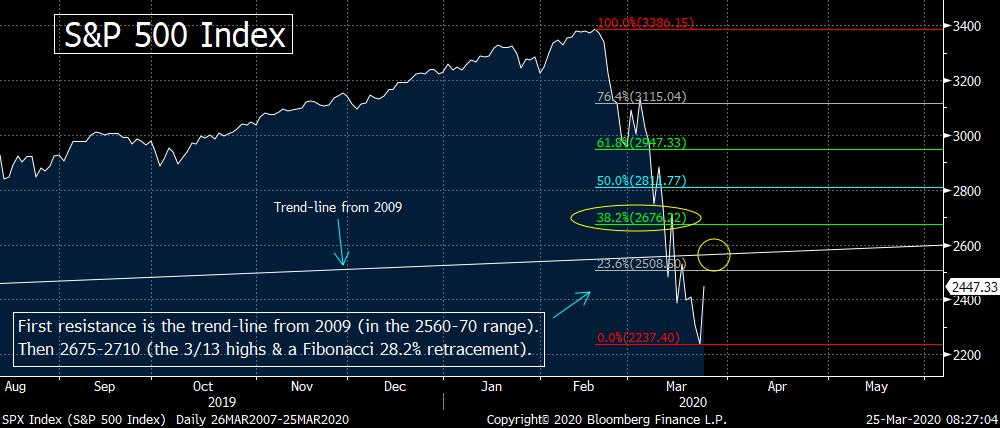

With this in mind, we believe the short-sellers should be VERY careful over the coming days (and even the next few weeks). If the stock market is indeed able to bounce of this morning’s lows in the futures, the first resistance level will be the 2560-70 range. That’s where the long-term trend-line going all the way back to the 2009 lows comes-in. Above that we have the 2675-2710 range. (The lower part of that range is a Fibonacci 38.1% retracement of the decline…and the upper-end of that range is the March 13th highs…the last time we saw a one-day 10% rally)………We could also talk about the trend-line from the all-time highs, but since it’s so incredibly steep, we don’t think it will be as important as it had been in the past.

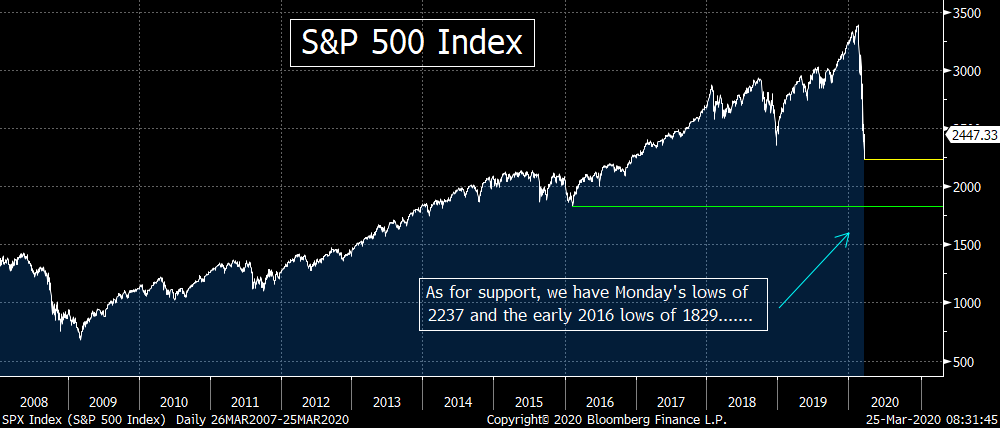

If we’re wrong…and this morning’s drop in the futures turns into another rout, the first support level will obviously be Monday’s closing lows of 2237.40 (and then the intraday lows from that day of 2190.86). Below that, we have the levels we highlighted over the weekend: 2031 (a 50% retracement of the entire bull market from 2009) and 1829 (the early 2016 lows). (Three charts attached below.)

This decline has been historic, but history shows that once “forced selling” subsides in a meaningful way, the market usually bounces strongly and quickly. Therefore, we believe investors (and especially traders) should have this at the forefront of their minds as we move through the end of March (the end of the quarter) and into the beginning of April.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member