The futures have been trading all over the place since they opened last evening at 6:00pm. When we went to bed last night, they have been down by more than 1%...then they flipped to the upside overnight and stood in positive territory by over 1% at one point...and now (as we write) they’re down almost 1% once again. The bond market is also seeing a big move…with the yield on the 10-yr note down to almost 1% (1.054% to be exact). We’d also note that gold is bouncing back and acting like a “flight to safety” asset…after it has worked-off the extreme technical readings it was showing a week ago.

As we highlighted over the weekend, the market has become very oversold on a short-term basis and thus it has become ripe for a sharp bounce. Remember, even the worst bear markets in history have seen many sharp bounces along the way, so even if you think this correction will turn into a bad bear market, the odds that it will move into bear market territory in a straight line are quite low.

If we have one concern about the near-term, its that a lot of people are looking for a short-term bounce, so maybe it will be a shorter one and/or a smaller one. However, the RSI chart on the S&P 500 index closed below 20 on Friday…and got as low as 16 (before the mysterious late-day rally on Friday). When you combine this with the other signs of capitulation we saw last week and highlighted in our weekend piece (very extreme levels of negative breadth, a huge jump in volume…etc.)…and we would still expect a good sized bounce in the market very soon.

Last Monday morning, we said that we believed investors should shift from “buying the dips” to “selling the rallies.” Well, we haven’t seen any rally over the past week, but we should get one soon. Therefore, we do believe that investors should now indeed look to “sell the rallies.” However, if history is any guide, the upcoming bounce should be in the 5%-7% range. When the stock market falls as much as it has over the past seven trading days…and sees the kinds of signs of capitulation it has seen over the fast couple of trading days…the ensuing bounce is RARELY just 2 or 3 percent. In other words, not only are we saying that investors should not chase the “first bounce” on the buyside, but they shouldn’t sell at the very beginning of that bounce. Again, the bounce should be a very sharp one…and therefore, we would not be aggressive sellers on the initial pop in the stock market.

Of course, short-term traders might want to buy the bounce…because it should be a material one. However, we don’t think the initial bounce will become a multi-week one, so those short term traders will want to be very nimble…and even more nimble than they usually tend to be.

Ok, so what levels should we be watching? On the support side, it’s the intraday lows from Friday. Any break below that level is going to be very, very bearish. Any meaningful break below that 2855 low from Friday afternoon raises will be a disaster. It will leave the S&P vulnerable to a very fast drop to (AT LEAST) its June 2019 lows of 2744. In other words, if we’re going to see a sharp bounce early this week, it’s going to have to start at a level that is higher than last Friday’s midday low of 2855.

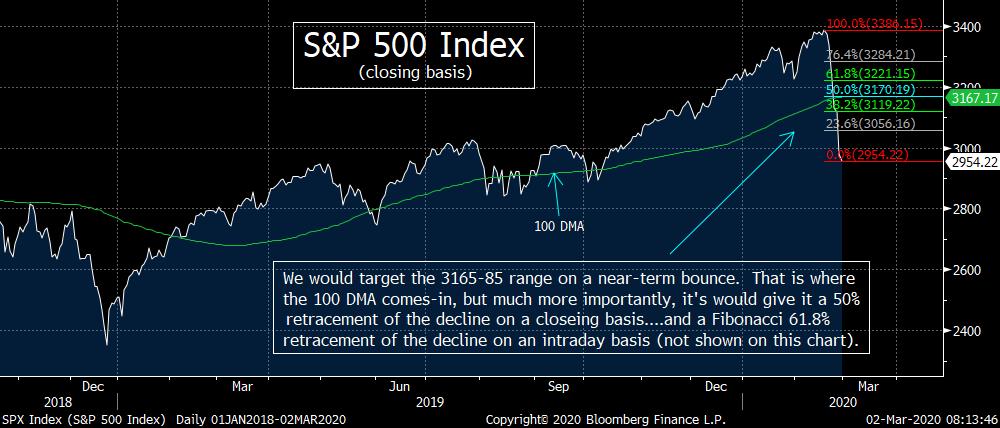

If it can bounce soon (like we think it will), we’re targeting the 3165-3185 level on the S&P. That is where the 100 DMA comes-in, but more importantly, it is also a 50% retracement of the entire decline on a closing basis…and a Fibonacci 61.8% retracement of the decline on an intraday basis. That would give the SPX a 7% bounce on a closing basis…which would put it right in line with other initial bounces we have seen after sharp drops in the market over the past 20 years. (Two charts attached below.)

There’s not a lot more we can add to what we said in our Weekly Top 10 piece from this weekend, but we would like to make one other comment…this one on the political front. Pete Buttigieg has a great future in the Democratic party. This is especially true now that he decided to pull-out of the Presidential race two days before Super Tuesday. The Democratic establishment must have made some very juicy promises to get that one done.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member