Stocks pulled back a bit yesterday in response to Donald Trump's threat to shut down the government if he didn't get his border wall. On this topic, it is important to note that (a) the government is slated to run out of money on October 1 and (b) the House has already approved $1.6 billion for the wall - but the issue appears to be problematic in the Senate.

From a technical perspective, the S&P 500 is basically searching for direction. From a short-term view, stocks are in a downtrend. From an intermediate- and longer-term perspective, the trend of the stock market is in pretty good shape. The key here is that a break below Monday's low would threaten the health of the intermediate-term trend and embolden the bears.

And with speeches from both Janet Yellen and Mario Draghi on tap in Jackson Hole tomorrow, it is a decent bet that traders may not want to make any big moves today. Unless, of course, Yellen's speech gets leaked and contains market-moving info, that is.

So, since stocks remain in a seasonally weak period, valuations are in rarified air, and we appear to have some time on our hands this morning, I thought I'd continue our discussion of the various ways investors can manage the risk of severe market declines in their portfolios.

Going Back To The Beginning

When I first entered the business in mid-1980, something called "market timing" was gaining popularity. The idea was to invest 100% of your account either in the money market or the stock market, depending of the reading of various indicators - usually moving averages. Such a concept would have helped the proponents of such strategies to avoid the difficult markets of the 1970's, which saw the DJIA go mostly sideways for years.

I didn't realize it at the time, but a couple things made this strategy successful. First, very few people were doing it as the mutual fund industry was in its infancy and calculating a moving average wasn't easy, requiring a legal pad, a pencil, and a calculator. Remember, charts weren't available on your phone back then. Heck, cell phones didn't exist back then.

In addition, an investor could earn a VERY strong rate of return when in the "defensive" money market position. Thus, "market timing" was pretty easy when you were earning 10% annualized sitting in cash.

But as time went on, such strategies lost favor. In my opinion, this was largely due to the secular bull market that began in 1982. The mutual fund industry launched a massive campaign encouraging investors to put their money into a fund family and leave it there - forever. "Time, not timing" was the battle cry. "Be a long-term investor" was also a big theme promoted at the time. Since there wasn't much in way of risk for nearly a decade after the Crash of '87, the concept of risk management became laughable and "market timing" was a dirty word by the middle of the 1990's.

So, with the public being told that no one could "time the market" (never mind the boatload of research that proved otherwise) and that such efforts were a waste of time (stocks just went up every year, so why bother?), the "buy and hold" approach became all the rage. (P.S. If this sounds similar to today's emphasis on passive investing, give yourself a gold star!)

Thus, risk managers were scoffed at during the mid-1990's. Risk? What risk?

However, the ensuing bear markets triggered by the bursting of the technology bubble and then the credit crisis have changed people's point of view on the subject - in a big way. Thus, risk management is now an important part of many investors' portfolios.

The trick is the figure out a way to reduce one's exposure to market risk when the bears are in town and to "make hay while the sun shines" the rest of the time. Simple enough, right?

So far in this series, we've talked about BlackRock's approach, which entails the use of low volatility vehicles, as well as the idea of diversifying your portfolio by employing multiple risk management strategies. Today, let's keep moving and talk about one of my favorite strategies to risk management.

The Exposure Method

The goal of what I call the "exposure method" is to keep one's exposure to market risk in sync with the "state of the market." When the market is healthy, you want to be onboard the bull train and enjoy the ride. Then as conditions weaken over time, as they often do during long bull market runs, you reduce your exposure to risk accordingly.

The challenge, of course, is finding a way to accomplish this goal. The bottom line is there are many approaches to this strategy. My take on the subject is to employ a diversified approach by using multiple indicators and/or models, with each controlling a set portion of the exposure.

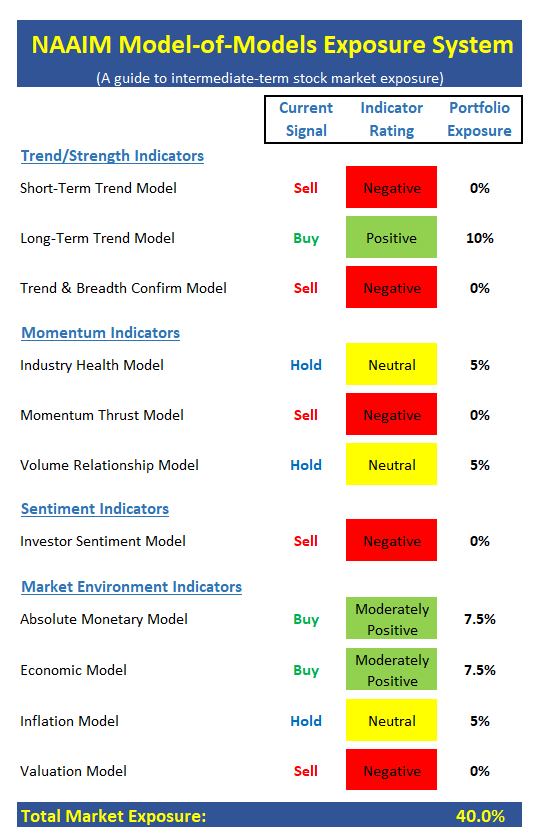

For example, if I have 10 market indicators, I can assign each indicator a 10% weighting. When all 10 are positive, I'm 100% long. But as indicators flip to red, the exposure gets reduced. For example, if 3 indicators are negative, I'd be 70% long and 30% in cash, etc.

Of course, the real key to this method is the indicator selection and weighting. To be sure, there are a myriad of ways to do this - and trust me, I've played with a great many over the years!

What I've found is that a combination of trend, momentum, sentiment, and "external" factors can be a pretty good guide to the health of the market. In fact, I publish the readings of these indicators every Monday in my weekly indicator review. Here's a link to this week's edition.

To illustrate the concept further, below is an example of an exposure model I developed and publish weekly for the NAAIM (National Association of Active Investment Managers) organization each week.

The idea is pretty straightforward. I allocate 60% of the model to trend and momentum indicators/models and 40% to sentiment and external factors. My goal is to blend both technical and fundamental indicators because, if I've learned one thing since 1980, it is that all strategies/indicators/models WILL go into a funk at times and/or stop working. Thus, I've learned that it is critical to avoid using a singular indicator to drive your exposure. As the saying goes, all indicators work great, right up until they don't!

Therefore, I prefer to employ a "model of models" approach to build what I hope will provide me with a "weight of the evidence" for the overall health of the stock market.

To review, the game plan is to be invested more heavily in stocks when the "weight of the evidence" is positive and less so when the model reading suggests some caution.

Is the system perfect? Heck no. No matter how hard you try, Ms. Market will always find a way to trip you up at times. But to me, this approach makes sense as my goal is to get it "mostly right, most of the time."

Currently, the market's internal momentum had clearly stalled and the table was "set" for a pullback. The model sensed that all was not right in the indicator world and recommended that chips be taken off the table. From my seat, this is what "risk management" is all about.

A friend of mine uses this model with live money. He takes the model reading as his long equity exposure and puts the remainder in bonds on a weekly basis. As such, this week he'd have 40% in stocks and 60% in bonds. And for the record, the model's exposure to equities was 75% at the end of July, 65% the week of August 6, and first went below 50% on August 13.

And I am pleased to report that since my NAAIM friend went live with this approach, it has outperformed a traditional 60/40 portfolio by a pretty sizable amount.

Thought For The Day:

When men speak of the future, the Gods laugh. -Chinese Proverbs

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Trump Administration/Policies

2. The State of the Economic/Earnings Growth (Fast enough to justify valuations?)

3. The State of Geopolitics

4. The State of Fed Policy

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member