Overview

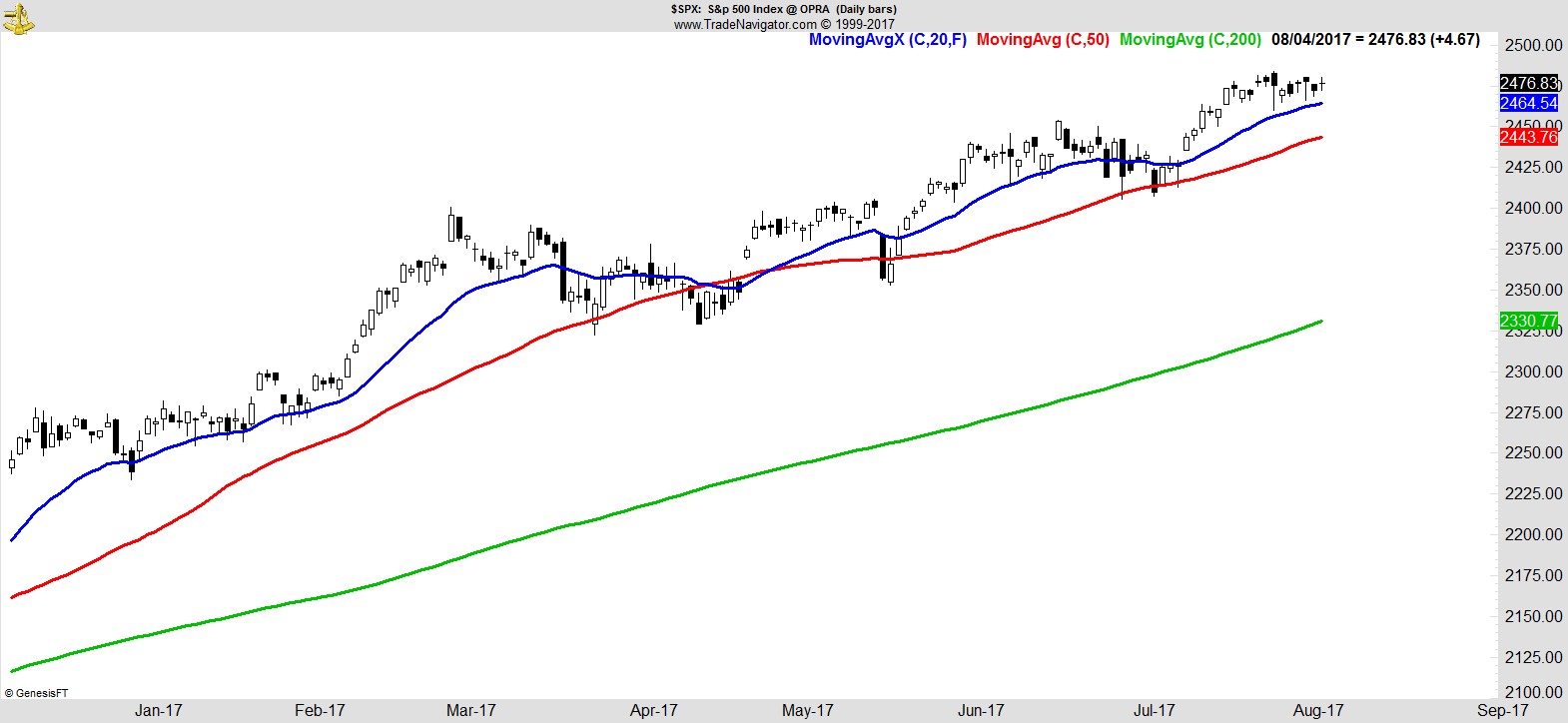

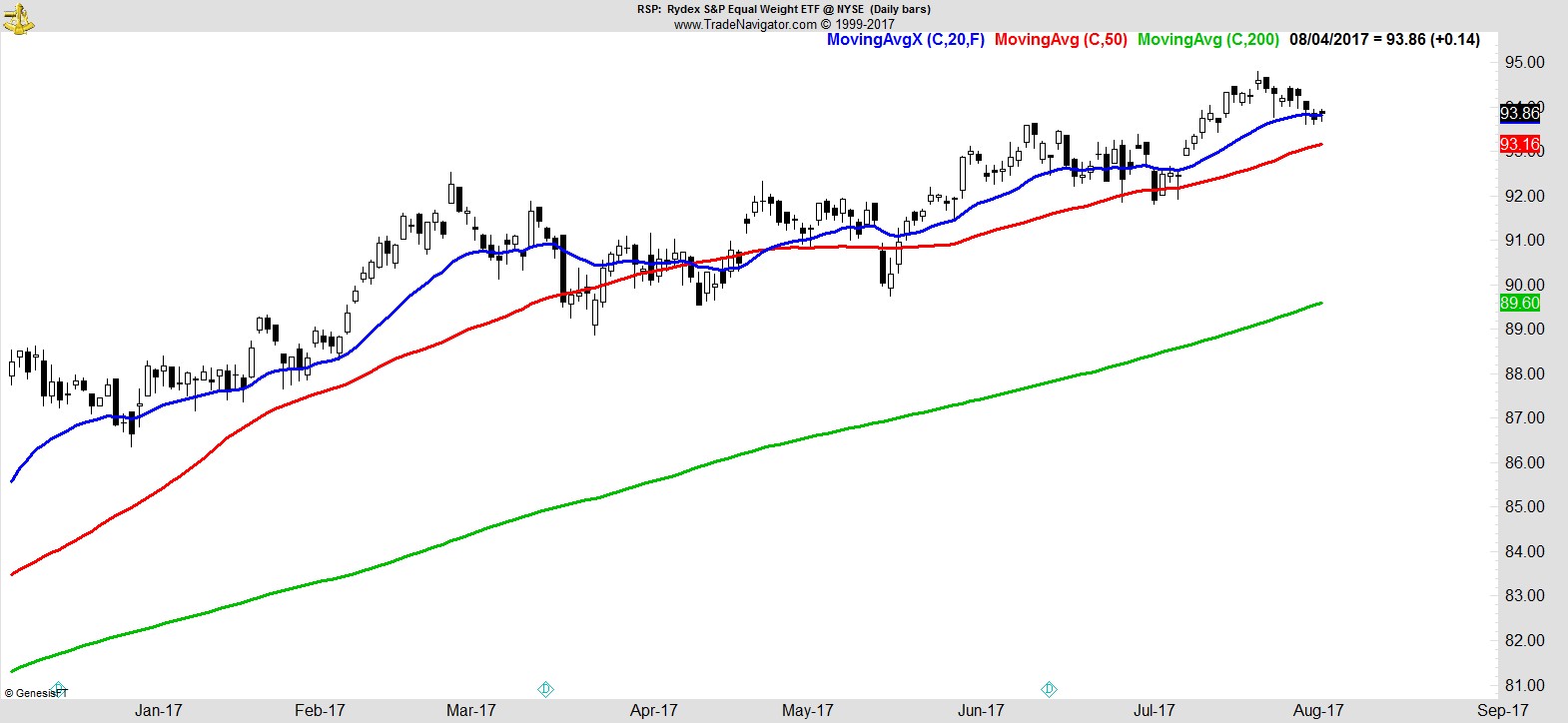

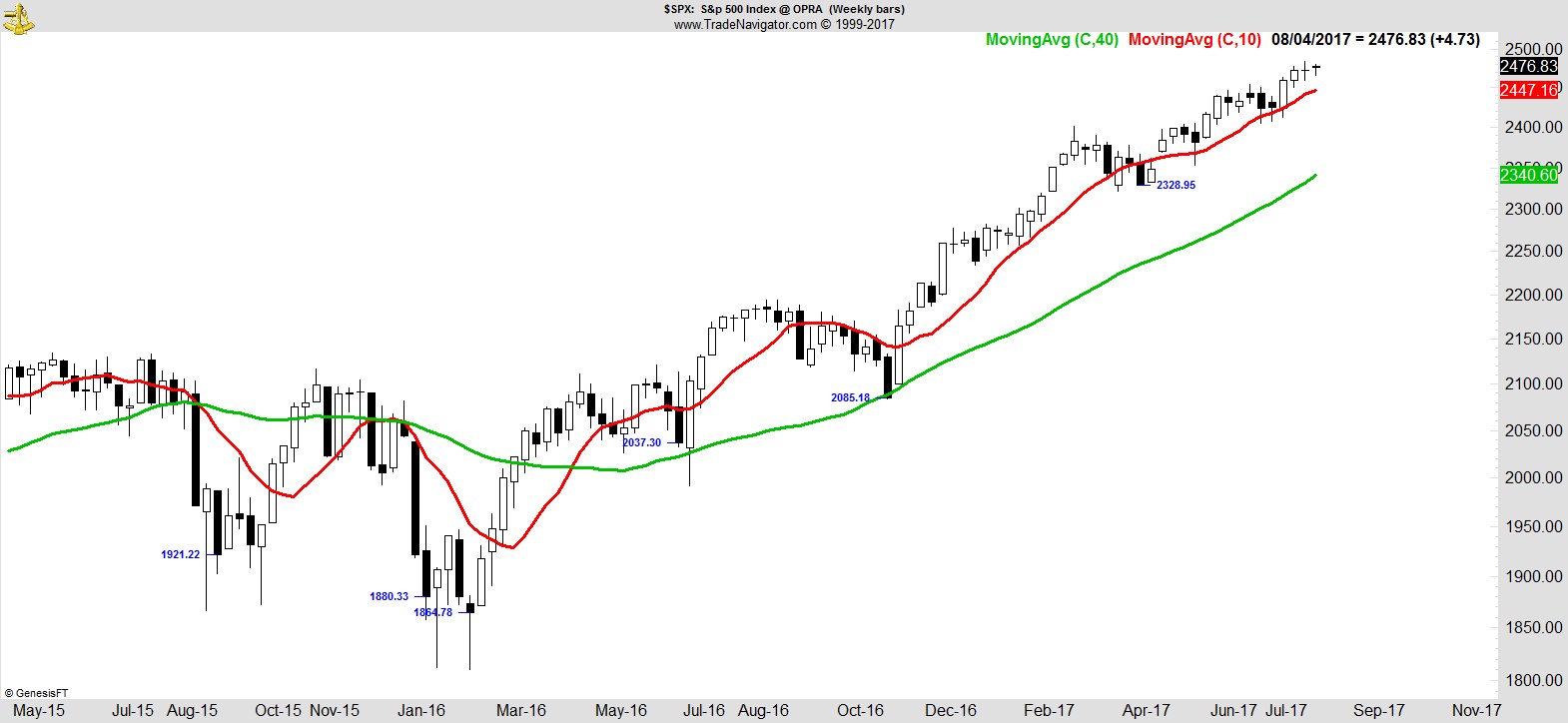

The S&P was more or less unchanged for a second week as it continues to trade in a tight range just below its highs. Interestingly, its equalweight equivalent $RSP weakened further this week, briefly testing the mid-June highs and breakout level from 3 weeks ago.

.

However, the S&P did manage to close at a new high on a weekly close basis.

.

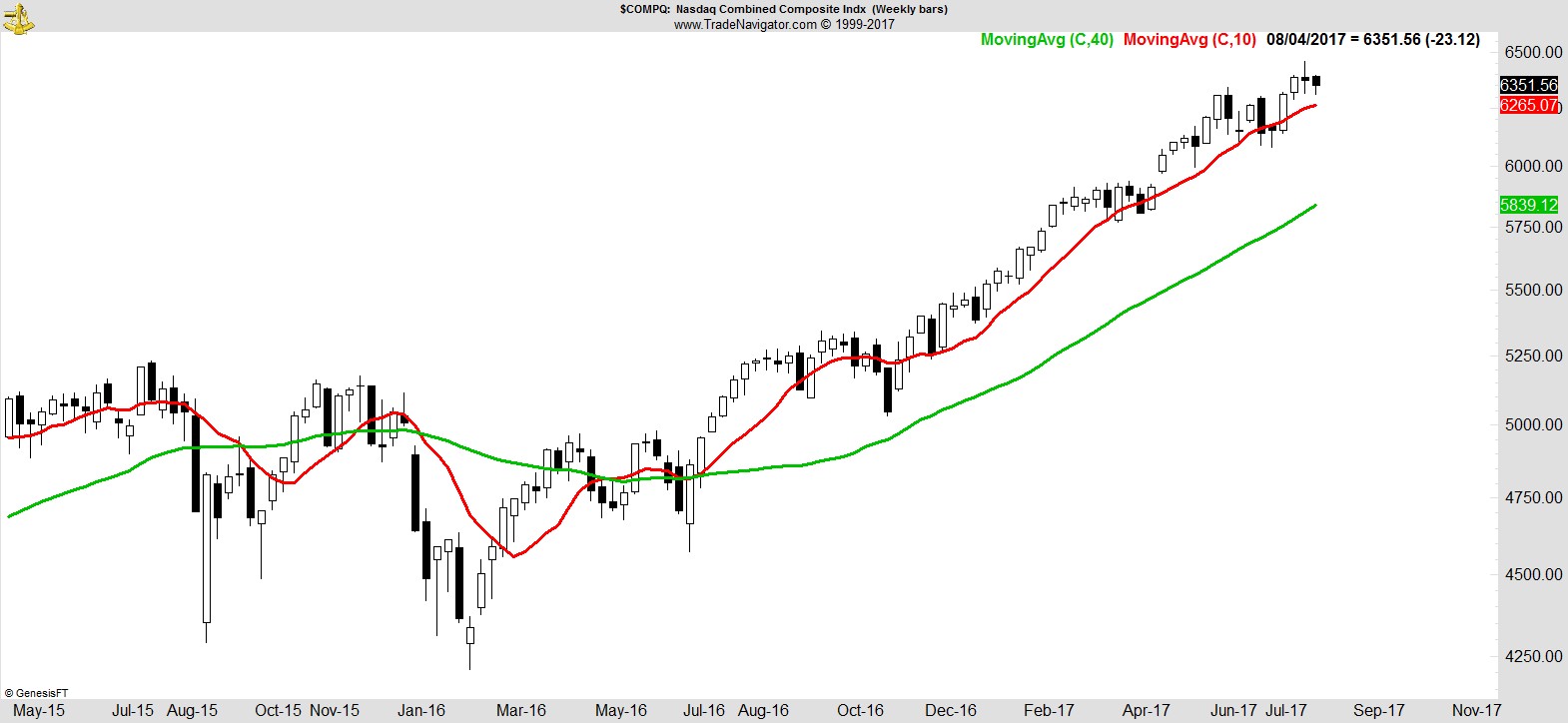

The NASDAQ was lower for a second straight week but without causing any damage, and remains just below its highs.

.

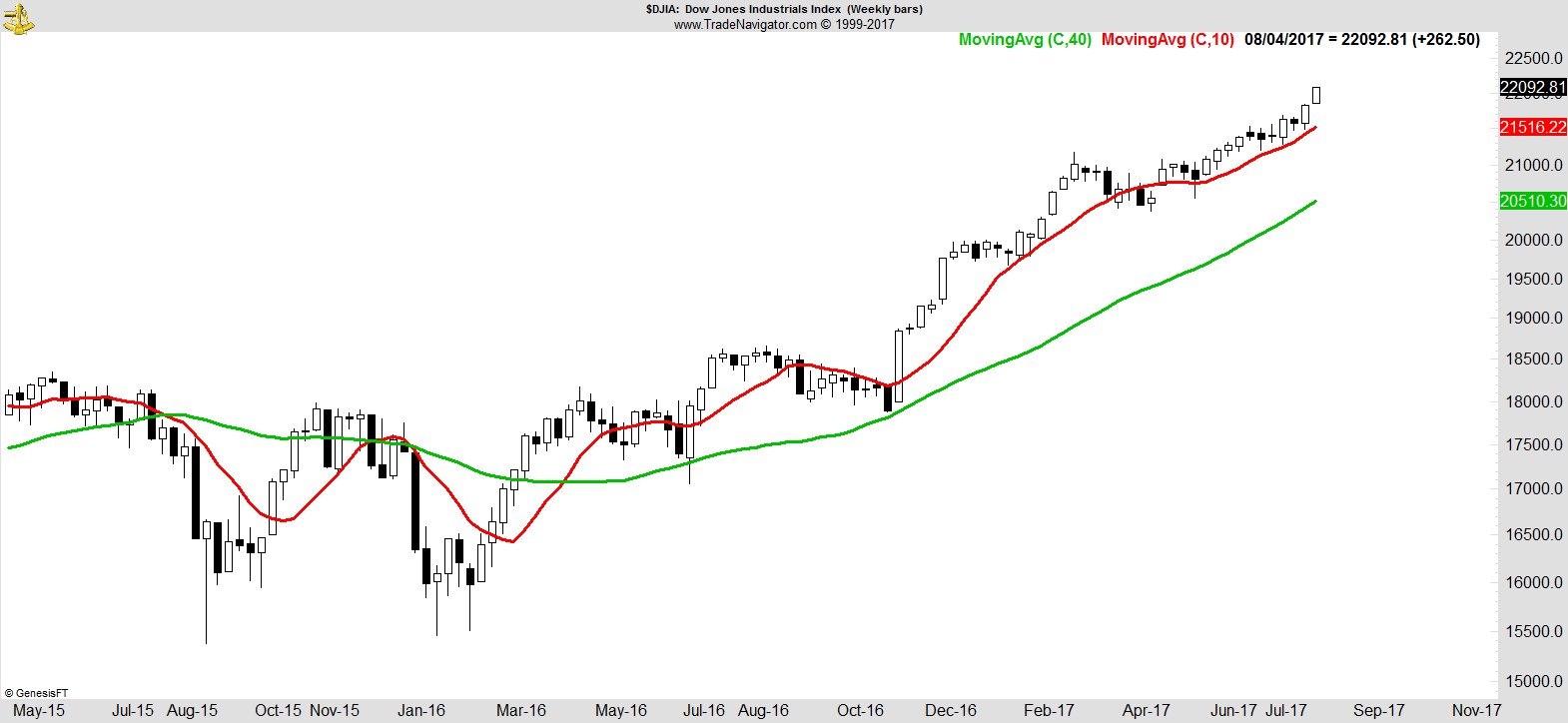

The Dow was the big winner, posting its eighth straight record close.

.

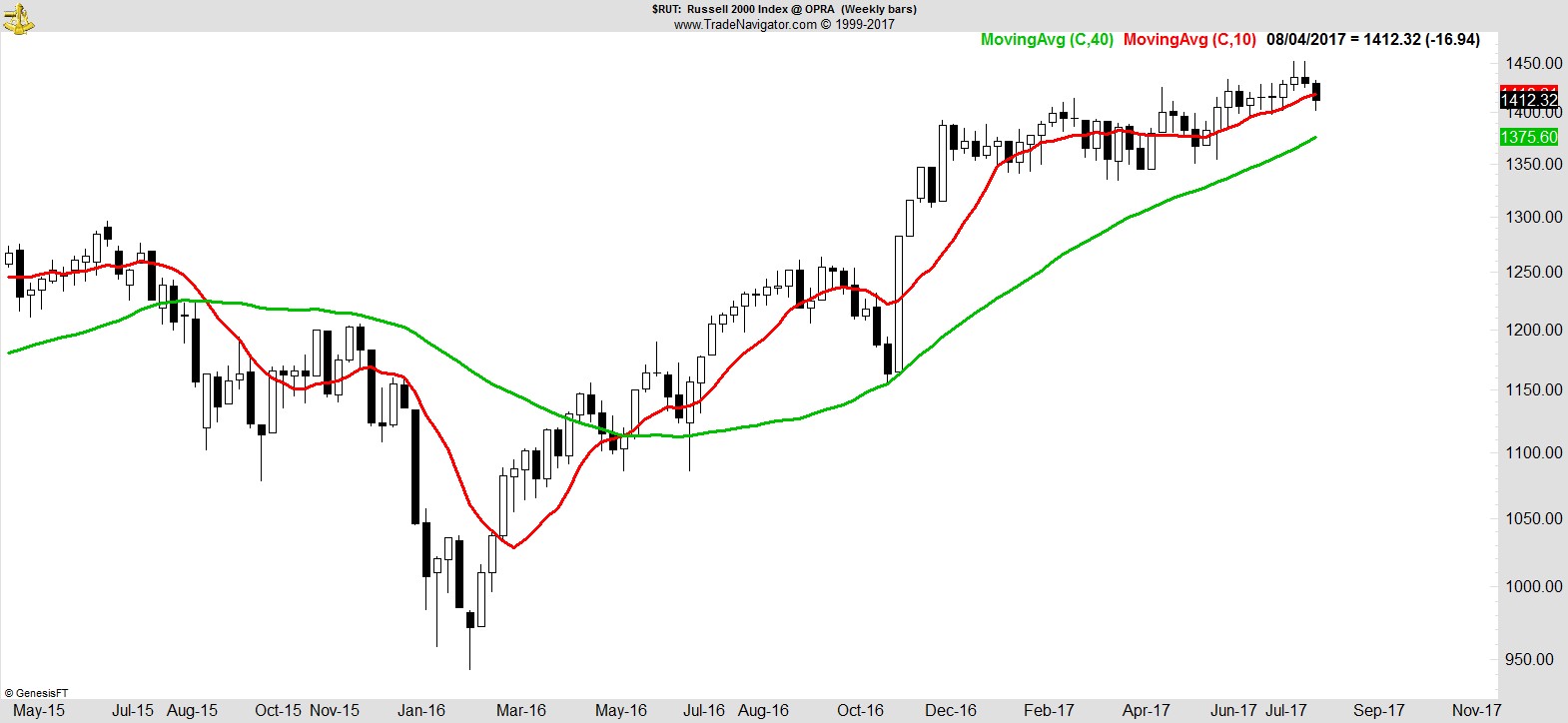

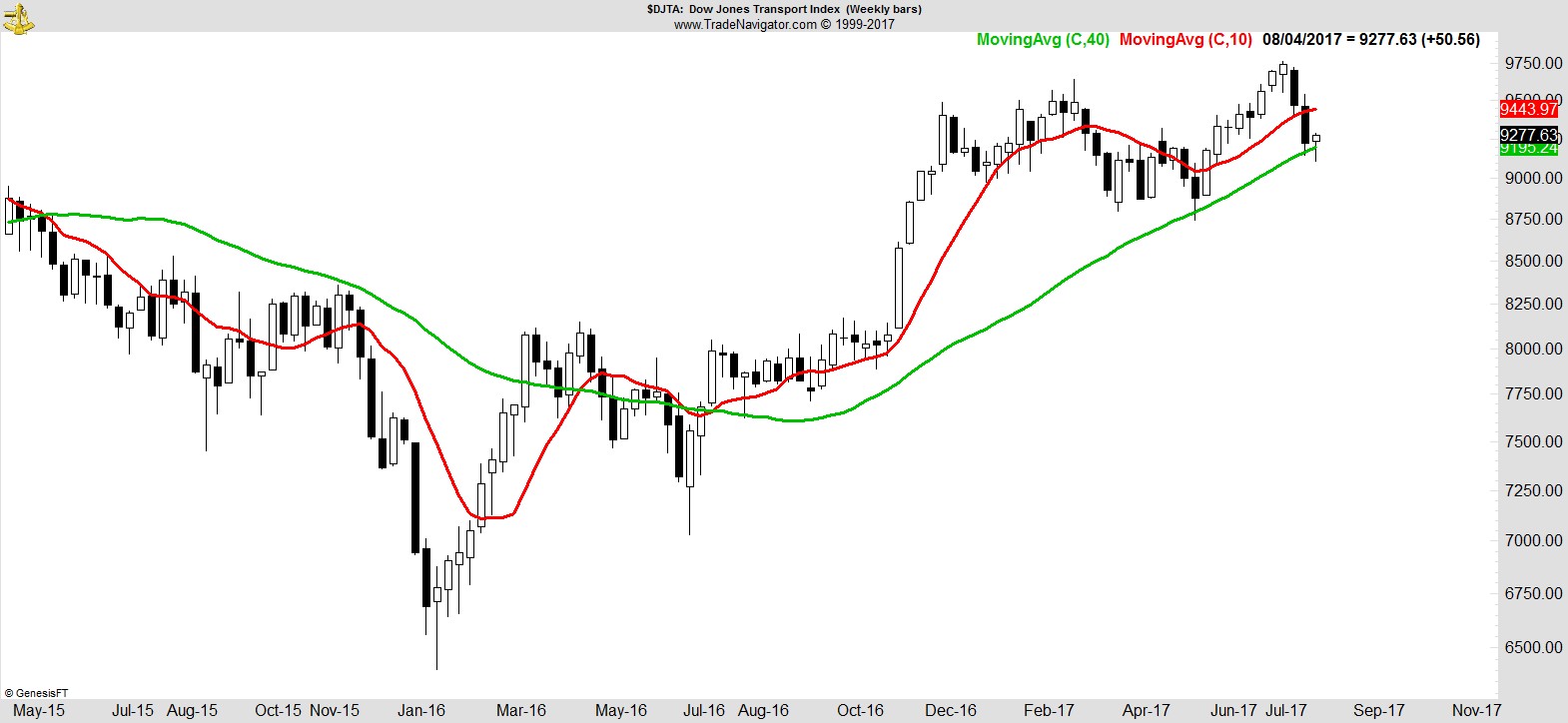

Contrast that with the Russell 2000, which slid below its 10-week MA to post its lowest weekly close in 2 months, and the Transports, testing its 40-wk MA for a second straight week.

.

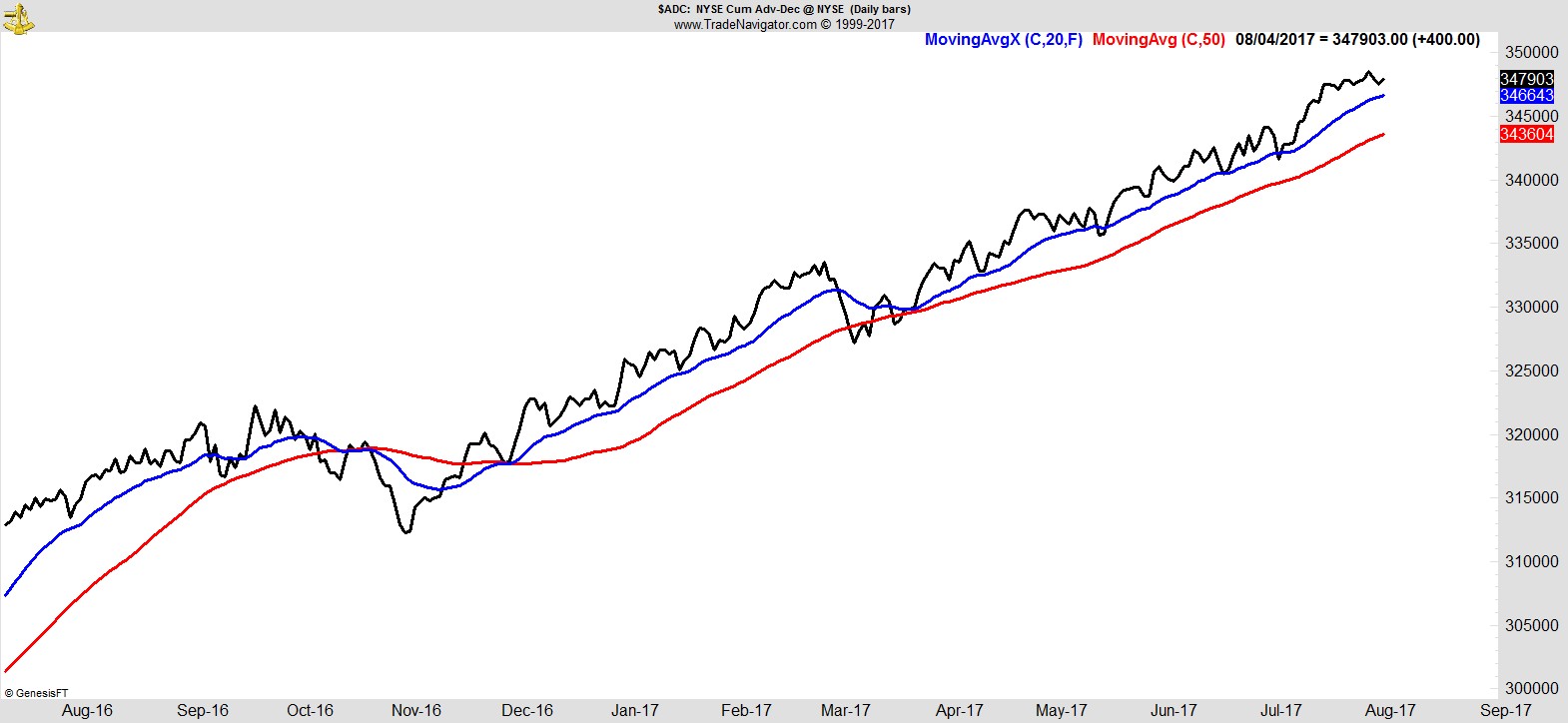

Overall though, despite the obvious divergences between the major indices and the sector rotation under the surface, breadth remains near its highs.

.

Sector Analysis

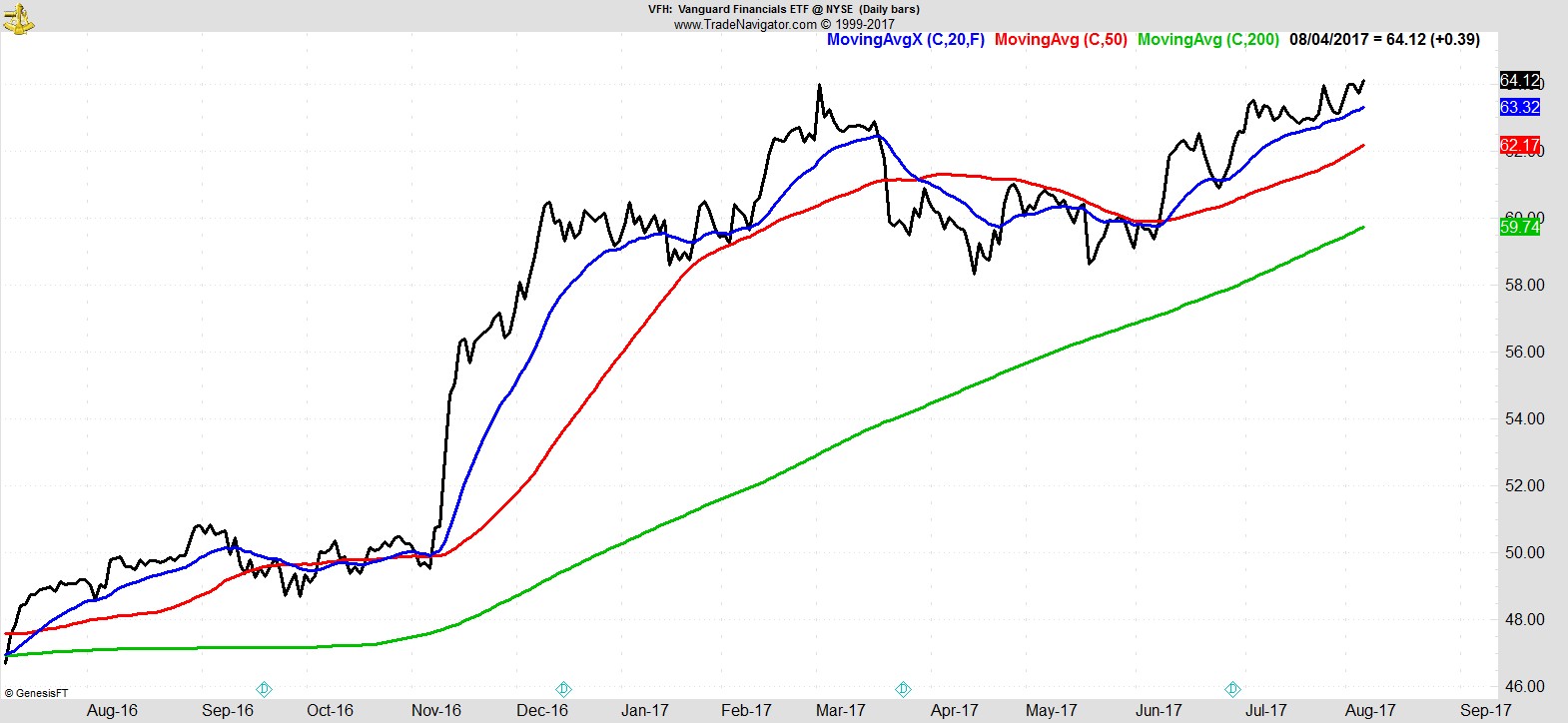

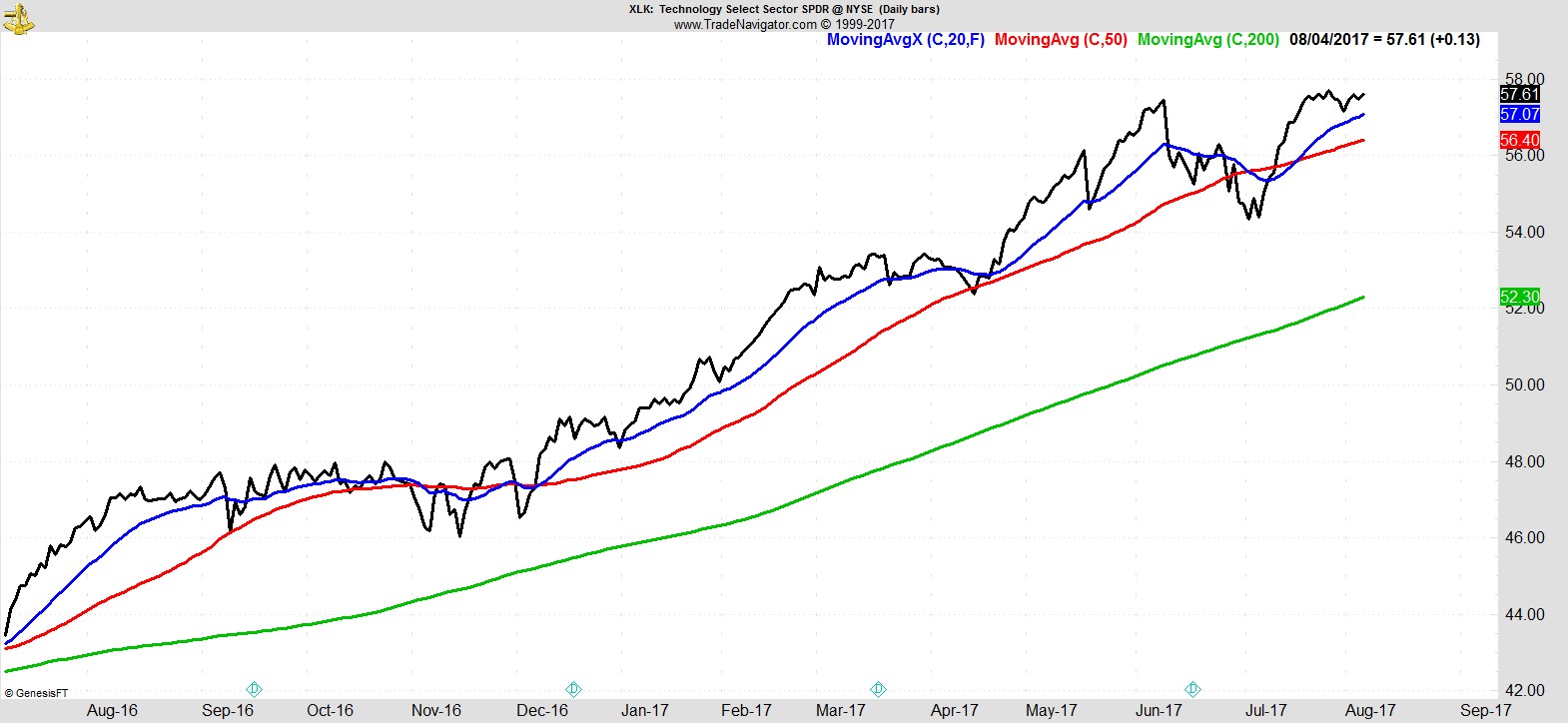

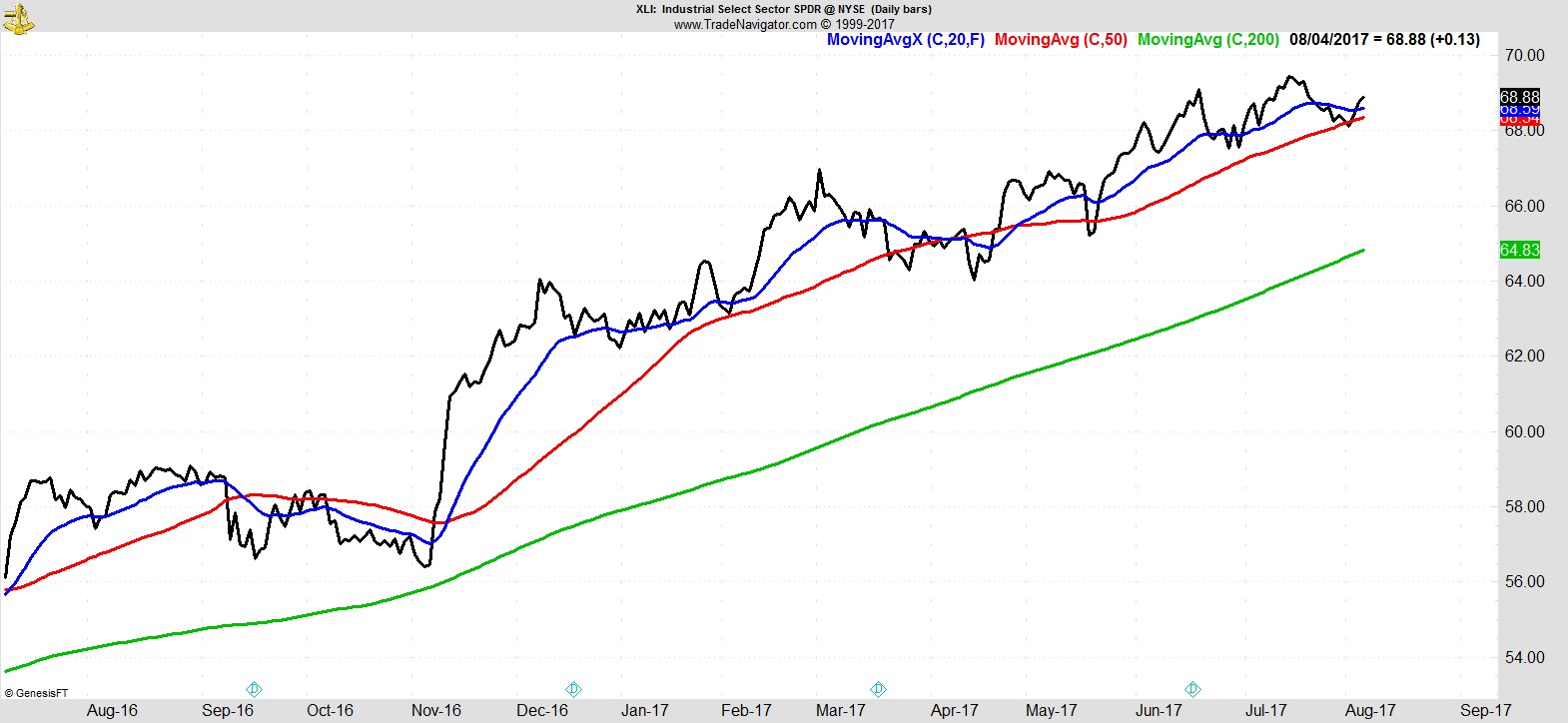

Leading the way this week I have Financials, Technology, and Industrials.

.

They're followed by Utilities, Real Estate, and Consumer Discretionary which are also all above their 20, 50, 200-day MAs.

Then comes Healthcare, and Materials, which remain in long term uptrends but short-term have deteriorated. At the bottom I have Staples which has now put in place a lower high and lower low, and sits below its 20 and 50-day MA, and Energy, which gave back most of the previous week's gains.

.

Alpha Capture Portfolio

Our model portfolio edged -0.2% vs +0.2% for the S&P in another quiet week, and is +1.5% YTD. It had two more exits this week and now stands at 6 names, 2.6% open risk, and over 50% cash.

Interestingly, in client portfolios that run a similar strategy but with slightly different timeframes and risk tolerance, the performance is better at +7% YTD, but they are also now down to a handful of names and have over 50% cash.

It's a curious situation to be getting exits and nothing to replace them with when the market is so close to its highs, but it's simply a matter of not finding opportunities that meet entry or risk/reward criteria.

I see many names making marginal breakouts, giving sub-optimal entry signals, or extending so far that the stop necessary to invalidate the trend is so far away, it would result in a negligible amount of capital being allocated to it.

The downside of taking on such signals by not having a minimum capital allocation, is you can end up with a portfolio of 40-50 names which then acts more like an index, rather than a more desirable highly concentrated portfolio, that will perform very differently.

.

Watchlist

I've had to cast a bit of a wider net this week in putting a watchlist together, as despite the market remaining near its highs and overall strong breadth, there are definitely fewer opportunities in the normal familiar hunting grounds of traditional growth and momentum names. The result is still a fairly broad list, but with more large cap stocks than usual.

Here's a sample from the full list of 25 names:-

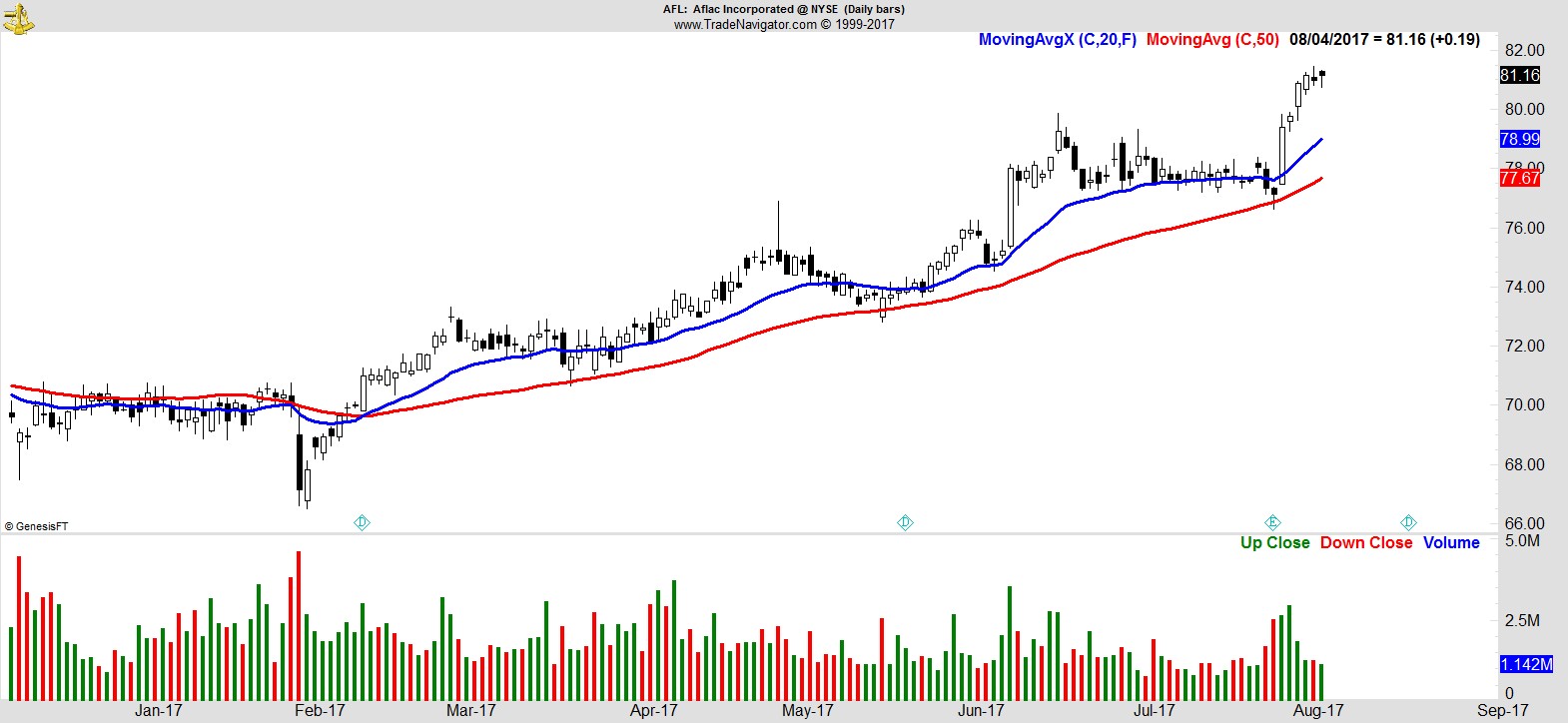

$AFL

.

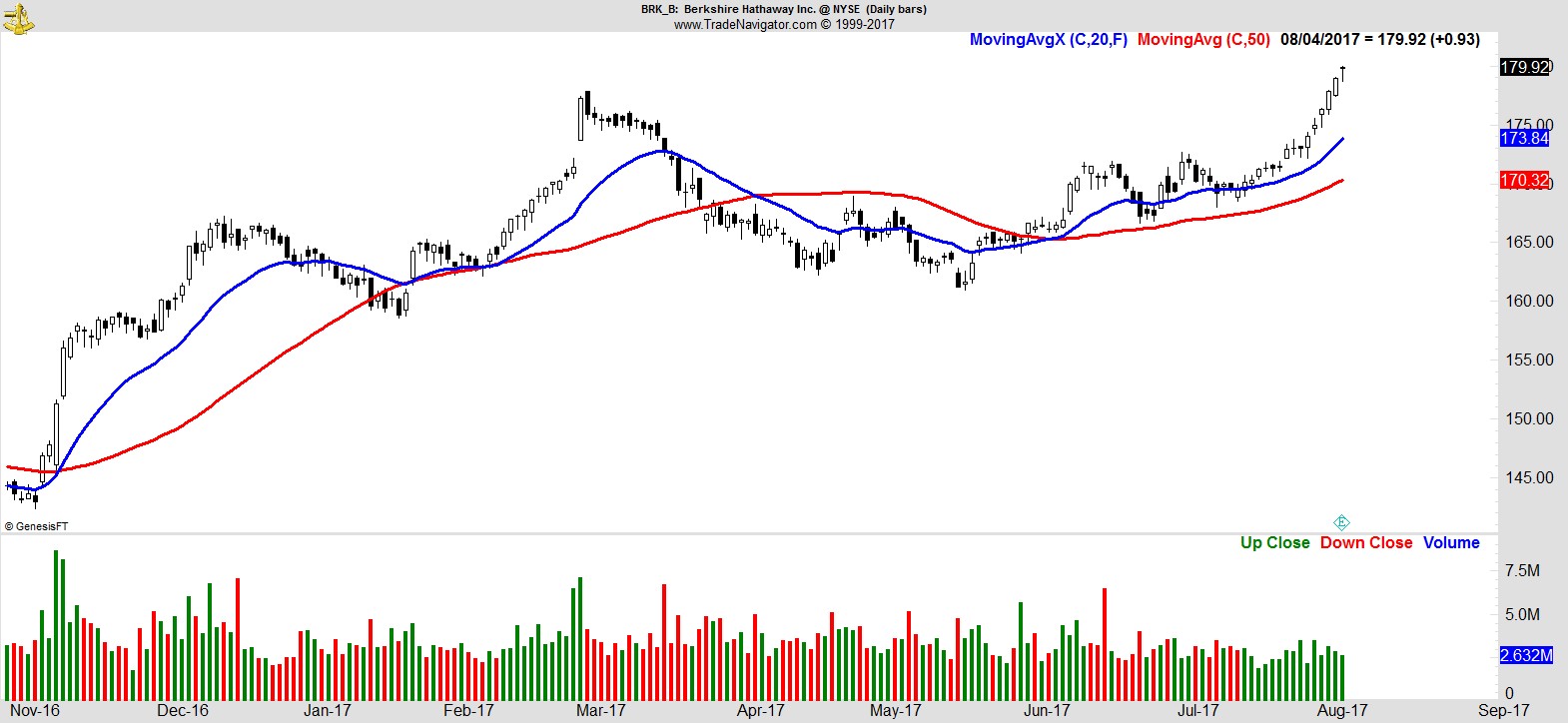

$BRK_B

.

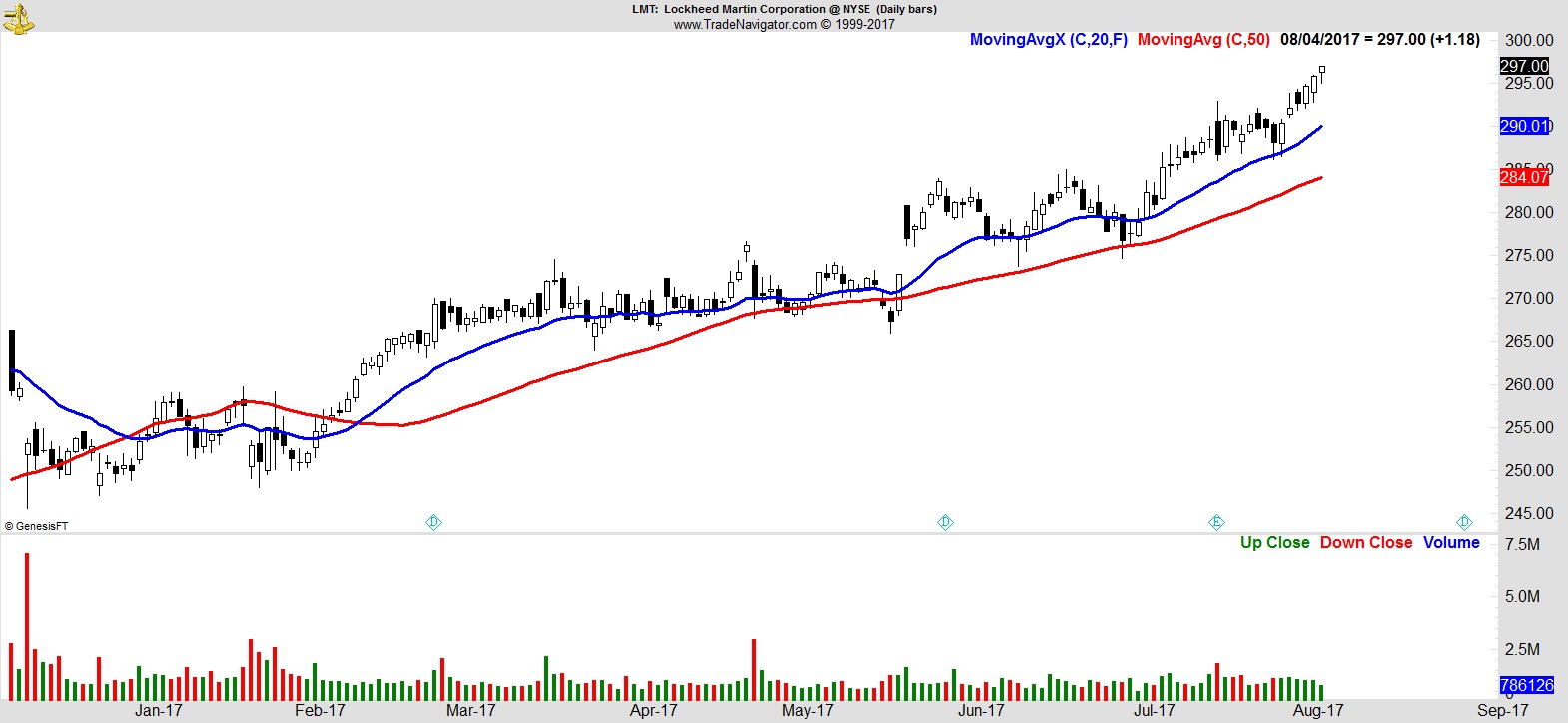

$LMT

.

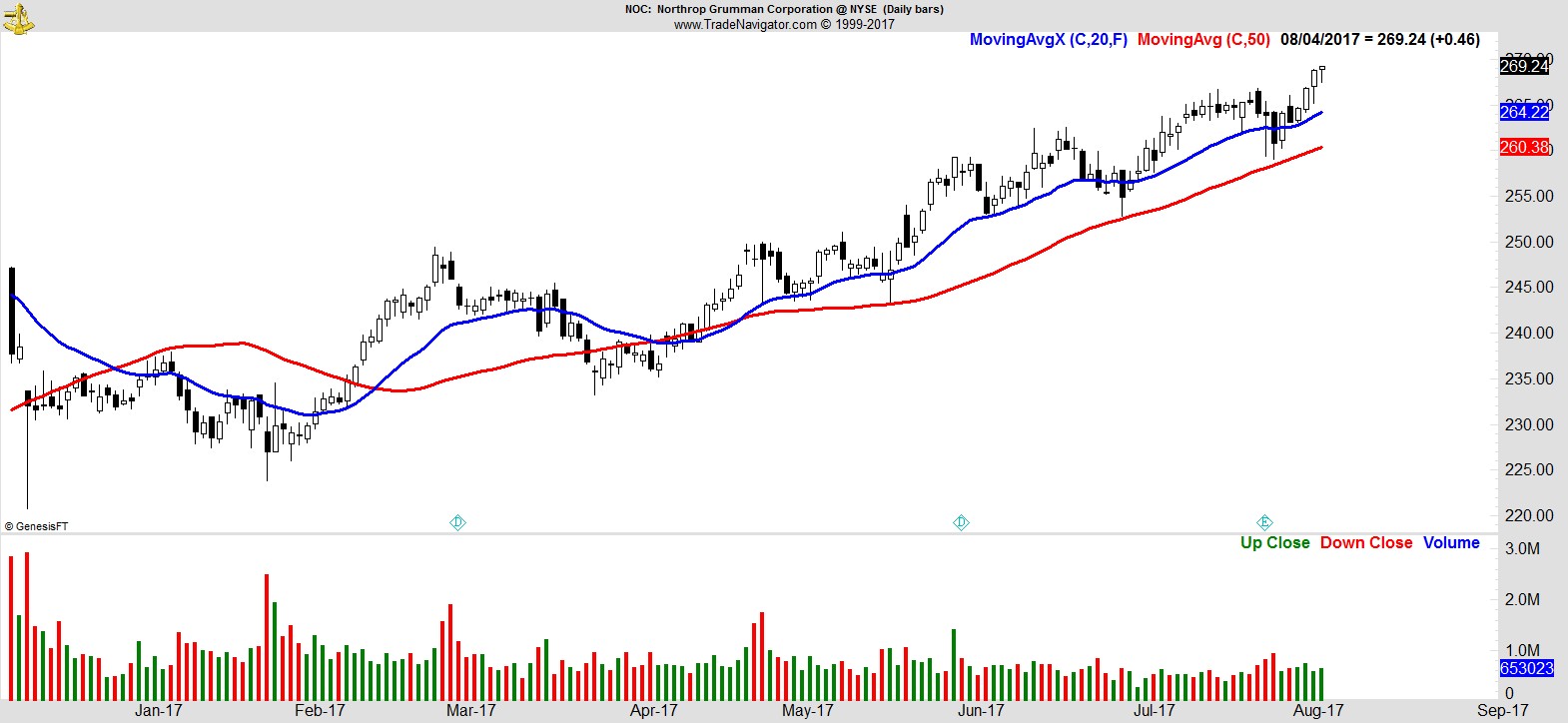

$NOC

.

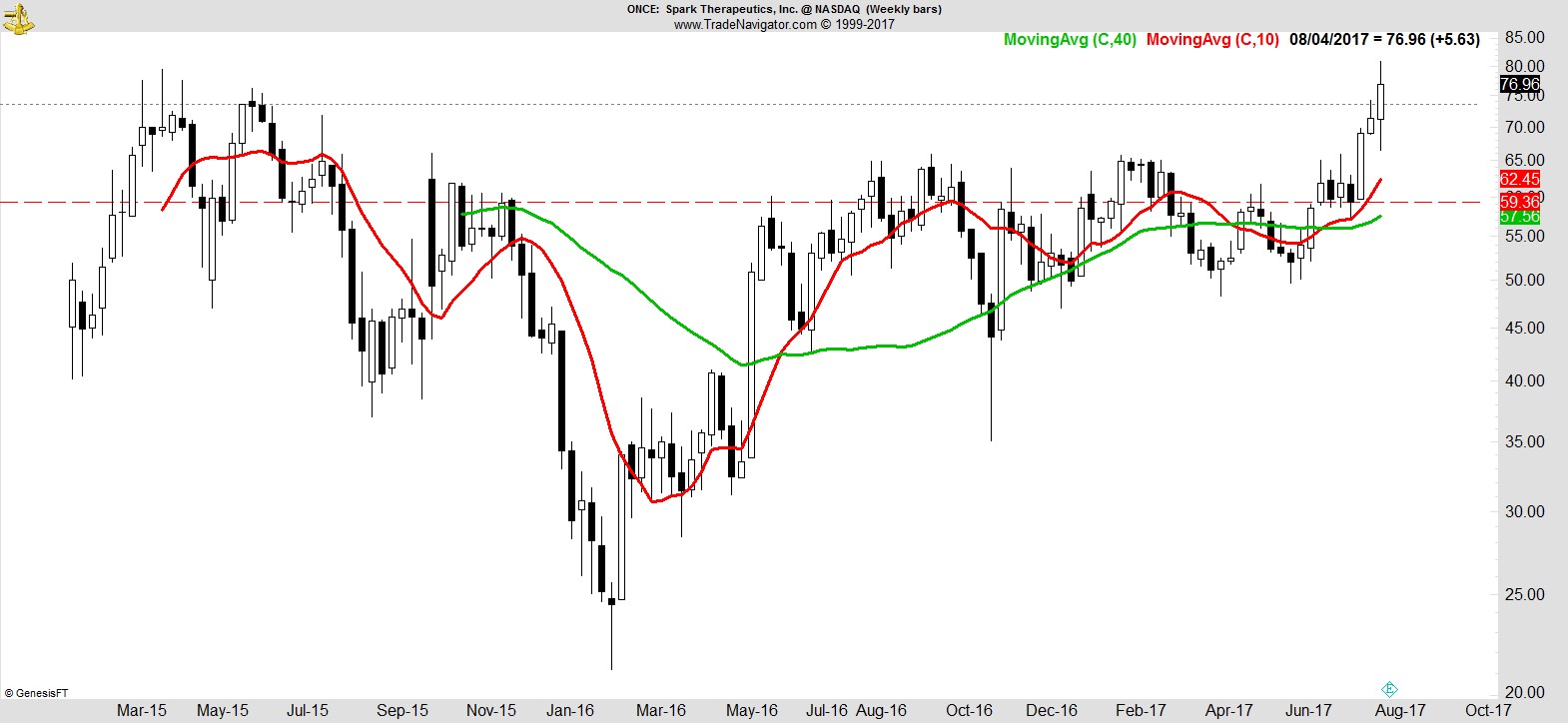

$ONCE

.

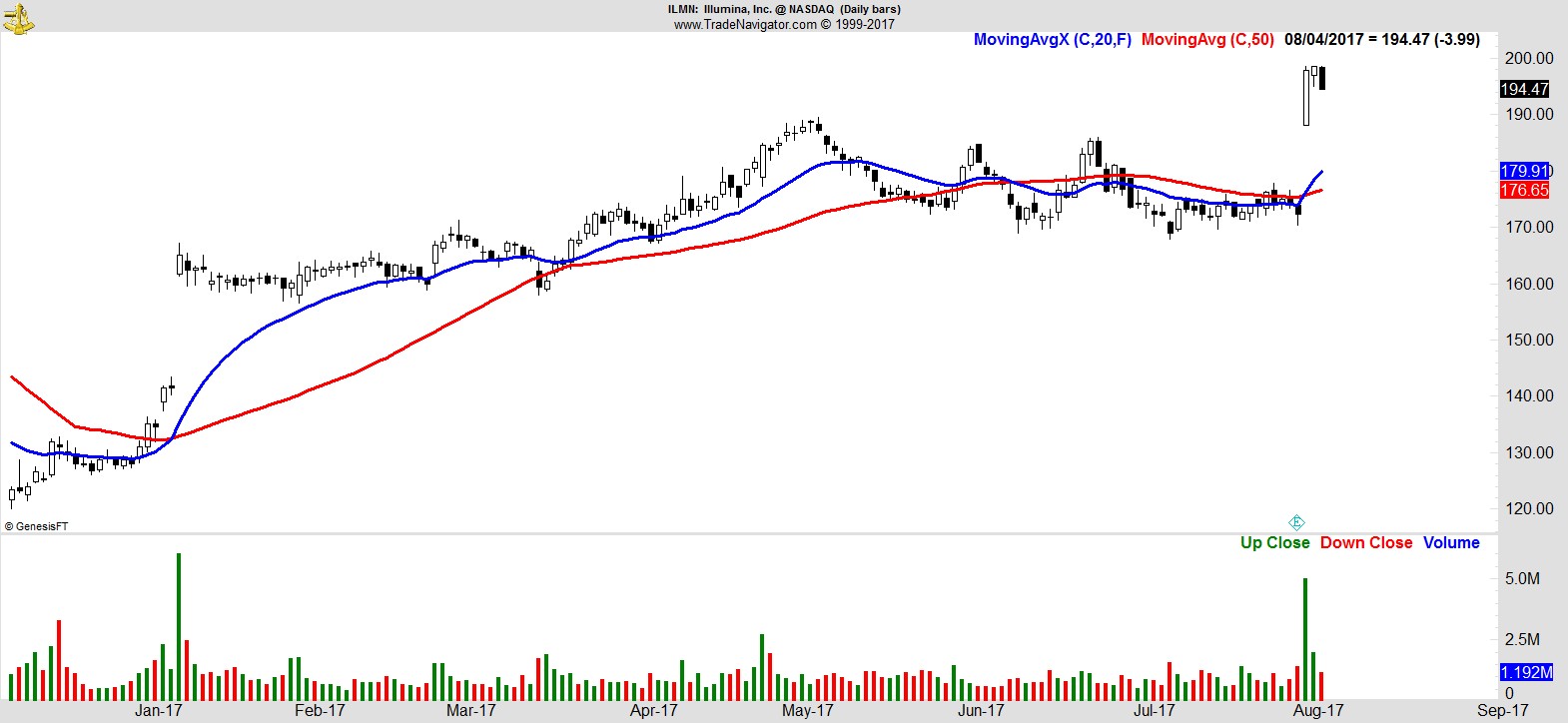

$ILMN

.

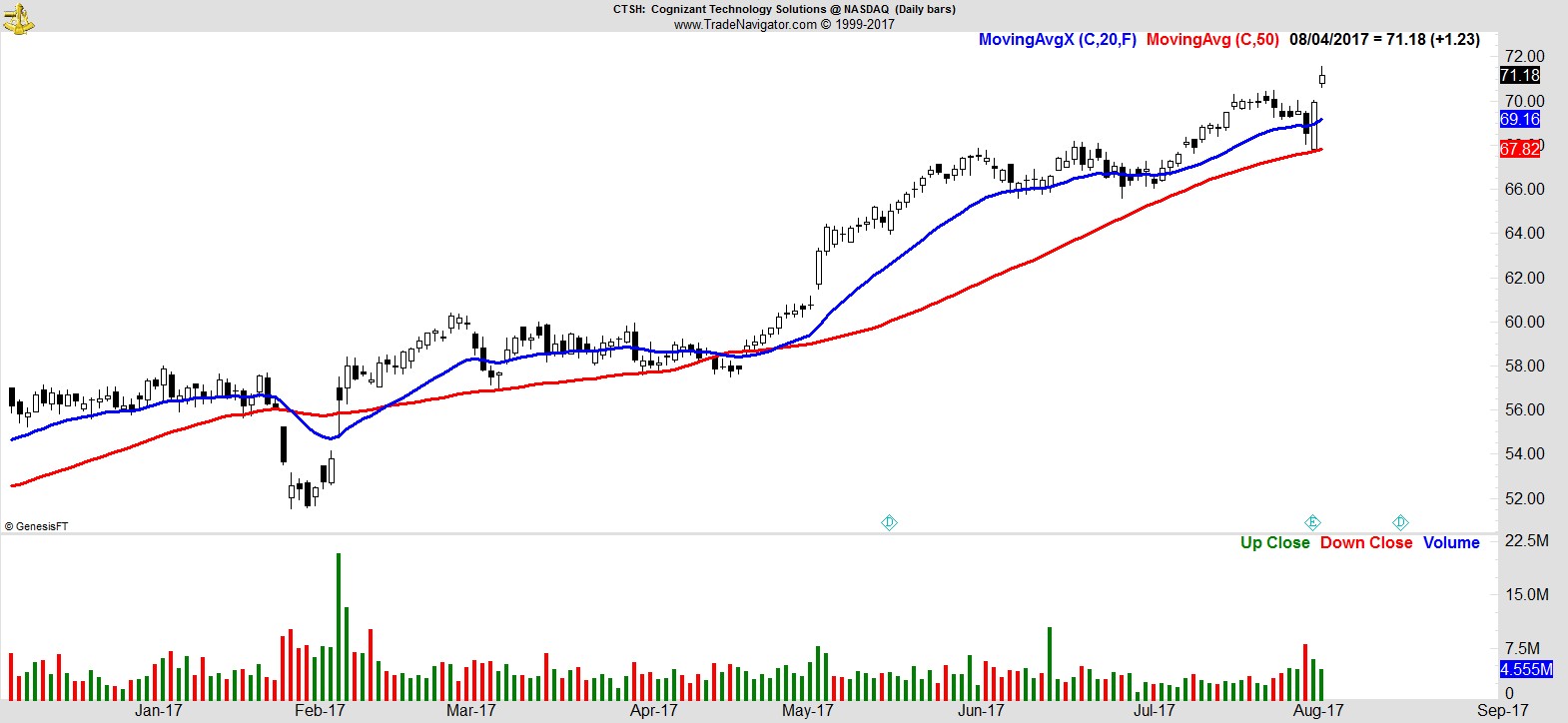

$CTSH

.

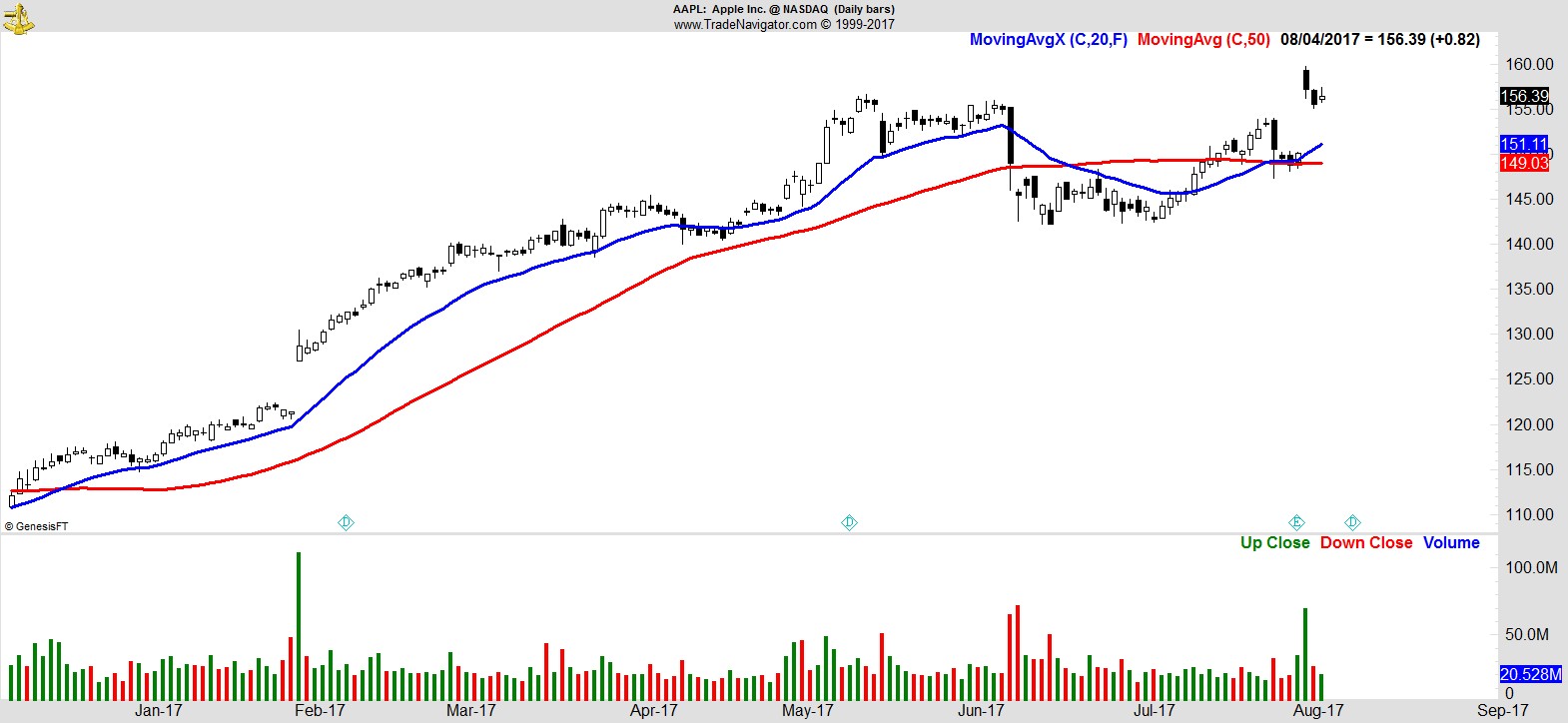

$AAPL

.

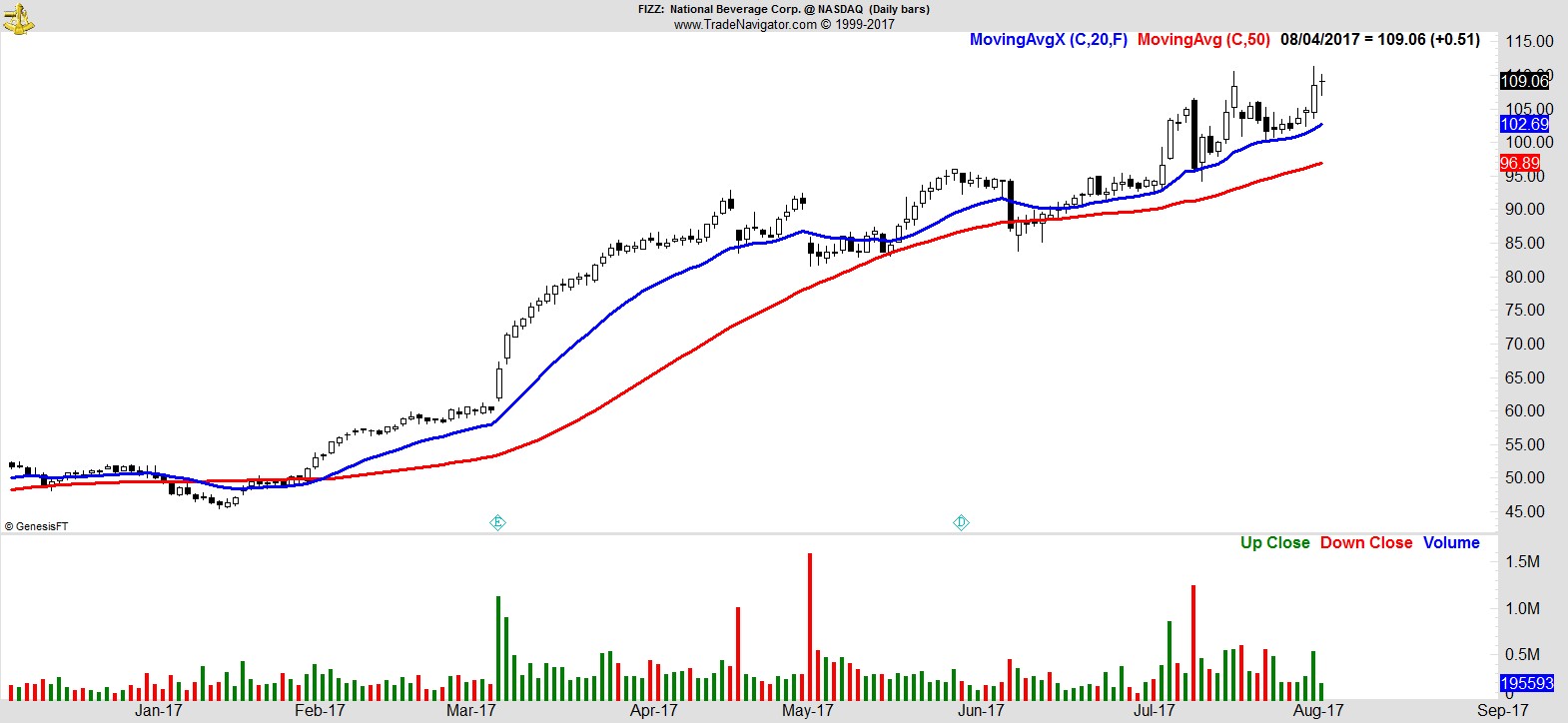

$FIZZ

.

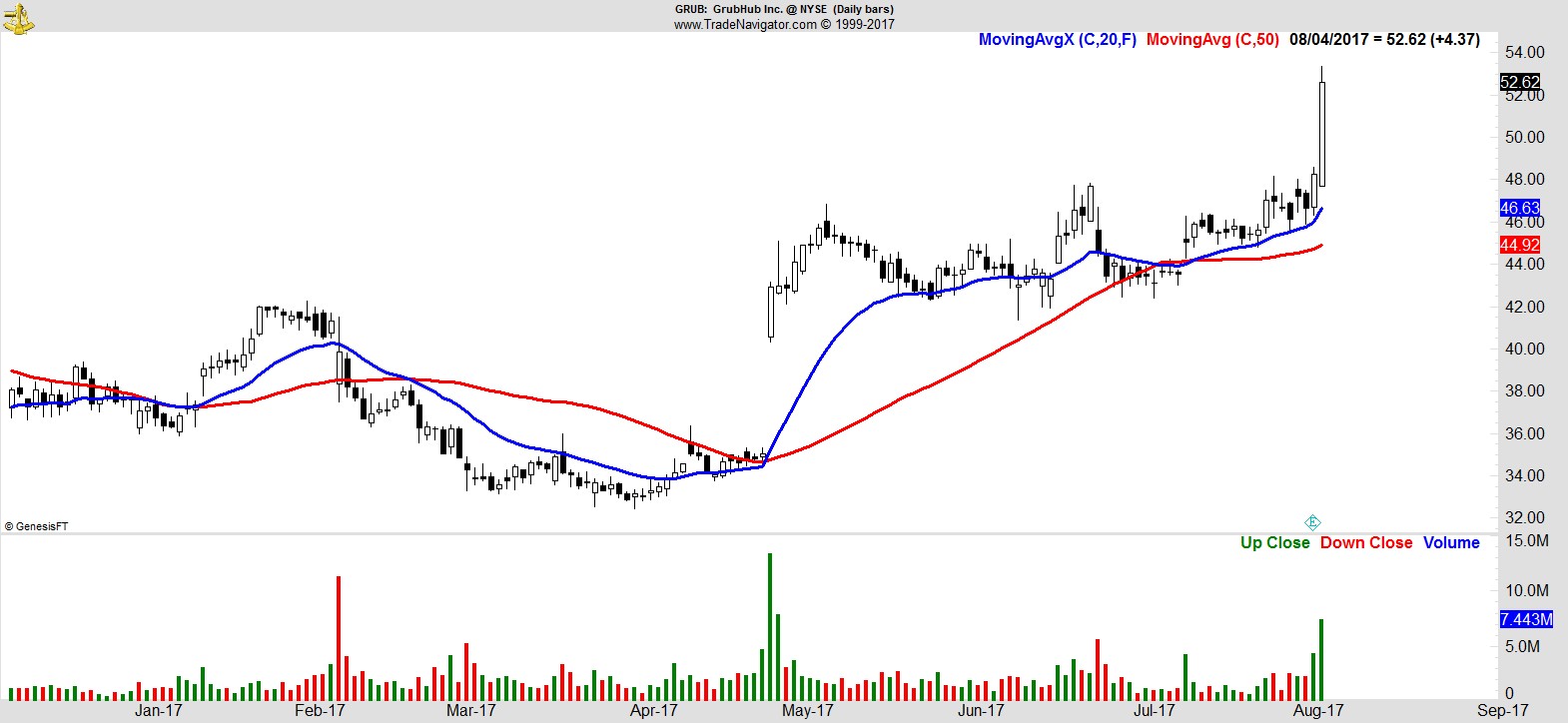

$GRUB

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17