- Nice “Biden rally,” but a short squeeze provided A LOT of fuel as well.

- Despite the rally in stocks, Treasury yields and gold prices did not respond in-kind.

- We also did not see much of a tightening of credit spreads (at all).

- In other words, many “other” markets are still sending up warning signals.

- Is President Trump making the same mistake President George HW Bush made???

Nice “Biden rally,” but a short squeeze provided A LOT of fuel as well.

Ok, we’ll say it…Joe Biden is better for the stock market than Bernie Sanders, but we still don’t believe that Bernie’s rise had much to do with the correction in the stock market in recent weeks. Therefore, we do not believe yesterday’s strong bounce had as much to do with the Democratic campaign for president as most people think. In fact, we have some proof that yesterday’s rally was not entirely related to the Super Tuesday results.

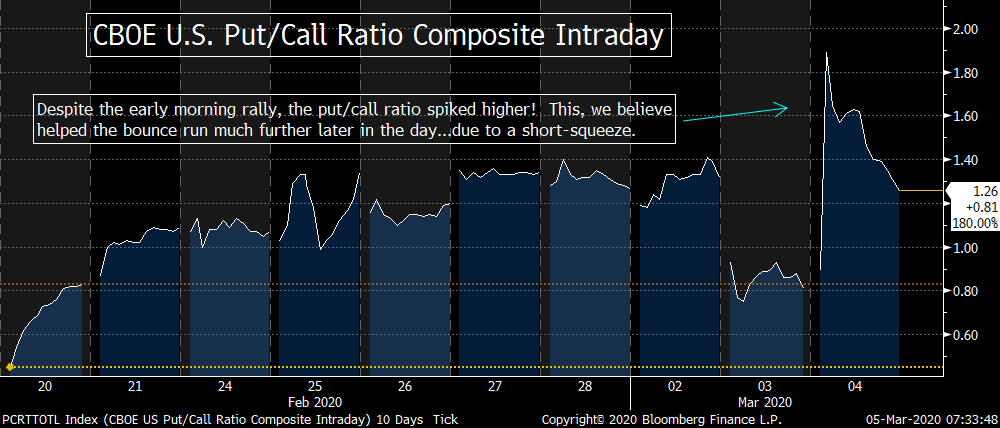

First and foremost, the put/call ratio move HIGHER yesterday. In other words, the options players did not believe in the rally yesterday morning….and started buying puts in a significant way. This took the intraday put/call ratio up to 1.89 in early trading. It fell to back to 1.26 by the close, but as you can see, it actually spent much of yesterday at a higher level than it did when the scary drops took place in the stock market on Thursday and Friday of last week and Monday of this week!

In other words, the players in the options market got short in the morning yesterday…and when the stock market did not decline, they got squeezed in the afternoon. As the market rallied while those players got squeezed, the momentum-based algos kicked-in on the buyside…and the whole thing snowballed. THAT is the main reason why the rallied as much as it did yesterday in our humble opinion……Don’t get us wrong, the results from Super Tuesday DID have a positive impact, but it was these other artificial factors that turned yesterday’s bounce into an outsized one in our opinion. The question now is whether the short squeeze can continue. Given that the futures are trading down 2% as we write, it doesn’t look like we’ll get a further short squeeze over the near-term.

Despite the rally in stocks, Treasury yields and gold prices did not respond in-kind.

There is another reason to think that yesterday’s rally won’t see much follow-through. None of the “other” markets saw the kinds of moves yesterday that would indicate that we’re out of the woods on the negative impact of the coronavirus. As we highlighted yesterday, safe havens like Treasuries and gold did not see any pull-backs on Monday (when the market rallied strongly that day). The same thing happened yesterday…as the yield on the 10yr note fell below 1%...and gold held-up near its eight year highs. Therefore, the moves in these “safety trades” markets did not confirm what was going on in the stock market yesterday.

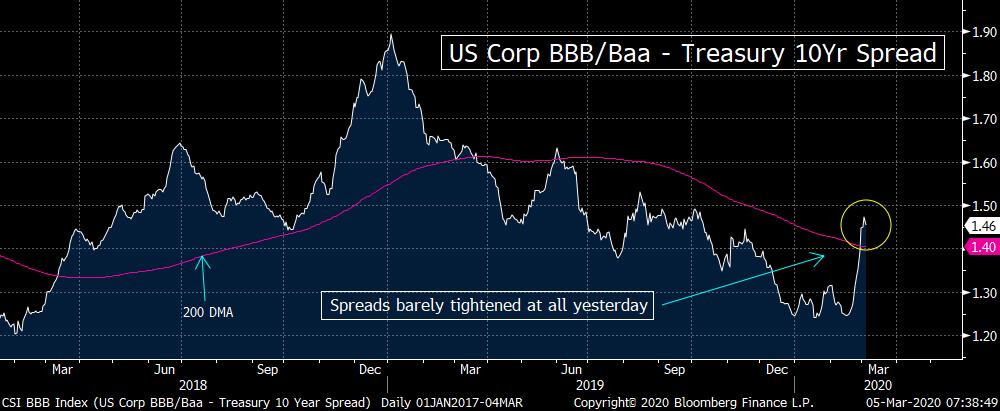

We also did not see much of a tightening of credit spreads (at all).

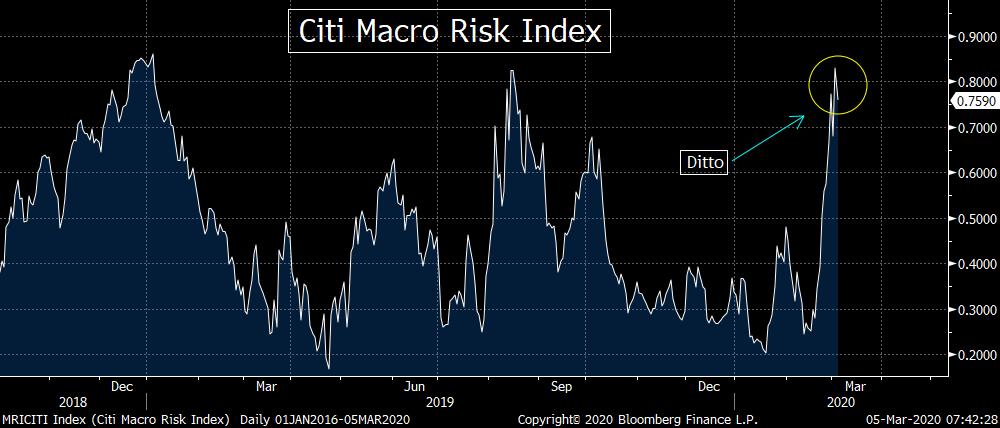

However, the Treasury market and the gold market are not the only “other markets” that did not confirm the rally in the stock market. There was also another areas that told us that yesterday’s rally in stocks might not last very long. We’re talking about credit spreads. Yes, they tightened up slightly yesterday, but not much. Instead they remained very near their widest levels of the year (which are also the widest level we’ve seen in several years)…….We’d also note that the Citi Macro Risk Index did not drop much at all yesterday either…and it remains very near its highs from late 2018!

As we highlighted in our weekend piece last weekend, there are some REAL reasons to worry about the credit markets going forward…because of the record high levels of corporate and individual debt here in the U.S. (and around the globe). Yes, the banks are in much better shape than they were a decade ago, so we’re not saying that we’re headed into another major credit crisis. However, if we go into recession due to the coronavirus (or any other reason), it’s still going to put a lot of stress on the credit markets…as those who are carrying these historic levels of debt with have a tougher time servicing that debt during a recession.

To review, what we’re trying to say is that the action over the breadth of the entire market place is telling us that it’s going to be tough for yesterday’s rally to give us much follow-through over the near-term. A lot of the rally in stocks was induced by short-covering…and several of the “other” key markets did not respond in-kind to that rally. When you combine this with the fact that we really didn’t get any positive news on the coronavirus…and the impact of the coronavirus was (by far) the most important reason for the recent correction in the stock market…there are several reasons for us to stay with our call from earlier this week. In other words, we still believe a retest of last weeks lows…at the very least…will take place before we see a sustainable rally in the stock market.

Of course, this does not mean that a further decline will take place immediately. Just because the futures are down significantly this morning does not mean they cannot bounce today. Oil is trying to bounce…after OPEC agreed to cut production by 1.5 million barrels a day…so maybe that will help the markets today. We could also get news that Tom Brady has agreed to stay with the Patriots…which would be an important catalyst.(???) However, given the action in the entire market place this week, we still believe that we’ll see more weakness in the stock market going forward.

Is President Trump making the same mistake President George HW Bush made???

Finally, we’d just like to make one quick comment on the issue of “fiscal stimulus.” We believe the Trump administration is at risk of making the same mistake the administration of George HW Bush made in 1992. Back then, the Bush administration decided to do nothing on the fiscal front to offset the impact of the weakening economy during that election year. We later learned that they believed the economy were turn around on its own…and thus decided to do nothing. Well, the economy did not turn around on its own soon enough to help President Bush get re-elected. (“It’s the economy, stupid.”)

It sure seems like the Trump administration is using the same strategy. They believe the coronavirus will dissipate relatively quickly…and that the bounce-back in the economy that will ensue will take place during the all-important summer months and help the President get re-elected. (We use the term, “the all-important summer months” because those are the key months in an election year for any president when they are running for re-election.)

Yes, this healthcare crisis might indeed pass by this spring, but if it doesn’t….President Trump is going to take a lot of flack. No, the electorate won’t blame the President for the coronavirus, but they will probably place a lot of blame in his lap if he does not at least TRY to put a contingency plan in place in advance. President Bush did not “try” in 1992…and when things did not bounce-back, it hurt him badly in the 1992 election. The same thing will probably happen again if (repeat, IF) the coronavirus lingers well into the summer months.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member