Overview

The market was unchanged in a relatively quiet week with the Thanksgiving holiday, but I felt the turnaround from the lows on Tuesday was impressive as was continued resilience in the face of supposedly negative economic numbers and news stories.

.

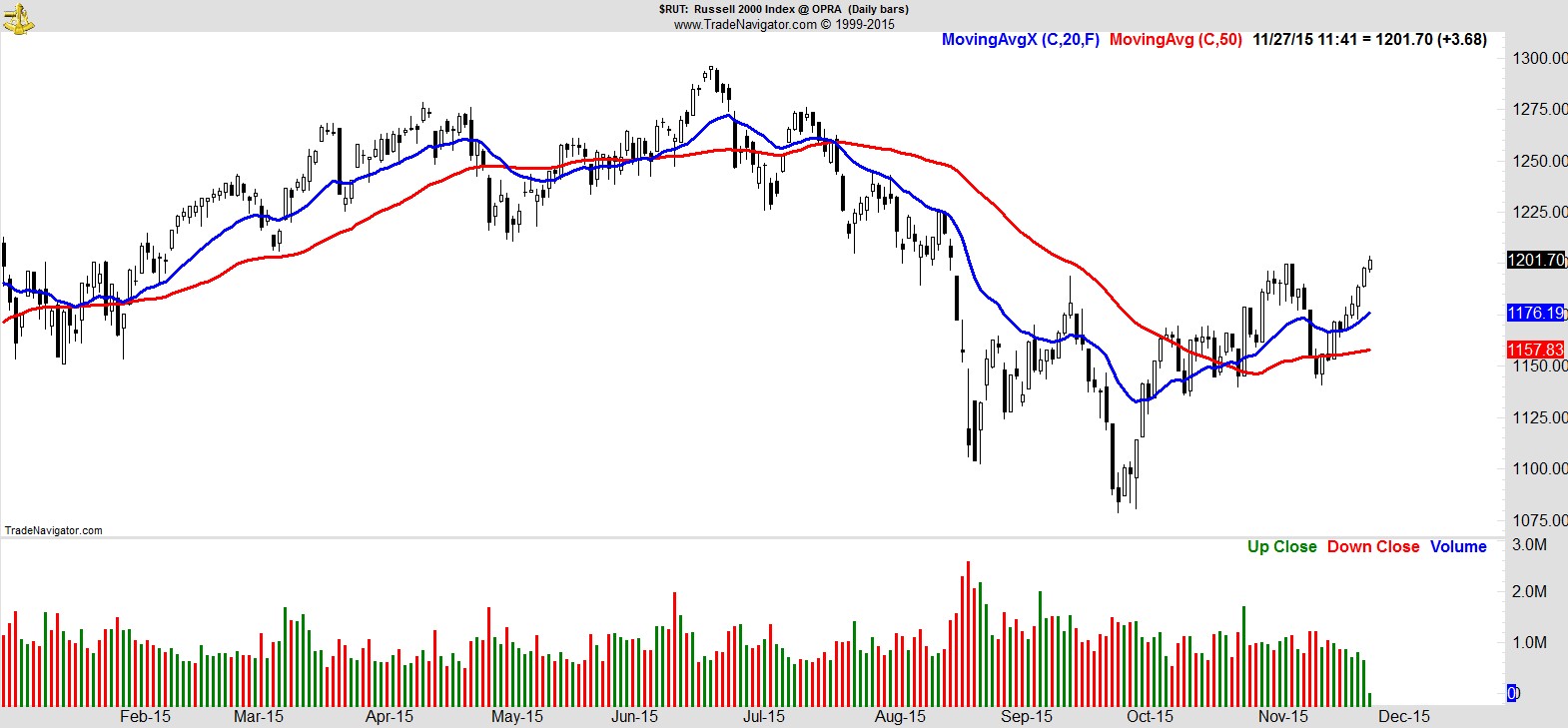

The best move was perhaps in small caps, shown here via $RUT, which finished at 3-month highs.

.

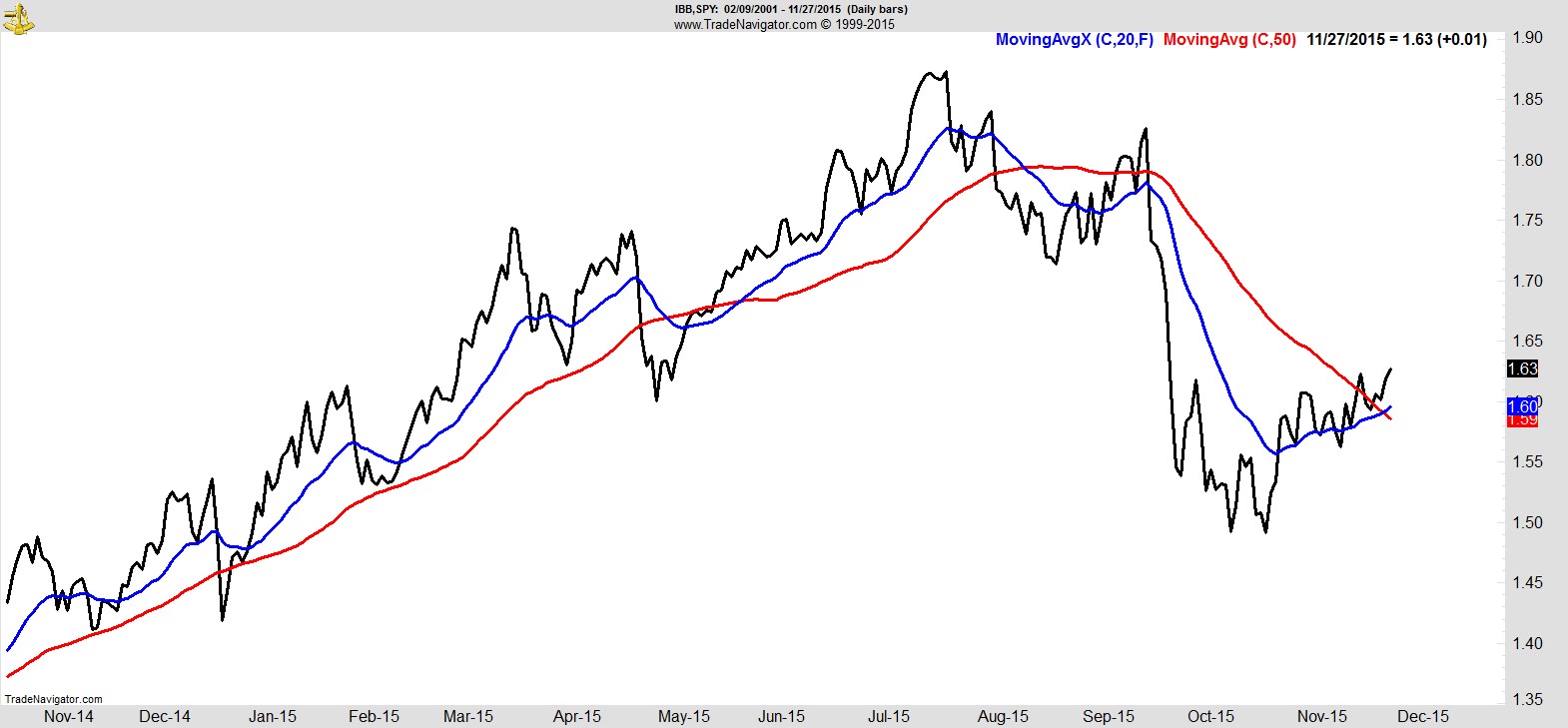

That was arguably fueled by the continued recovery in biotech shown here via $IBB relative to $SPY:-

.

Alpha Capture Portfolio

The Alpha Capture portfolio edged higher by 0.14% this week vs 0.04% for the S&P.

That takes it to +3.2% YTD vs +1.5% for the S&P.

There were no fresh signals this week and we remain fully allocated with 13 names and around 7.2% total open risk.

Sector Overview

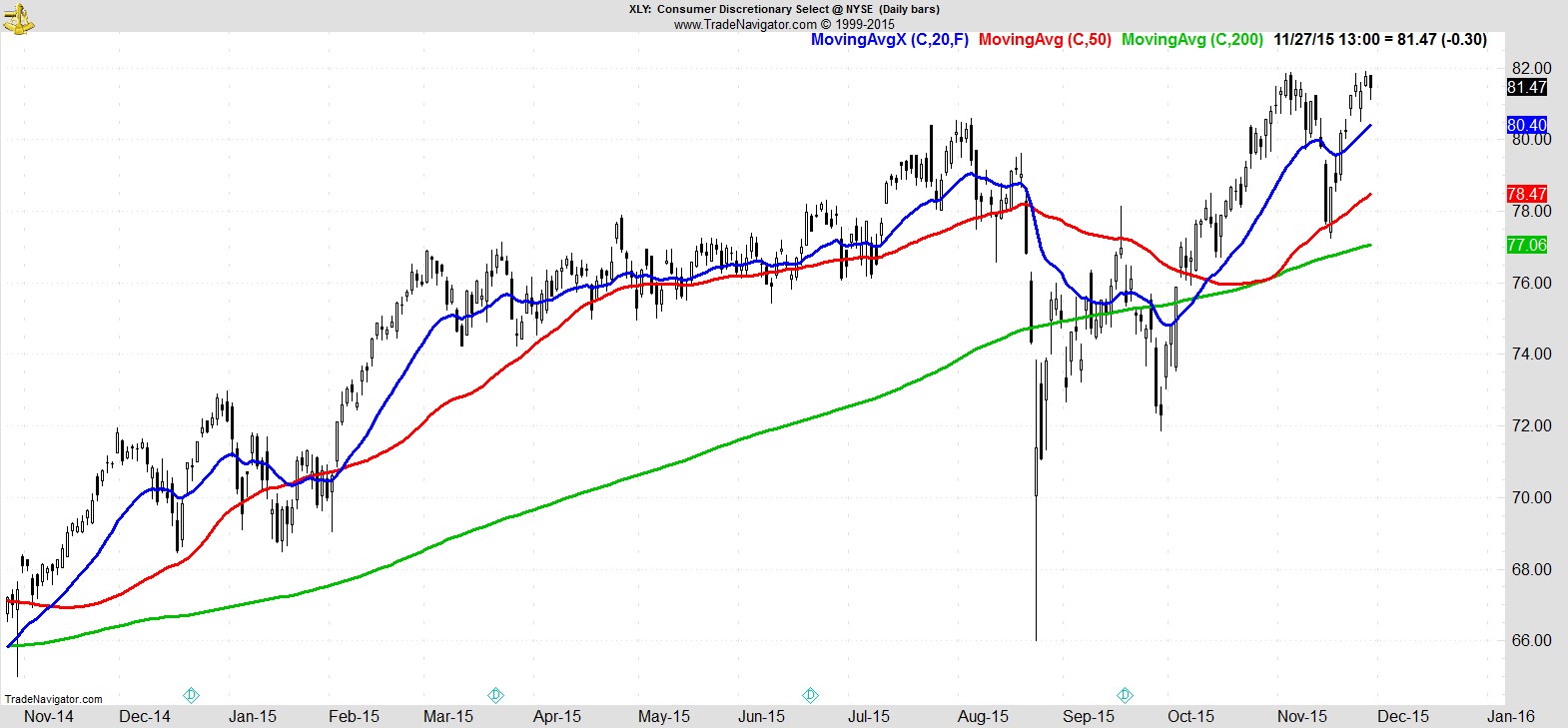

Consumer Discretionary ($XLY) and Technology ($XLK) continue to lead the way:-

.

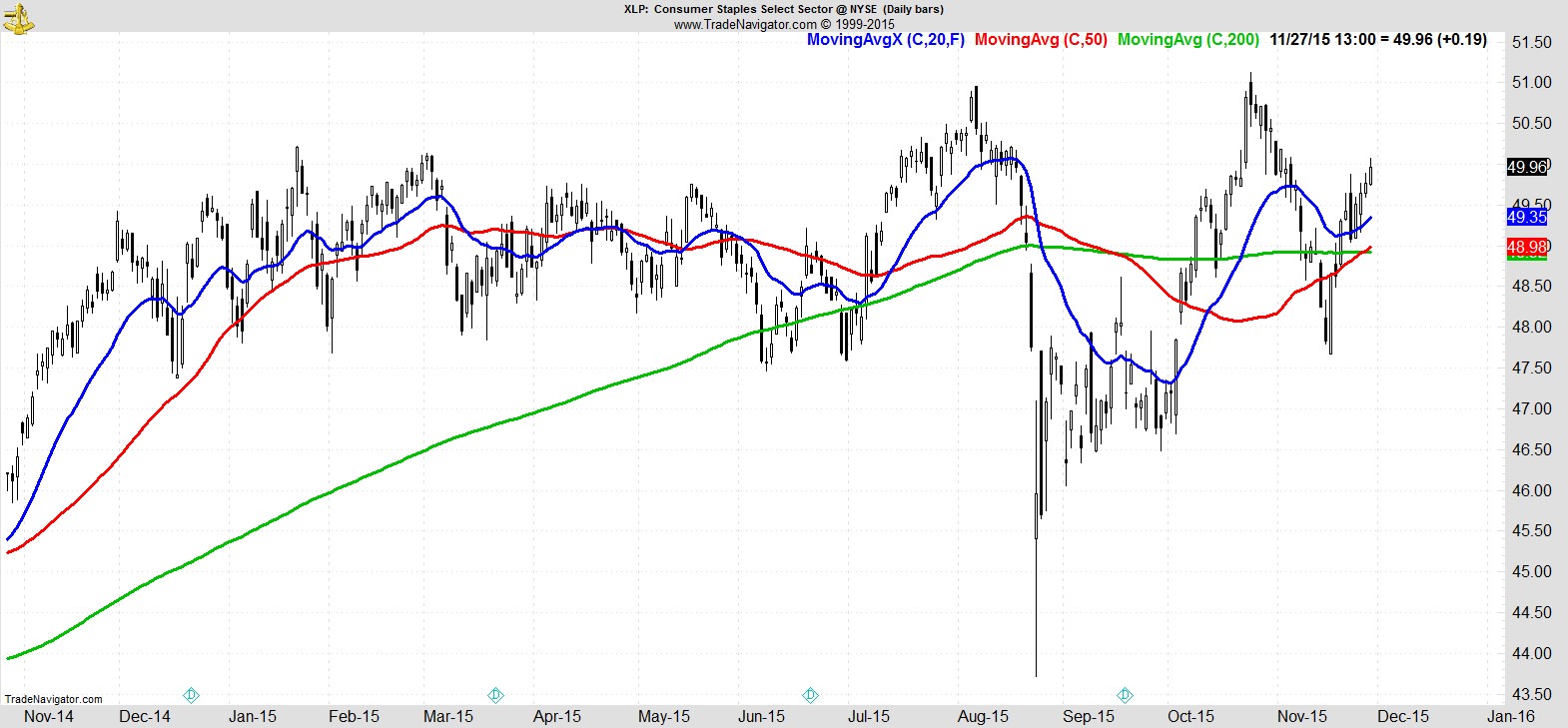

They're followed by Consumer Staples ($XLP) which has staged a strong recovery over the last couple of weeks:-

.

Then comes Financials ($XLF) and Industrials ($XLI):-

.

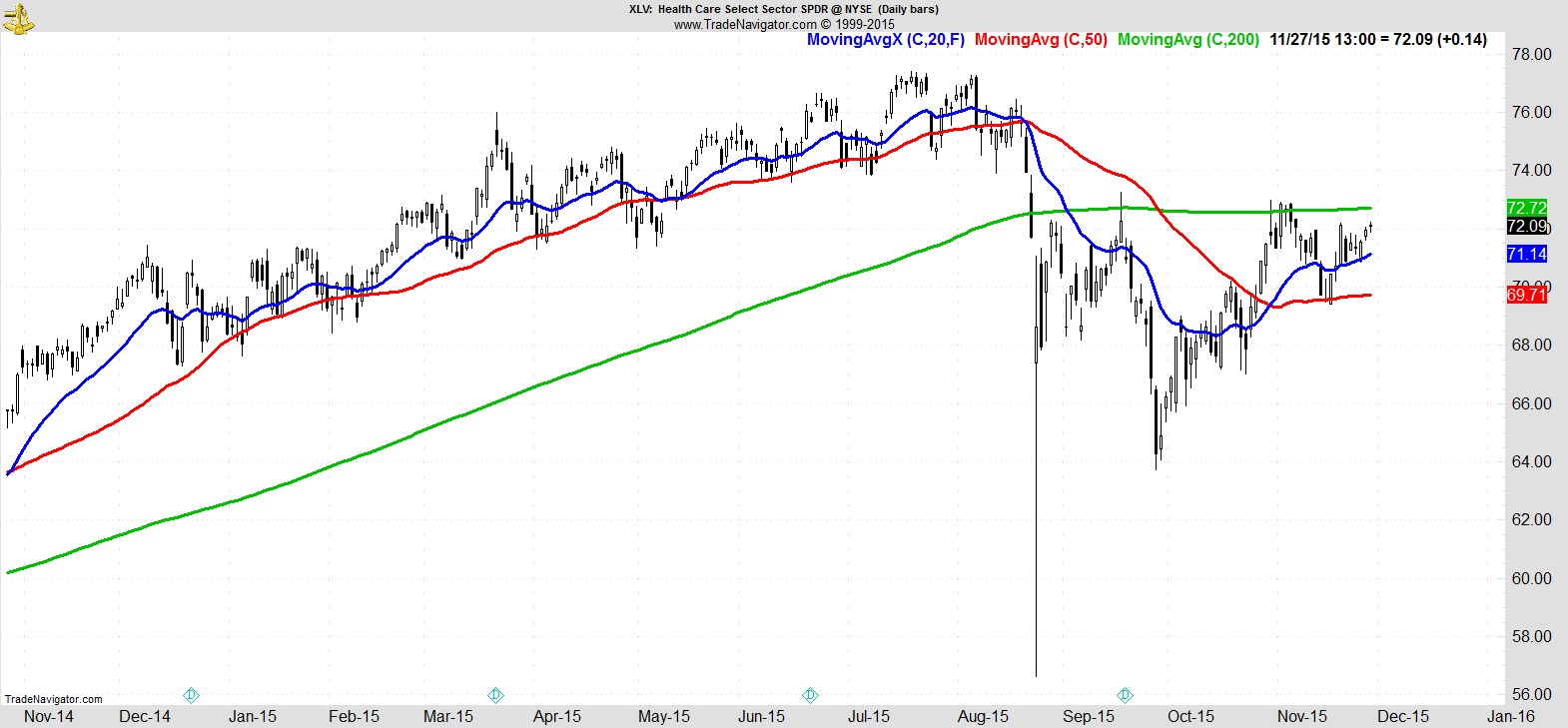

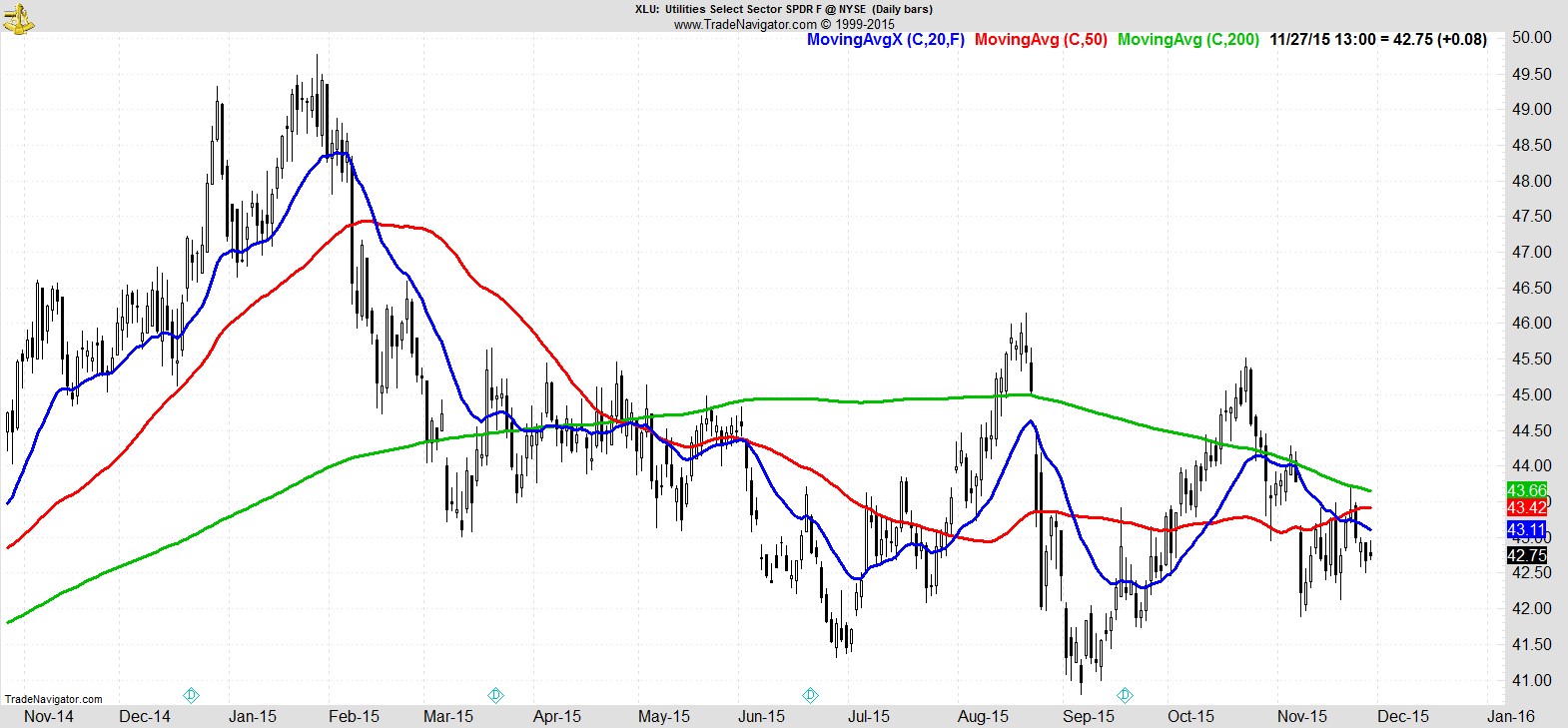

Of the others, Healthcare ($XLV) is again testing the underside of its 200-day, Materials ($XLB) continue to consolidate recent gains, Energy ($XLE)'s recovery has stalled, and I wouldn't recommend Utilities ($XLU) even to my worst enemy.

.

Watchlist

With the holiday-shortened week there weren't many changes to the overall mix of our watchlist, but given we already have a full portfolio I've reduced the list slightly in an attempt to concentrate on only the strongest names and most favorable setups.

Here's a sample from the full list of 25 names:-

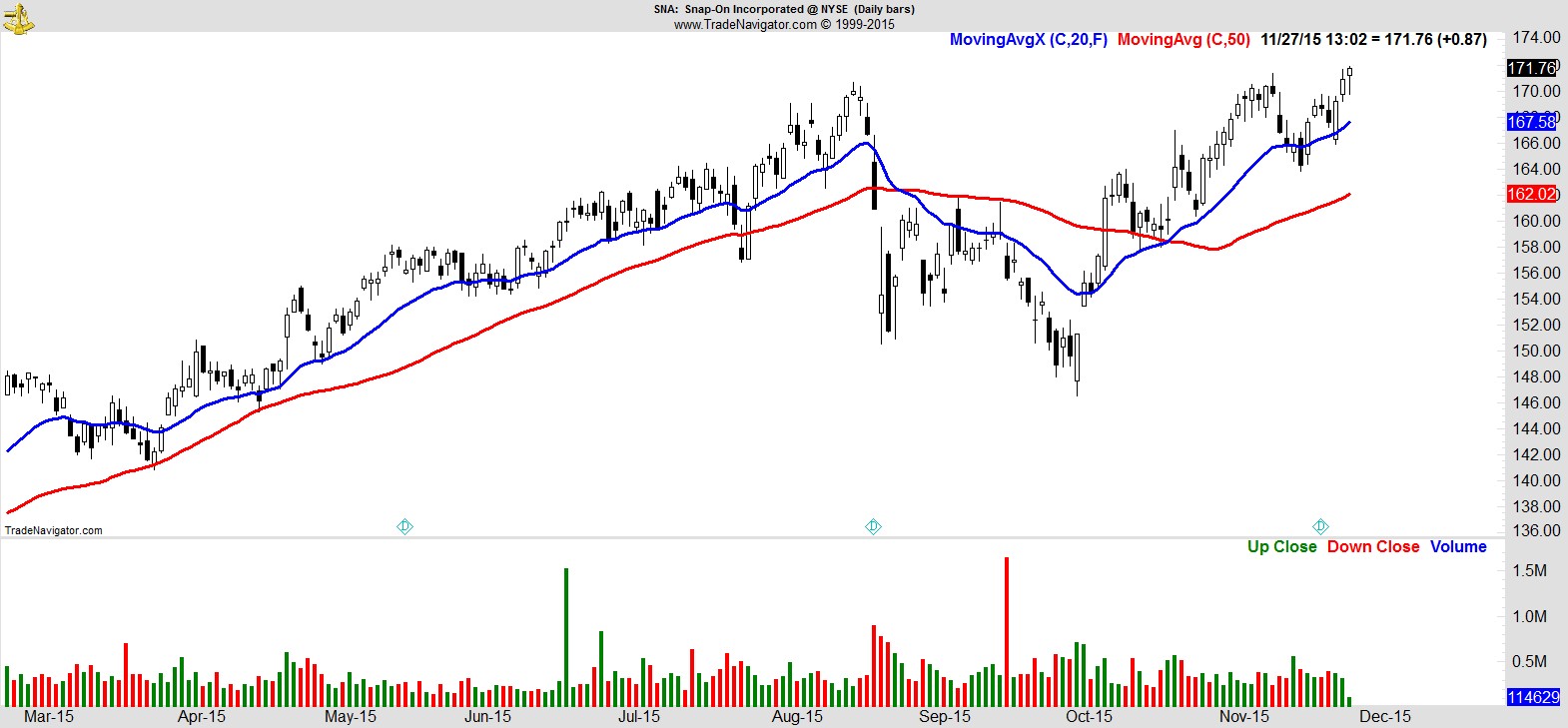

$SNA

.

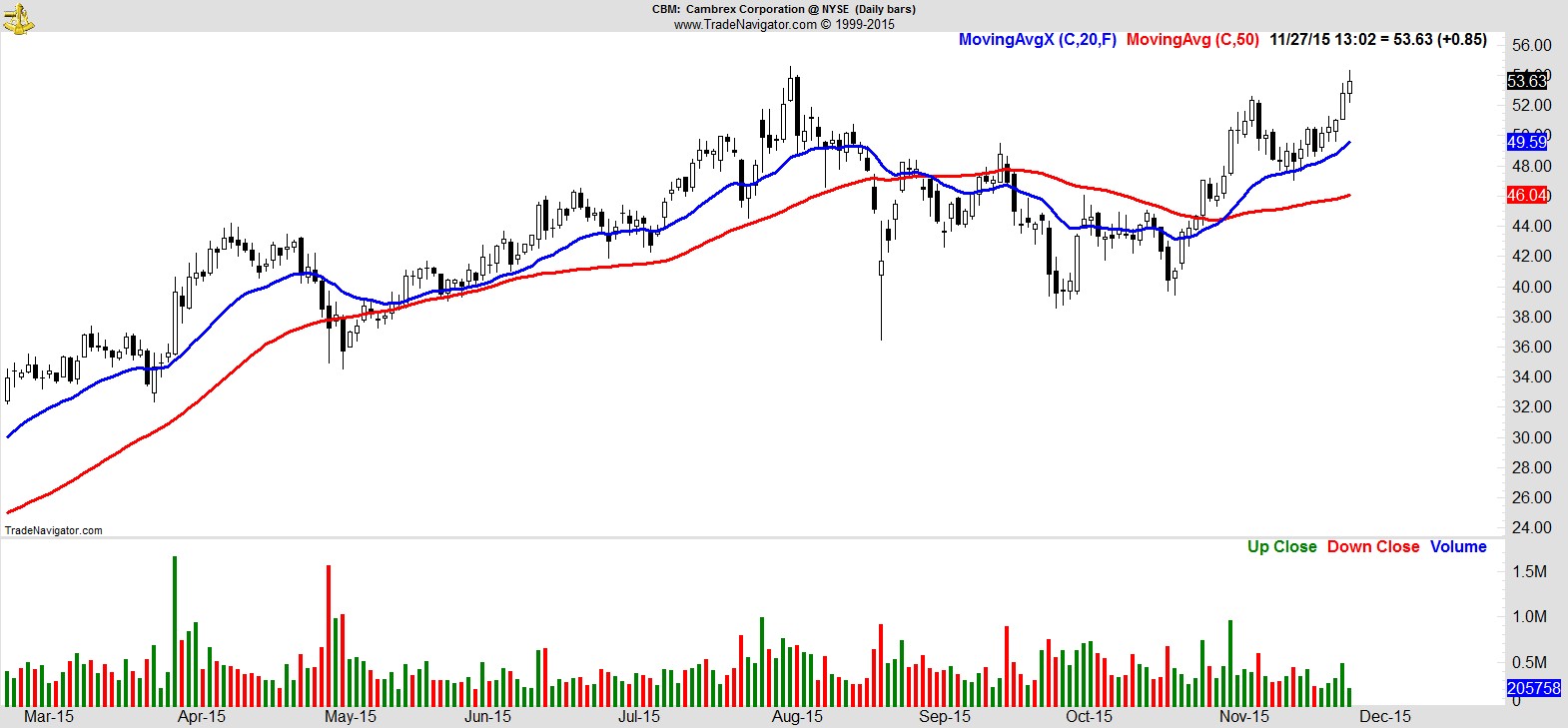

$CBM

.

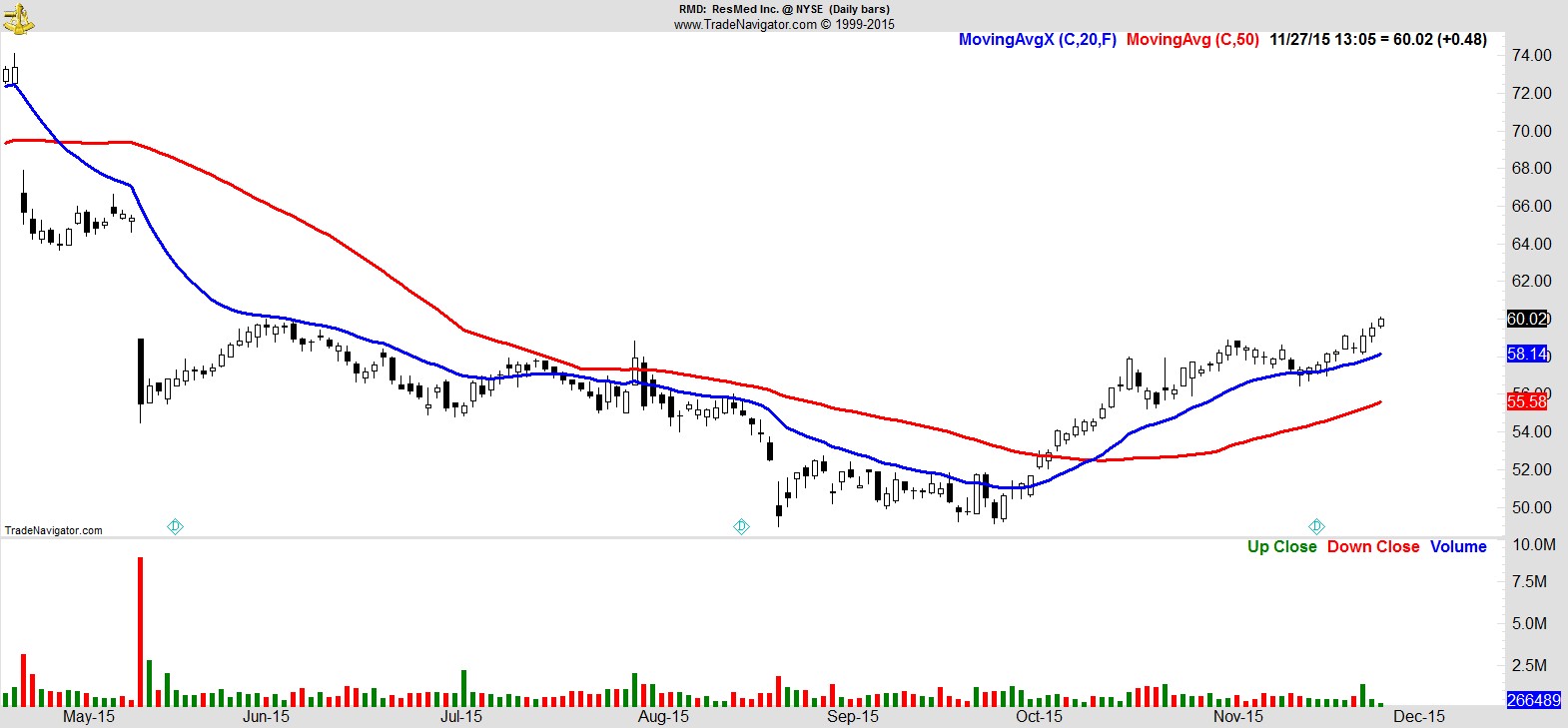

$RMD

.

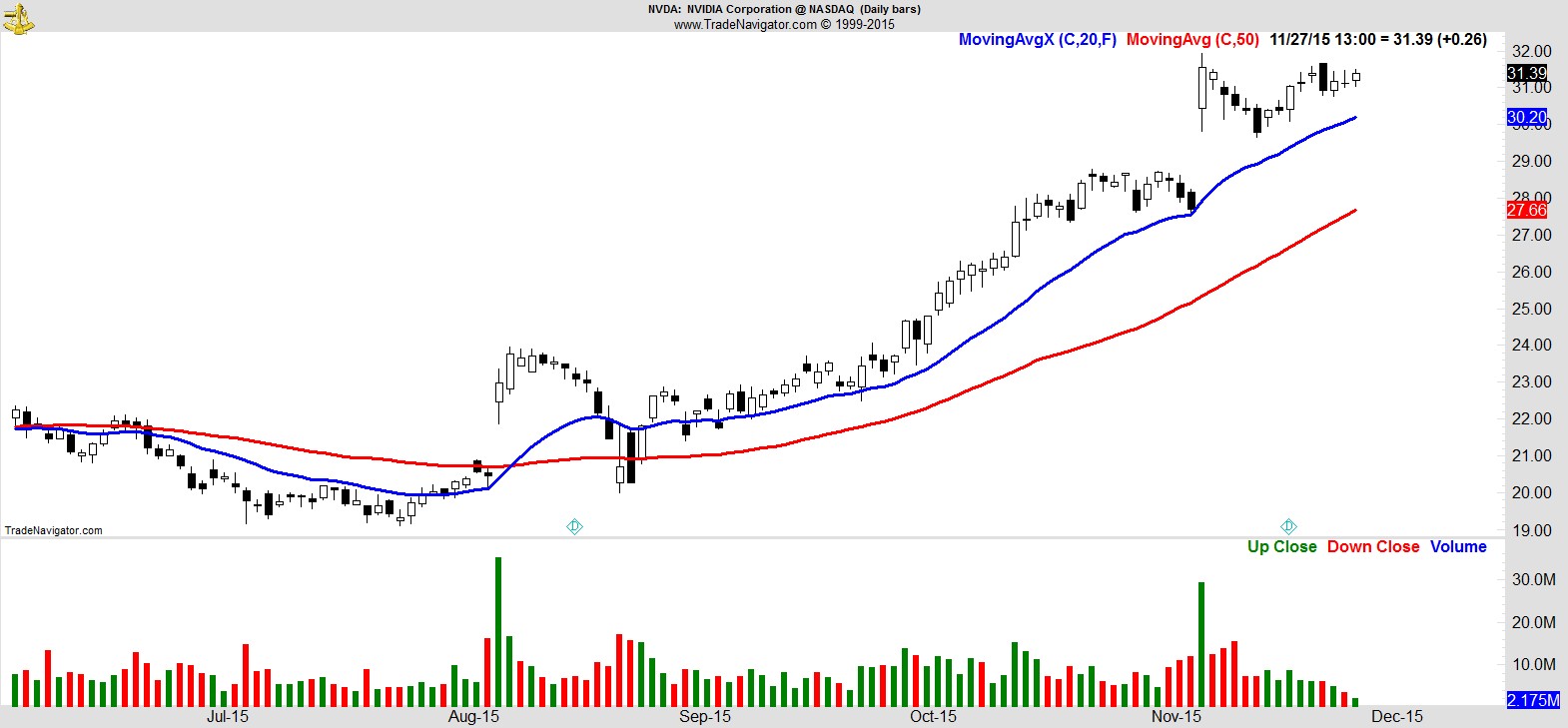

$NVDA

.

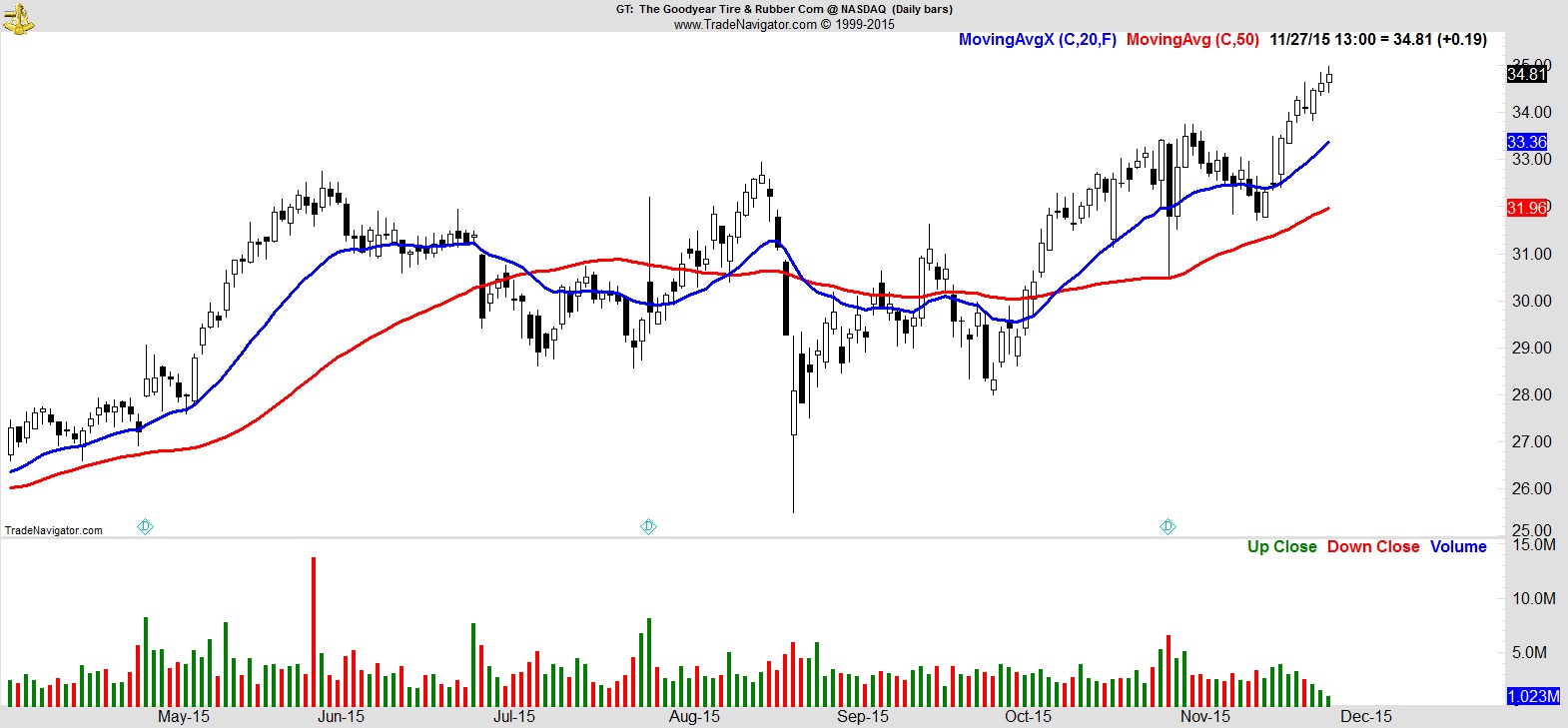

$GT

.

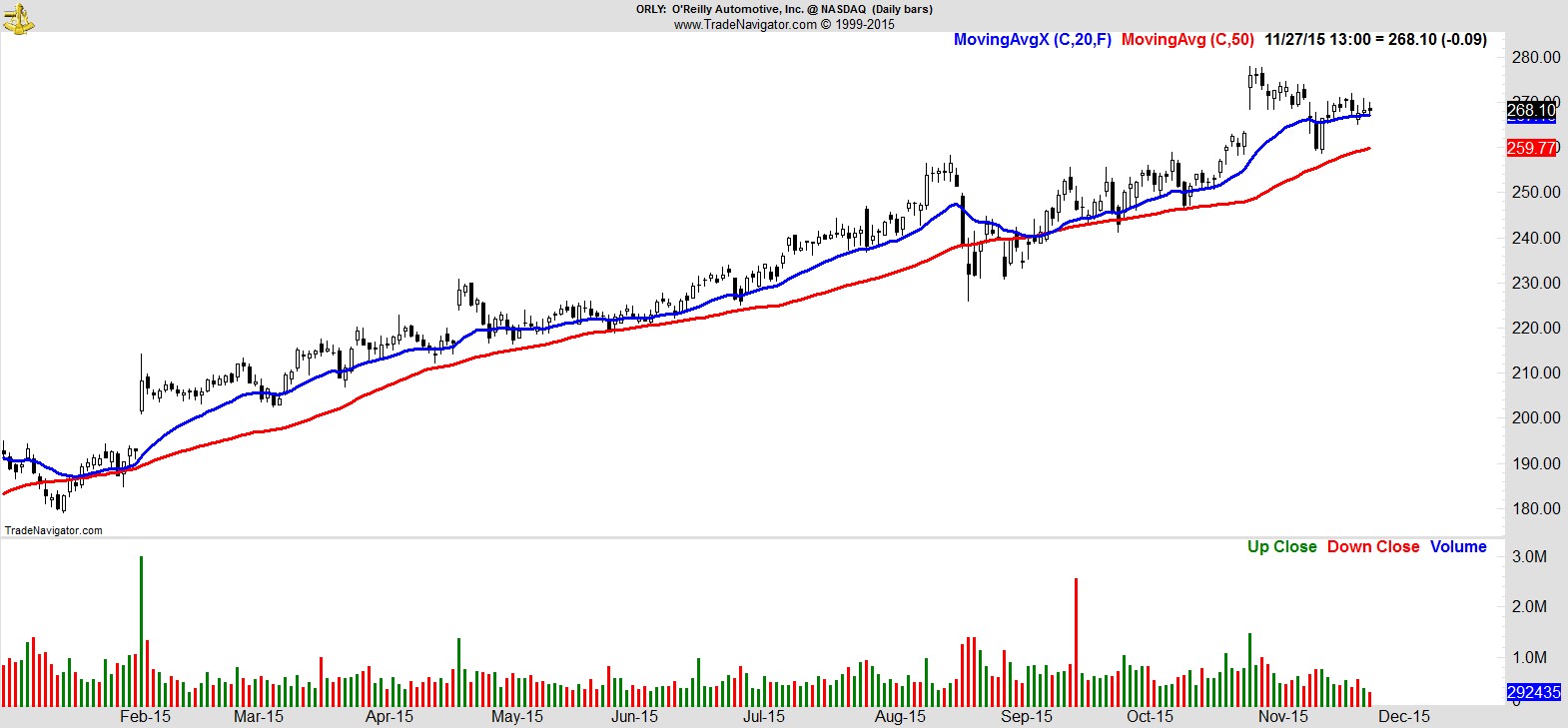

$ORLY

.

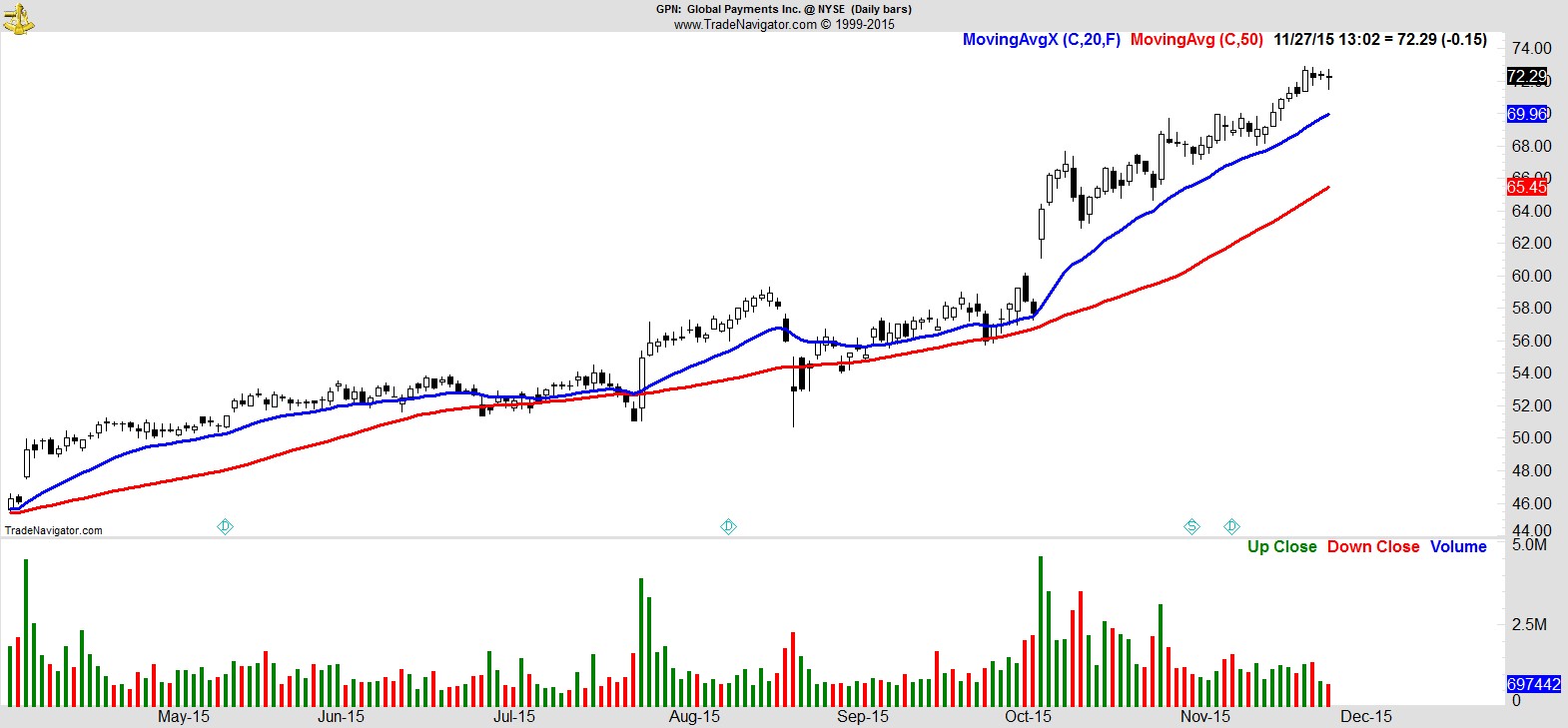

$GPN

.

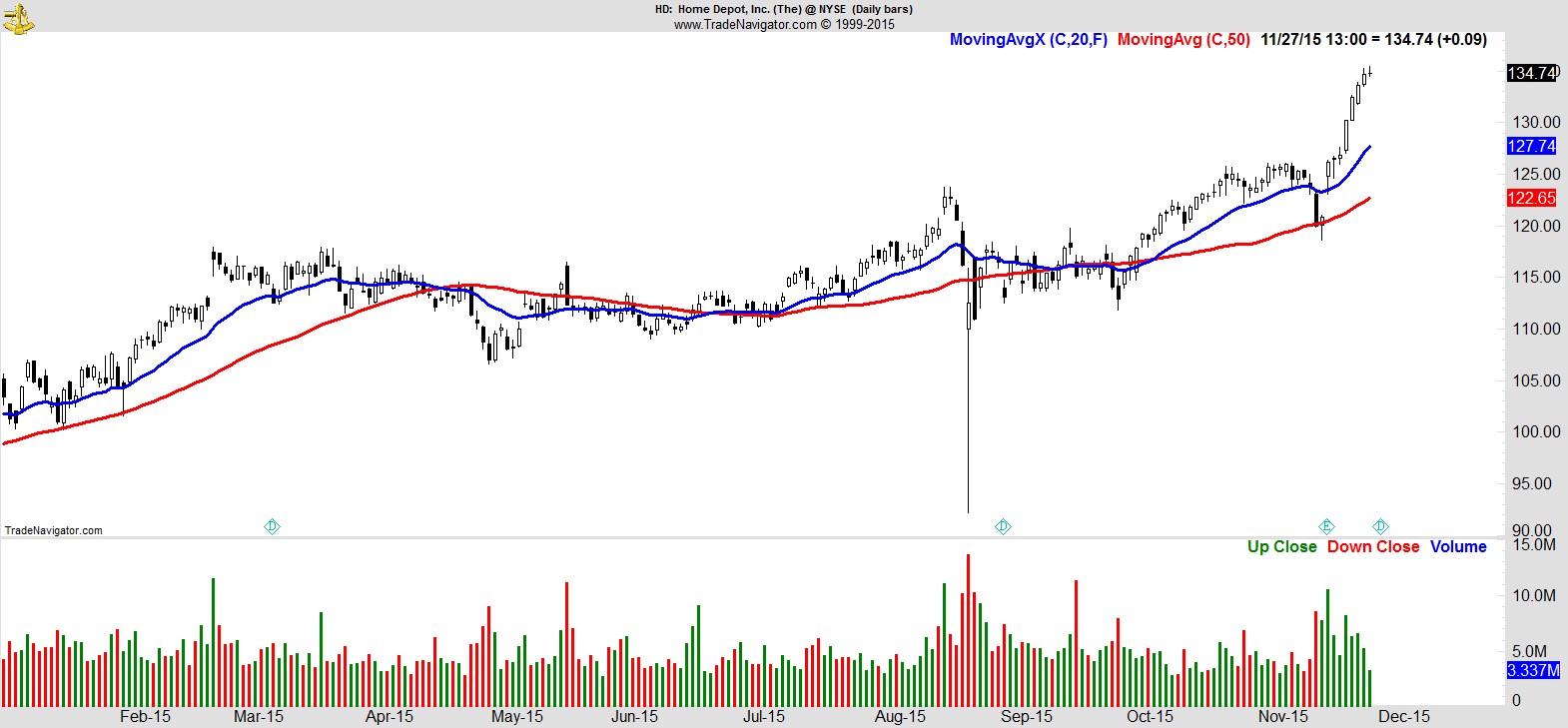

$HD

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17