Modern times demand modern thinking in portfolio design. Learn more...

If you find yourself shaking your head over the action of the stock and bond markets over the past six sessions, you are not alone. Talk about schizophrenic!

To review briefly, one week ago today the bears told us that the economic world as we know it was about to end due to the BREXIT vote. Stocks were diving. Bond prices were soaring. Currencies were fluctuating wildly. In short, it felt like the bad ol' days of the European Banking Crisis had returned and there was no telling how bad things might get this time around.

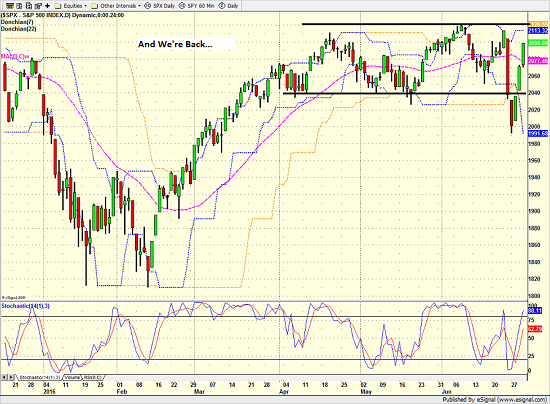

Fast forward to yesterday and we find that the S&P 500 has returned to just about where it was before the BREXIT freakout. Thus, the question of the day would seem to be, why the violent, turn on a dime, V-bottom? Why did stocks spike higher by 5% in three days? And why would all of the upside action occur in the fact of the economic calamity that was to be the BREXIT?

S&P 500 - Daily

View Larger Image

Another Banker Heard From

On Wednesday, one of the reasons I cited for the initial rebound was all the talk of coordinated global central bank intervention. Within hours of the BREXIT vote, we had heard from Mario Draghi, Janet Yellen, and the Bank of Japan - all of whom were talking nice about rates, economic stimulus etc. And in short, this type of verbiage from central bankers has tended to be very good for stock prices over the last 8 years or so.

In keeping with that theme, Thursday's +1.3% rally in stock prices, which, by the way, was also accompanied by an ongoing rally in bonds, was sponsored by yet another central banker. This time it was Bank of England Governor Mark Carney's turn to effectively whisper sweet nothings into Ms. Market's ear.

Cutting to the chase, during Mr. Carney's second televised address since the BREXIT vote (a vote he had warned would be harmful to the U.K. economy) the BOE Governor said that his group won't hesitate to act when it comes to safeguarding the economy and/or the banking system.

"It now seems plausible that uncertainty could remain elevated for some time," Carney said Thursday morning in London. "The economic outlook has deteriorated and some monetary policy easing will likely be needed over the summer."

This caused a "Wait, what?" type of reaction in the markets as rate cuts (which would be the first since 2009), QE, and a host of other monetary options were suddenly on the table. And the U.K.'s central banker was talking about taking action soon - very soon.

An analyst from Investec in London suggested action by the BOE could come as soon as the Financial Policy Committee's next policy announcement on July 5, while monetary stimulus could be teed up on July 14, in time to be announced at the following meeting on August 4.

To be sure, this was a surprise to the markets - and a good one at that. But in reality, such talk by Mr. Carney shouldn't be surprising at all. If investors have learned anything since 2008 it should be that central bankers around the world now have a set playbook for dealing with a crisis that involves cutting rates, buying bonds, and talking about "doing whatever it takes."

The idea is to keep the markets from freaking out, which could, in turn, scare the bejeebers out of the public, which, of course, causes economic activity to stop on a dime, which impacts the economy and the banking system. So, the central bankers have learned that it is better to talk about taking action BEFORE things get out of hand. And in short, this is exactly what Mark Carney did on Thursday.

Investors Take Action

What this means to investors - especially institutional investors (the kind that control billions of dollars, pounds, euros, yen, etc.) - is the BOE is joining the coordinated central bank intervention party. We have the U.S. saying global uncertainty is enough to keep the FOMC from raising rates. We have the BOJ talking about more stimulus. We have the ECB saying the usual stuff about doing whatever it takes. And now the BOE talking rate cuts and possibly QE.

The end result here is that the "lower for longer" theme on interest rates remains alive and well. This means that rates will stay low and possibly go lower - and that the global chase for yield will continue.

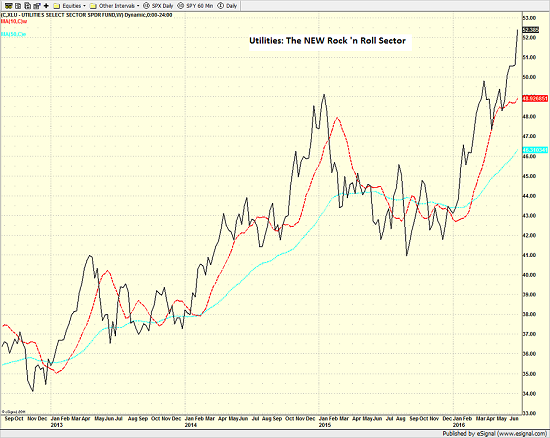

A perfect example of the chase for yield is the long-term chart of the utilities sector. It looks to me like the XLU is the new momentum play!

Utilities Select Sector (XLU) - Weekly

View Larger Image

If that chart doesn't make you shake your head a bit, I don't know what would. Seriously, these are utility companies - not biotechs or internet startups.

The Chase For Yield

In keeping with the chase for yield theme, let's not forget that approximately 60% of the stocks in the S&P 500 currently yield more than the U.S. 10-Year T-Note (which closed Thursday at 1.42%). As such, it would appear that investors continue to pile into stocks as an alternative source of yield.

I don't know about you, but I can't help but think that this type of trade is becoming more than a little crowded and as such, it isn't likely to end well. However, with no other game available, most analysts, myself included, argue that the yield chase game is likely to continue.

Finally - I'd like to wish everyone in the U.S. a safe and Happy Fourth!

Publishing Note: I am traveling next week and as such, reports will be published as my schedule permits.

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of Global Bank Policies

2. The Impact of the "BREXIT"

3. The State of U.S. Economic Growth

4. The State of the Stock Market Valuations

Thought For The Day:

"Let yourself be silently drawn by the strange pull of what you really love. It will not lead you astray." -Rumi

Here's wishing you green screens and all the best for a great day,

David D. Moenning

Founder: Heritage Capital Research

Chief Investment Officer: Sowell Management Services

Looking for More on the State of the Markets?

!function(d,s,id){var js,fjs=d.getElementsByTagName(s)[0],p=/^http:/.test(d.location)?'http':'https';if(!d.getElementById(id)){js=d.createElement(s);js.id=id;js.src=p+'://platform.twitter.com/widgets.js';fjs.parentNode.insertBefore(js,fjs);}}(document, 'script', 'twitter-wjs');Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member