You've heard the term a Lehman moment. It refers to one instance becoming the start of a domino effect which causes a global crisis.

We had our actual Lehman moment in the US about a decade ago from which we have not yet fully recovered. The repercussions were global and catastrophic in nature.

Now, the leading candidate for a repeat of the US Lehman moment stems from Europe: Germany's Deutsche bank (DB).

The chatter is that DB's internals are headed by way of Lehmans just before its collapse. The stock price action is indicative of investors warning of underlying issues thereby repelling money away.

You can see the similarity in the price action below. While price action is not a metric that causes the fundamentals to deteriorate, it does point to something 'not passing the smell test.'

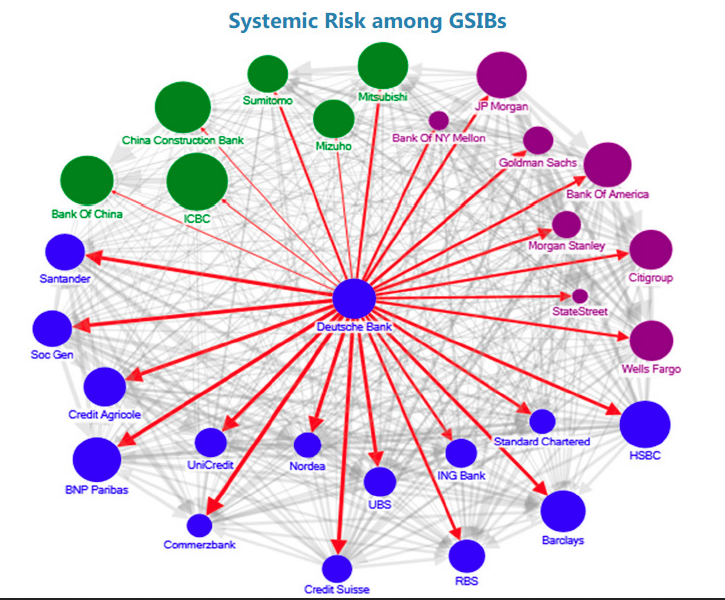

Below is a chart that shows the potential for the domino effect should DB fall. The weight of the financial sector is sizable but the real risk comes from the contagion factor.

- 1 bank falls -> many banks could follow = Sector falls

- 1 sector falls -> many sectors could follow = market-wide crisis.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member